With the results from the new regulations in Europe becoming more or less clear, the value of retail brokerage companies has been declining steadily. As of December, the only companies which haven’t registered a dramatic decline are those which are buying back their own stock.

Plus500 and GAIN Capital have been maintaining an effective floor for their shares’ value over the past several months. The year has been quite a tumultuous one for shareholders of publicly listed retail brokers.

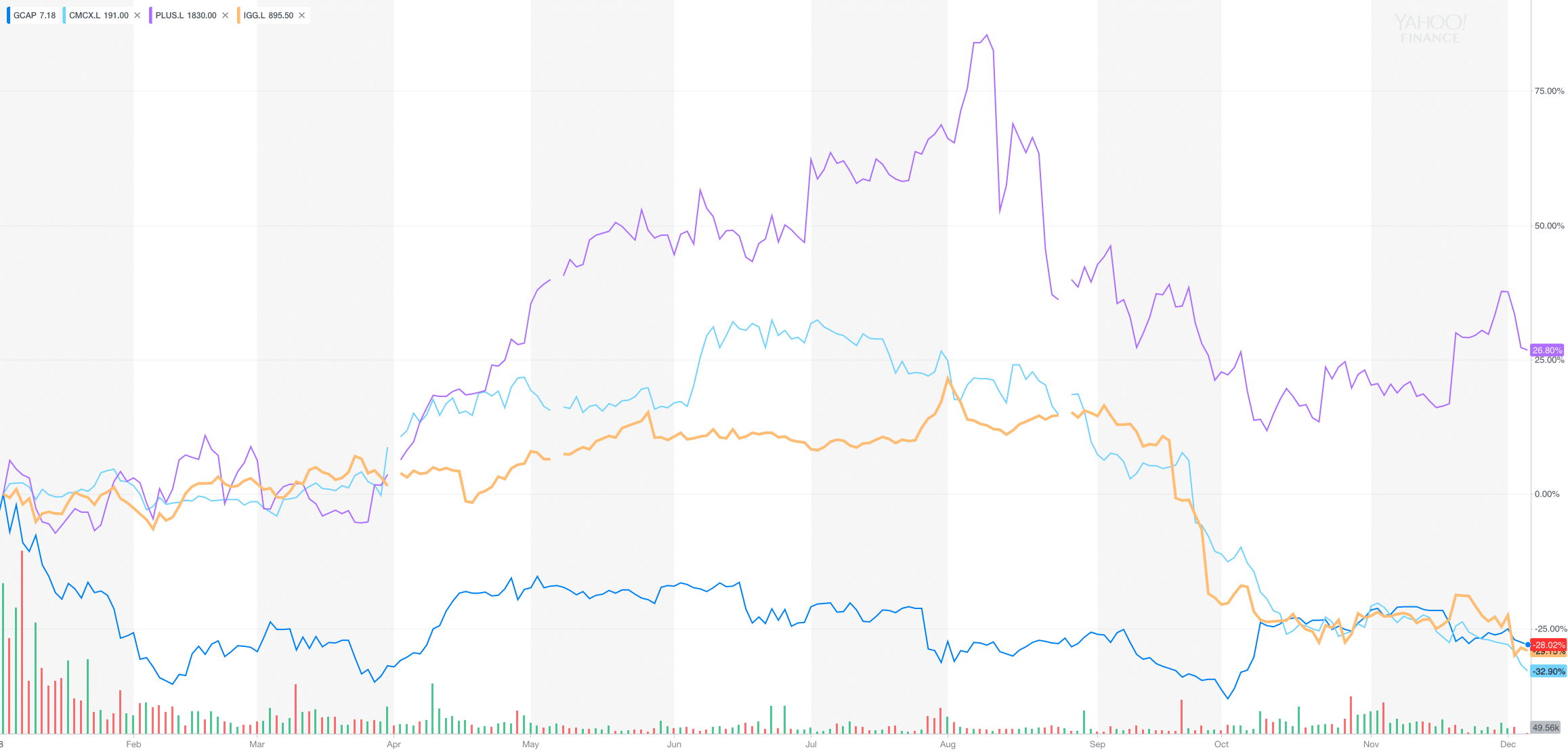

After the regulatory framework was ignored by the market until about the day when it took effect, the decline in the shares of GAIN Capital, CMC Markets, IG Group and Plus500 serves only to prove that markets are always acting in the least expected way.

Regulatory Issues and Market Trends

The regulatory issues plaguing the retail Forex and CFDs trading industry have been the main fundamental development since December 2016. Around the time of the first hint by the FCA about the severity of the measures discussed at a pan-European level, shares of all publicly-listed brokers tanked materially.

What happened on the stock market in the aftermath, was largely a result from the failure on behalf of some firms to communicate to their investor base about the impact that the changes will have on the business.

While some companies have done an incredibly good job and have even been warning markets about being too optimistic about their prospects, others have painted a picture which turned out to be rosier than many wished.

Plus500 and GAIN Capital Buybacks

Both Plus500 and GAIN Capital chose to provide a cushion to the blow and committed to buying back stock. The effort has helped to prop up shares of the companies so far. Some old-times investors in Plus500, like Crispin Odey, are once again holding a more significant interest in the stock.

After the sale of its GTX business, GAIN Capital provided $50mln worth of Liquidity for investors to exit their positions. After the announcement, the company’s stock stabilized between $7 and $8 per share.

CMC Markets and IG Group Hit New Lows

As the diversification effort for both CMC Markets and IG Group gets on its way, so might the value of the shares of the companies which have been punished lately. The reports from IG that the company lost close to 20% of revenues from the EU and the UK caused another leg lower this week.

Both firms have been impacted heavier than expected. The focus on higher net worth clients and the shifting focus to professional clients has been a universal attempt on part of the industry to mitigate the impact of the new regulations. The impact to attracting new clients, however, has been felt the hardest as new client acquisition costs increased dramatically.

2018 Chart of publicly listed retail brokers

Looking Beyond Standard Solutions

Publicly listed and private retail brokers have been looking for ways to mitigate the impact of the new regulations in several areas. Geographical diversification has played a role and will continue to be the dominant factor, however, increased changes to the product mix are not out of the question.

The value of mobile apps that are bringing in traffic has become increasingly more important for firms. With the competition from several smaller companies, the majors in this industry are facing yet another challenge to prove themselves.

The End of Uncertainty

The first full week of December saw one last missing element from any analysis of FX and CFDs broker shares. The FCA announced that it is proposing that the temporary measures on FX and CFDs trading be made permanent.

The news removes a key element of uncertainty from the market. Retail brokers can now focus on implementing their long-term plans to tackle the new regulatory environment.

Traditionally, the removal of uncertainties is a positive thing for markets. Whether or not EU brokers are prepared, the changes to regulations are now a fact.

Those who manage to adapt will be the best-positioned for long-term growth. The industry has become more capital-intensive in recent years and publicly-listed companies are at an advantage to the rest of the industry to a certain extent.

The long term performance of shares of listed CFDs brokers depends on how flexible they are and how well they execute their diversification plans. As to their share prices, with the worst of the news being priced in and the volatility cycle appearing to take a turn, current levels could prove to be attractive for long-term investors.