Commission-free trading app Robinhood is updating the list of stocks that it offers to its clients. The company has announced in a blog post that it is enabling trading of American Depositary Receipts (ADRs). The addition will provide clients with over 250 new global stocks to select from.

The new shares, which will be available for commission-free trading, include companies listed in Canada, China, Germany, Japan, and the United Kingdom. The list includes companies such as Adidas, BMW, Heineken, Tencent and Nintendo, and extends the no-fee trading trend at retail-focused outlets.

Robinhood has been at the core of an industry-wide trend in the US, as retail traders started getting access to the market for little or no fees. The ongoing expansion of available assets will continue in the coming months with the addition of French stocks.

Commission-Free Trading for Retail Investors

US retail investors have been eagerly embracing the evolution of the brokerage market place. Robinhood has become a pioneer in the industry, with a massive user base currently estimated at about 5 million accounts. The company is valued at $5.6 billion following its latest Funding Round .

JP Morgan’s app 'You Invest', which debuted this week, is the company’s response to the massive decline in retail investors commissions. The big bank’s response to companies like Robinhood is to provide its clients with 100 free trades per year.

Low commissions brokerages such as Charles Schwabb, TD Ameritrade and TradeStation are facing increasingly agile competition. If a retail investor’s approach towards the market is to buy and hold, traditional brokerage houses have become much less attractive than they used to be.

Buying into a Bull Market

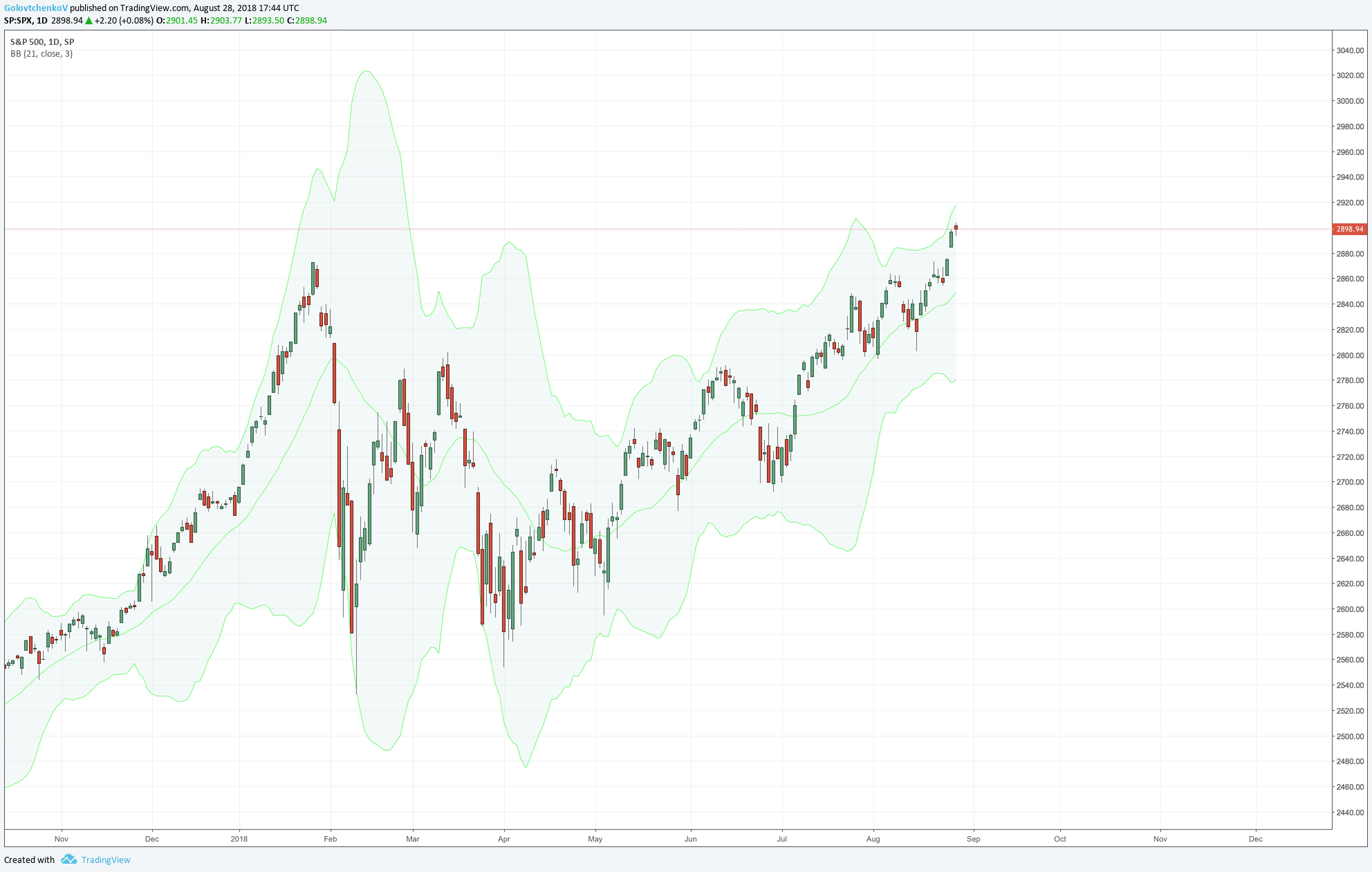

Stock brokerage houses have been alarming the retail crowd since the start of the year because their holdings are at an all-time high. This typically precedes a period of significant market correction. While we already saw one in February, the exposure of retail investors today is still at or around all-time highs.

The S&P 500 hit a new all-time high yesterday. Chart: TradingView

That said, in the aftermath of the February market crash, the crowd lost confidence in the market’s ability to post new highs. Fast forward to today and we are seeing the NASDAQ and the S&P 500 hitting new records in the aftermath of a successfully resolved trade dispute between the US and Mexico.

As for Robinhood, this isn’t the company’s first breakthrough this year. Back in February, the brokerage tried disrupting the crypto space. With its massive user base growing rapidly, the firm has been gradually expanding its range of products.

Robinhood Crypto is coming to Georgia, and we're feelin' peachy! Trade Cryptocurrencies , commission-free. ? pic.twitter.com/8eX57gv8sw

— Robinhood (@RobinhoodApp) August 2, 2018

The vision of the co-founder and CEO of Robinhood is to run the business in a way that allows the firm to break even. That’s some tough competition for publicly listed discount brokerages which have been the traditional stop for retail investors.