Commission-free investing app Robinhood has officially raised its latest round of funding, bringing in $363 million at a $5.6 billion valuation. The investment is led by DST Global, the firm run by Russian billionaire Yuri Milner, and includes participation from new investors Iconiq, Capital G, Sequoia Capital and KPCB, as well as old investors NEA and Thrive Capital.

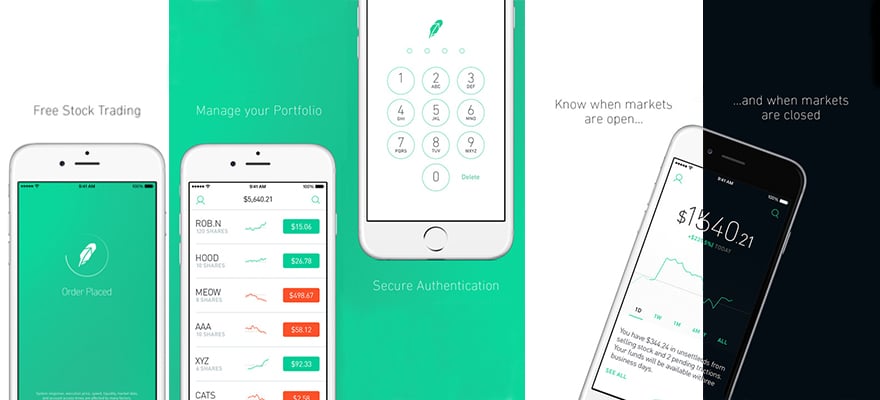

The Silicon Valley company, whose mobile app lets users buy and sell public stocks without trading fees, said that it would use the funds to increase hiring and develop new products around its stock trading app, which has more than 4 million users. The six-year-old Startup has been growing at an explosive rate, doubling the number of accounts in the past year.

Robinhood’s offering is particularly popular among the "millennial" population, who appreciate the ease of using the app to trade several asset classes without fees.

Hitting more than 4 million users isn't the only milestone for Robinhood. The company’s co-CEO Baiju Bhatt told CNBC that Robinhood has more than $150 billion in transaction volume since their introduction. The impressive metrics mean that the New York startup has been able to bring on nearly as many customers as E*Trade, which has been in the online brokerage industry since 1982.

When it comes to valuation, Robinhood pales in comparison to E*Trade, which is currently valued at nearly $15 billion.

For now, Robinhood can keep its free platform afloat through making compromises to some business aspects such as not having many physical locations, a small staff for client service, and not spending on massive promotional campaigns.

In April, Robinhood has officially launched its much-anticipated cryptocurrency feature, allowing US customers to explore Bitcoin and Ethereum trading alongside traditional investment products.