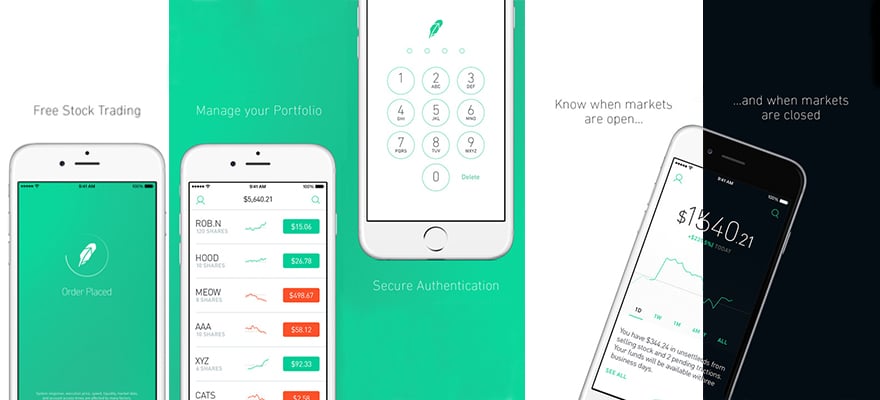

The family of a 20-year-old student, who committed suicide last year thinking he incurred losses of over $700,000 on his Robinhood account, are suing the millennial-focused stock app.

Alex Kearns misunderstood the Robinhood financial statement and believed he had lost more than $730,000 from trading options. However, the Negative Balance referred to available buying power in his trading account and the value of stocks tied to those options rather than to debt.

Alex's parents blamed Robinhood for his death at a time when the app has become a popular entry point to the financial markets for first-time investors. They accused the no-fee app of wrongful death, negligent infliction of emotional distress and unfair business practices.

The lawsuit claims that Robinhood's provided no 'meaningful customer support' when Alex, a University of Nebraska student, reached out for help with the matter. Additionally, the family said they want to draw attention to what he sees as serious lapses in the app's oversight that allowed for this tragedy to happen.

The heartbreaking suicide has prompted the fintech unicorn, which has been credited with helping popularize trading among millennials, to announce multiple changes to its options trading products.

Robinhood Reveals Major Changes to Options Trading

Robinhood has introduced new measures that make it harder for options traders to qualify to support sophisticated products on its platform. This included additional criteria and education for customers seeking level 3 options authorization.

Robinhood now requires customers wishing to trade options to disclose, among other things, their investment experience and knowledge, as well as personal financial information such as income. Robinhood then conducts an assessment of this information to decide whether a customer may be approved for options trading.

On a related note, Robinhood is facing an investigation at the hands of Massachusetts securities regulators over alleged failures to protect inexperienced investors while aggressively promoting its products to them.

In response to the allegations, a Robinhood spokesperson said: 'We disagree with the allegations in the complaint by the Massachusetts Securities Division and intend to defend the company vigorously.'

According to the enforcement arm of the Massachusetts Securities Division, the app-based platform is alleged to have failed in its duty to stop frequent outages and disruptions on its Trading Platform . This was in addition to employing aggressive marketing tactics to draw inexperienced traders, including the use of “gamification methods to control clients.”

According to its own calculations, 68% of Massachusetts-based Robinhood customers had been authorised to trade options even after reporting limited or no investing expertise.