The Russian ruble has been on its back for two months now, marking new all-time lows pretty much every single week since the beginning of September. More worryingly, it has surpassed all of the major forecasters' expectations, currently trading at 43.50 rubles per US dollar.

While part of the rise can be attributed to the multi-year highs in the US dollar index, the drop has been accelerating in recent weeks as the value of the currency is suffering from ongoing capital outflows and loss of confidence in the value of the currency by the local population.

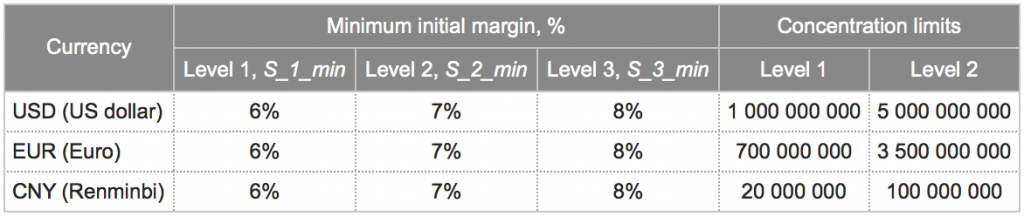

In another sign underlining the seriousness of the matter, the Moscow Exchange hit the wires today with an announcement that it is increasing Margin Requirements on Russian ruble major crosses against the US dollar, the euro and the Chinese yuan.

Moscow Exchange Russian Ruble Margin Requirements

The Russian ruble hit another record low today and is now trading lower by 17% since the beginning of September and over 28% since the start of the year.

The Bank of Russia has resorted to higher interest rates, boosting them to 8% in July as pressure rose on the Russian ruble due to geopolitical tensions in Ukraine and the resulting sanctions for Russian companies and wealthy individuals.

Another major factor affecting the Russian forex market has been the rapid decline in oil prices, which at the time of writing have dropped by 23% since the beginning of July. The Russian government is relying heavily on prices of oil remaining above the crucial $100 mark. Currently, Brent crude oil prices are hovering just above $86 per barrel.

Russian Ruble Weekly Chart, Source: NetDania

The next meeting of the Bank of Russia is tomorrow and markets are anxiously awaiting what they have to say about the next round of excessive Russian ruble depreciation during the past weeks. Recent talks of a currency peg of the Russian ruble now seem unrealistic at best.

Last time the central bank stated: “Current monetary policy stance will ensure decline in consumer price growth rate to the target of 4% in the medium run.” Since then the rate of inflation continues to rise, now double the 4% target mentioned in the Bank of Russia’s statement.