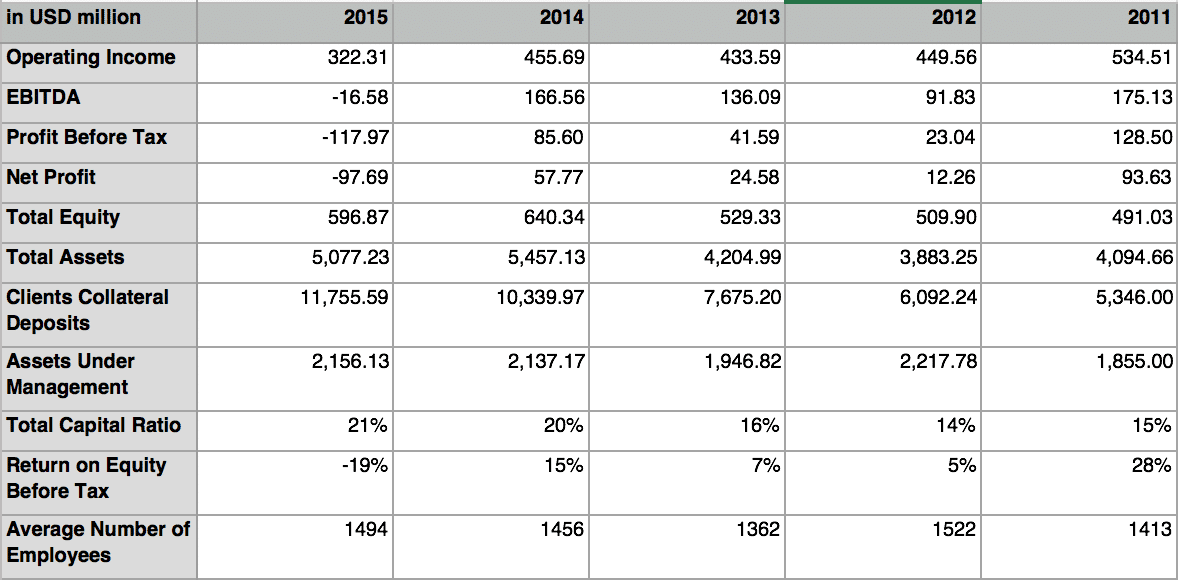

Saxo Bank Group has reported a net loss of $98 million (DKK 645 million) for 2015, compared to a net profit of $58 million (DKK 381 million) for 2014. The company’s net loss from the Swiss franc event totaled $108 million (DKK 700 million).

The new world of online trading, fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Excluding the impact from the Swiss franc Black Swan , Saxo Bank made about $10 million in 2015. The figure is more than five times lower than in 2014. Total assets of the company decreased by 7 per cent when compared to the previous year, amounting to $5.45 billion (DKK 36 billion). The annual report of the company states that the decrease is primarily due to a drop in the value of derivative financial instruments.

The operating income of Saxo Bank totaled $318 million (DKK 2.1 billion). The figure is lower by 29 per cent when compared to 2014, primarily affected by the Swiss franc black swan.

Saxo Bank's key operating figures for the past 5 years, Source: Saxo Bank

The operating costs for 2015 have increased by 14 per cent to $348 million (DKK 2.3 billion). The figure included a $13 million increase in provisions, but are largely due to the rising number of employees and increasing administrative expenses.

At the same time, the rollout of SaxoTraderGo and the continuing revamp of Saxo Bank’s FX offering with lower spreads and more flexible margin requirements has driven the collateral deposits of clients to a record high of $11.76 billion (DKK 77.6 billion) at the end of 2015.

Income from associates and joint ventures was negative in 2015, primarily due to an impairment charge on goodwill of $9 million related to Saxo’s investments in Banco Best S.A. The company has already registered a $1.67 million impairment loss recognized on goodwill related to the 25 per cent stake it had in Leverate Technological Trading Ltd. which was sold back to the firm in December 2014.

Post-SNB Danish FSA Review

The Danish Financial Supervisory Authority conducted an inspection of Saxo Bank A/S in May 2015. The inspection was a follow-up of the review in spring 2014 of the bank’s Risk Management of clients’ margin trading in the aftermath of the SNB crisis.

The inspection concluded with an assessment that Saxo Bank’s capital was sufficient to cover the bank’s estimated net losses that stemmed from the Swiss event with the regulator also noting that the Danish bank subsequently strengthened its total capital levels after placing a bond issue on the Irish Stock Exchange.

The Danish FSA has received a number of complaints from clients that have incurred negative balances as a result from the rapid increase in the value of the Swiss franc. After a thorough investigation the watchdog reprimanded Saxo Bank on two counts.

While the broker’s procedures have not been criticized, the reprimands noted incomplete marketing information and lack of immediate communication to some of the clients of the firm.

SaxoTraderGO Rollout, Outlook for 2016 and Beyond

With the rollout of the company’s SaxoTraderGO platform and the ongoing transformation of its offering, the company has continued its focus on attracting new clients and taking better care of existing ones. According to data from the company, over 20 per cent of overall retail trading has been taking place through mobile devices, with 75 per cent of all trades and orders coming from clients using multiple devices.

In the run up to the launch of the offering, Saxo Bank has incurred a substantial increase in costs, and it will continue updating its plans to be able to attract new retail and institutional clients.

The company started 2016 with a reform to its foreign exchange offering and added a number of perks for its existing clients and raised the prospects of attracting new business. Saxo Bank has gotten rid of the high fixed spreads it was offering and replaced them with an ECN offering, while introducing a tiered commission structure based on volumes and flexible leverage options for different types of clients.