Saxo Bank has announced to its clients a new update to its Trading Platform and the addition of new instruments, which might prove to be interesting to more unorthodox traders. The Danish multi-asset brokerage is launching a set of Non-Deliverable Forwards (NDFs) which will open a set of new currency markets which have been previously unavailable to its clients.

The NDFs will be traded only over the phone on an RFQ (Request For Quote) basis through Saxo's Trading Desks. A client will have to call the trading desk and ask the dealer for a quote to obtain a price on the instrument.

The minimum trade size on the NDFs at Saxo Bank will be USD 500,000 and the maximum open net position per currency is capped at a notional USD 5 - 50 million. All of the currency pairs offered through the new instrument will require 8 per cent margin (1:12.5).

The new offering is starting with some more popular emerging markets pairs like the USD/CNY (Chinese yuan), the USD/IDR (Indonesian rupiah) and the USD/INR (Indian rupee) and extends into some previously inaccessible closely managed Asian currency pairs like the USD/KRW (Korean won), USD/MYR (Malaysian ringgit), USD/PHP (Philippines peso) and the USD/TWD (Taiwan dollar).

Adding to the attractiveness of the new offering is a set of Latin American currency pairs like the USD/BRL (Brazilian real), the USD/CLP (Chilean peso), the USD/COP (Colombian peso) and the USD/PEN (Peruvian nuevo sol).

Retail traders have previously been largely unable to trade such exotic currency pairs and at a time when emerging market currencies have become increasingly volatile and the U.S. dollar has made a foray higher across the emerging markets currency trading boards, the new Saxo Bank offering comes at the right time.

Tier Based FX & CFDs Trading Commission Model

Saxo Bank has also introduced a new offering for foreign Exchange trading where spreads are starting as low as 0.2 pips. Depending on the tier in which the trader falls, the commission may range from $20 to $60 per million.

Traders without a minimum commission requirement will get the $60 per million rate, those who pay at least $600 monthly, will get access to a $30 per million rate, while those who fall into the most active traders category, where the minimum amount of commissions is $2,000, will enjoy a $20 per million rate.

Looking at CFDs, Saxo Bank states that clients who execute 100 trades or more per calendar month on stocks, ETFs and single stock CFDs, qualify for an active pricing plan where single stock commissions start from $6 per trade on the U.S. market, while minimum spreads on indices are declining to as low as 0.4 points on the S&P 500 and as low as 1 point on the German Dax.

SaxoTraderGo & SaxoTrader Updates

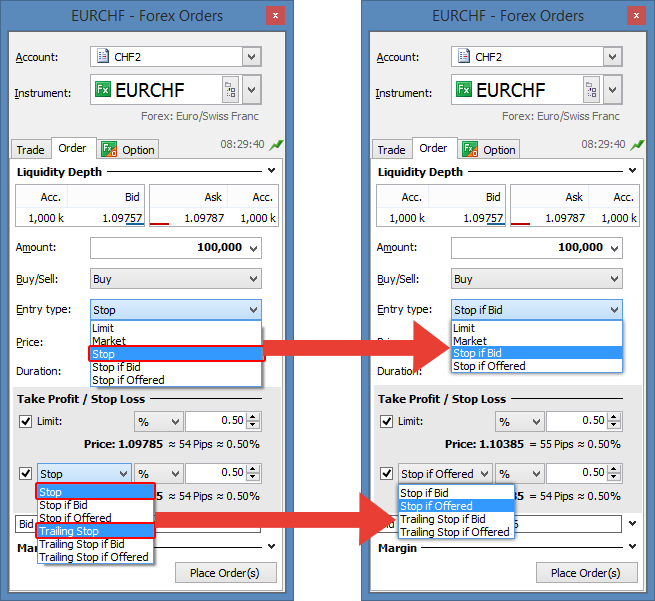

SaxoTraderGo and SaxoTrader have also received a set of updates. Looking at the trading orders, Saxo Bank has decided to scrap its ‘Stop’ orders in favor of ‘Stop if Bid’ and ‘Stop if Offered’ types. The change is set to add additional clarity as to which price is being counted when a stop order is being hit - the bid or the ask quote.

Changes to stop orders

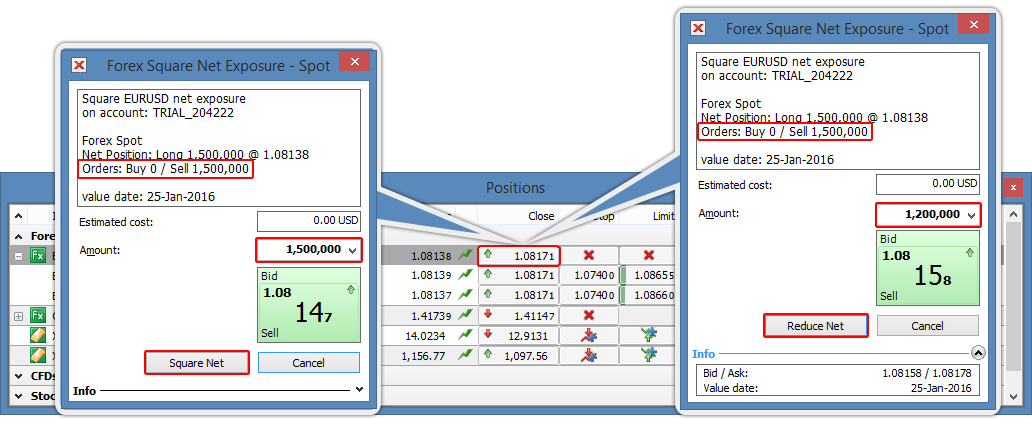

Looking at SaxoTrader, the company decided to reduce as well as square net positions. Previously if a client had wanted to partially close a position he/she would have to open a position in the opposite direction which would have been reduced or squared after the end of the trading day.

Square Net, Reduce Net positions example

Lastly SaxoTraderGo is now fully supporting Excel exporting of financial statements, account statements, trades executed, dividends and interest details reports. In addition, the dividends report screen of the platform has been redesigned and improved with a number of new features to give the clients a better overview of the dividends payed on their stock and bond holdings.