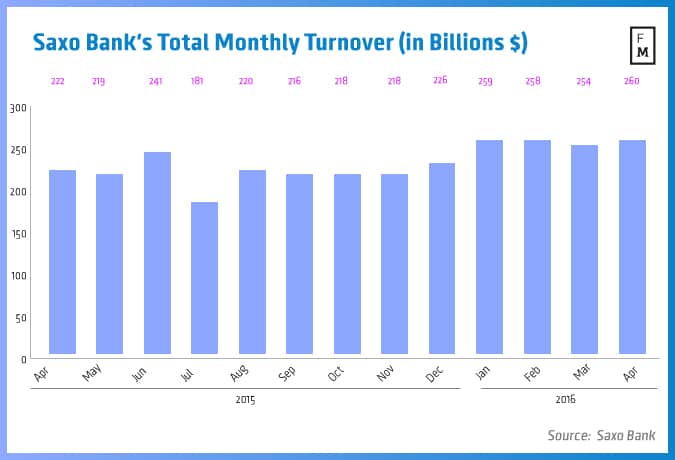

Danish multi asset broker, Saxo Bank, has released its latest monthly turnover figures for April 2016, which reversed a three-month decline in its average daily foreign Exchange (FX) figures, according to a Saxo Bank statement.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Saxo Bank’s trading volumes had been in decline in every month of the 2016 calendar year, falling off a peak of $12.9 billion in average daily volumes (ADV) in January 2016. The latest tranche of statistics in April helps allay this trend, orchestrating a rebound to $12.4 billion in ADV – this corresponds to a MoM ascension of 12.7% from just $11.0 billion back in March 2016. Compared to last year, April’s figures also have moved higher by 22.8% YoY from $10.1 billion in April 2015.

While March 2016 has represented a bottoming out of volumes this year, Saxo Bank also notched an improvement across its total monthly volume. April 2016 saw a total of $260.0 billion, reflecting a gain of 2.4% MoM from $254.0 billion in the month prior. This figure has also easily surpassed its 2015 equivalent, with April 2016’s volumes registering a YoY hike of 17.1% YoY from $222.0 billion in April 2016. The latest figures are the highest at Saxo Bank in over a year, since reporting $302.0 billion in January 2015.

Finally, Saxo Bank’s client collateral deposits also yielded a steady rise MoM, which moved higher to $12.06 billion in April 2016, up by 3.6% MoM from $11.64 billion in March 2016. Extrapolated to a YoY comparison, this figure is slightly higher by a factor of 2.9% YoY from $11.31 billion in April 2015.

Last month, Saxo Bank made headlines with the appointment of Jeff Zorek, who joined the broker’s sales team in the newly created role of Chief Operating Officer (COO) of Global Sales.