Danish multi-asset brokerage Saxo Bank has published its latest trading volumes for the month ending June 2017. Despite an uneven trend in recent months, the group managed to report its best month since March of this year, notching healthy gains across multiple asset classes.

The London Summit 2017 is coming, get involved!

[gptAdvertisement]

Saxo Bank’s total trading volume came in at $346.0 billion in June 2017, which represented a climb of $331.1 billion in May 2017 or 4.5 percent month-over-month. This growth came amidst one of the slower periods in 2017, with stagnated markets and low Volatility largely sapping volumes across most retail exchanges.

The latest total trading volumes also managed to best their 2016 counterparts, jumping 16.6 percent year-over-year from $296.8 billion in June 2016. This year has been defined by isolated pockets of volatility as recent months had seen a bottoming out of volumes back in April 2017 – Saxo Bank’s lowest reading since August 2016.

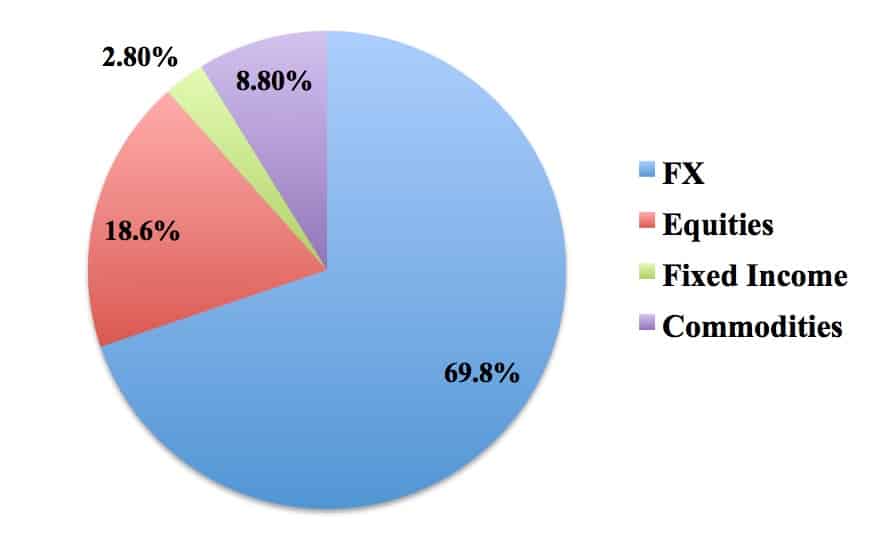

Of the $346.0 billion in total traded volumes, $241.6 billion was transacted on the foreign Exchange (FX) market. This segment also secured a climb of 2.8 percent month-over-month from $235.0 billion back in May 2017 – by extension, June 2017’s FX reading also grew by 8.7 percent year-over-year from $222.2 billion in June 2016.

Saxo Bank's share of trading volumes by asset class. Source: Saxo Bank

Furthermore, clients of Saxo Bank transacted $30.5 billion in commodities in June 2017, which shaped up as its worst performing segment, falling 8.1 percent month-over-month. Equities saw a total of $64.2 billion transacted during the month, setting a fresh yearly high en route to a 18.2 percent month-over-month gain. The results coincide with higher movements in European equity markets, which have been much more active over the past two months.

Fixed income trading meanwhile was also pointed higher in June 2017 with a reading of $9.7 billion, up 11.5 percent month-over-month from May 2017. Saxo Bank’s total average daily volumes in June 2017 amounted to $15.7 billion, with FX totaling $11.0 billion, commodities $1.4 billion, equities $2.9 billion, and fixed income netting $0.4 billion per day.