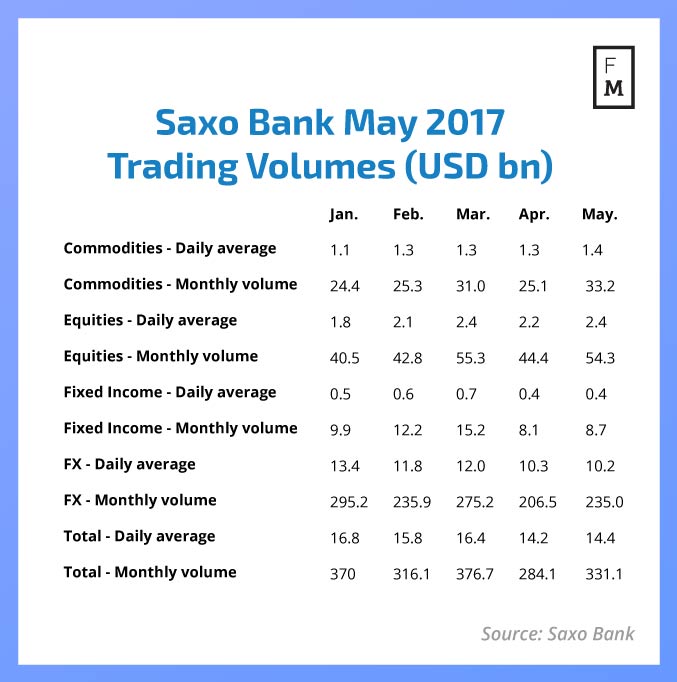

Danish Multi-Asset brokerage Saxo Bank has reported its monthly metrics for May 2017, which show a pick-up in trading volumes compared with last month’s very weak figures and improvement month-over-month across all but one of its business segments.

The London Summit 2017 is coming, get involved!

[gptAdvertisement]

During May 2017, Saxo Bank saw its total average daily volumes increase slightly to $14.4 billion, up just 1.4 percent month-over-month from $14.2 billion in the month prior. Comparing year-over-year, this figure looks a bit better, scoring a 5.1 percent increase from $13.7 billion in May 2016.

In terms of its total volume, Saxo Bank yielded a figure of $331.1 billion in May 2017, up 16.5 percent from $284.1 billion in April. In addition, the latest figure is also higher than the $300.9 billion in total volume secured last year in May 2016, which equates to a 10 percent gain year-over-year.

Looking specifically at the FX trading side of the business, the May results were mixed. Total monthly FX trading volume at Saxo Bank reached $235 billion, up 13.8 percent MoM and 8.9 percent YoY. However, this was not due to a daily pickup in FX volumes as these actually dropped to just $10.2 billion down from $10.3 billion in April 2017. Still, this is an improvement of 4 percent YoY from May 2016's daily FX volumes of $9.8 billion.

FX Global Code of Conduct

Saxo Bank has also announced today it has signed up to the FX Global Code of Conduct, which is aimed at improving industry standards and promoting best practice among FX market participants.

Kim Fournais

Kim Fournais, CEO and co-founder of Saxo Bank, said: “We are proud to have been given the opportunity to participate as a member of the Bank of England’s FX Joint Standing Committee in reviewing and drafting this important and unprecedented industry-wide initiative.”

“We take pride in being at the forefront driving transparency and signing the Code as well as publishing the Enhanced Disclosure as a proof of the full alignment of interest between Saxo Bank and our clients. It is a means of promoting integrity and trust and is a point of orientation for clients when choosing a facilitator.”