SBI Holdings, a highly diverse financial group whose subsidiaries specialize in Forex , securities and banking services has just reported its third quarter financial results through the fiscal year ending in March 2014, highlighted by staunch growth in operating revenue across its financial services (41.7%) and asset management (105.1%) sectors.

Tokyo-based SBI Holdings oversees an overarching group that includes SBI Securities, SBI Group and SBI Liquidity Market – the latter specializing in Fx technology and liquidity solutions. The parent group has shown robust growth throughout the year with several moves into various avenues and Fx-related ventures by its subsidiaries, along with a willingness to expand its operations across several other asset classes.

Operating Revenue Soars Across Financial Services and Asset Management

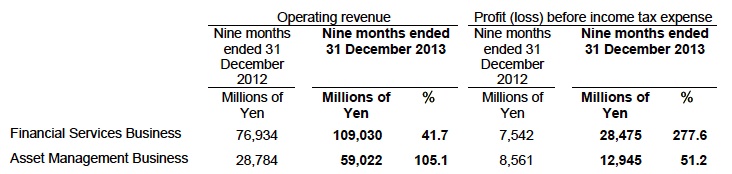

Relegated specifically to the Financial Services Business during the nine months ending in December 31, 2013, SBI Holdings reported an operating revenue of $1,064.3 million (¥109,030 million), highlighted by a growth of 41.7% YoY from $751 million (¥76,934 million) during the nine months ending in December 31, 2012. These services constituted all business conducted via brokerages, securities, banking services, insurance, etc.

Moreover, in terms of the Asset Management Business conducted by the group, operating revenue in the nine months ending in December 31, 2013 swelled 105.1% YoY to $576.1 million (¥59,022 million) from $280.6 million (¥28,748 million) previously.

Total Income Another Bright Spot

Despite the huge gains in operating revenue, it was in the area of income that SBI Holdings saw its highest increases over a nine-month interval. Total income exploded to $353.8 million (¥36,139 million) during the nine months ending December 31, 2013, from $69.1 million (¥7,062 million) previously, representing a staggering 411.1% growth YoY.

Operating Revenue, Income Growth Unable to Reverse Downtrend in Share Prices

SBI Holdings’ (HKG:6488) company stock has experienced an uneven year thus far in 2014, retreating off a yearly high of $11.60 back in January. The nine-month window cited above witnessed a meteoric rise in share value from $5.80 that initiated in March 2013 and ultimately topped out at $14.10 during the beginning of May 2013. According to Forex Magnates' research, the company presently trades at $9.52 per share, down nearly 18% since the start of the new year – ahead of the release, share prices were down -0.42%.