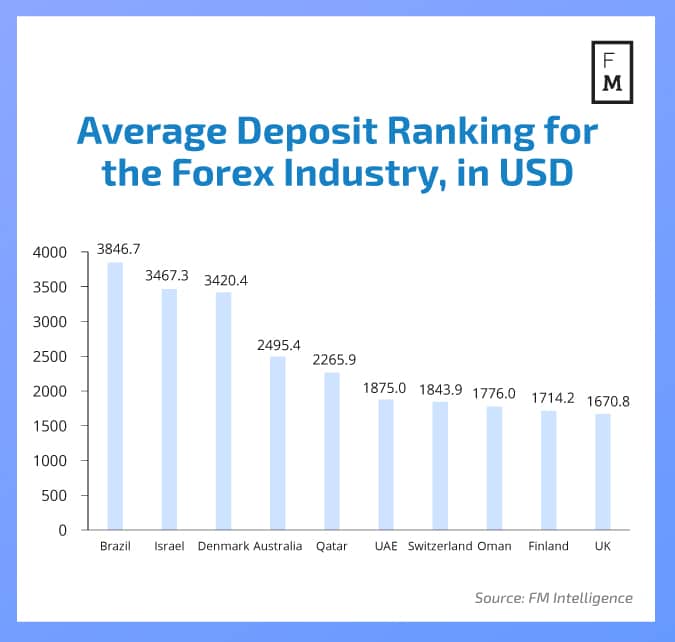

The latest report from the Finance Magnates Intelligence Department shows that Latin America is the new bright spot on the global Forex trading map. For the first time ever Brazil tops the forex industry's average deposit ranking in January 2017.

In second place is the very surprising market of Israel, where recent regulatory limitations and difficult licensing requirements have pushed most brokers out of the business. Considering this, it is possible that the remaining firms were able to attract more deposits per client, now that they do have the local seal of approval.

[gptAdvertisement]

Following the top two are the much more predictable rich markets of Europe, Australia and the Gulf. In descending order, these are: Denmark, Australia, Qatar, UAE, Switzerland, Oman, Finland and the UK.

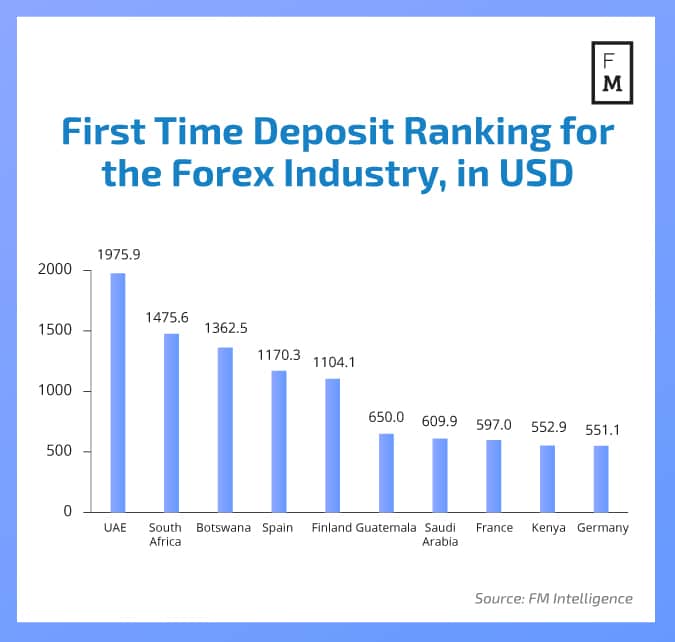

In terms of first-time forex deposits during January we see again the energy-rich Gulf region lead the way with the UAE on top. It is interestingly followed by two African markets, South Africa and Botswana, and the continent is represented again at number 9 with Kenya. Latin America is also on the map in first time forex deposits this month with Guatemala at number six. Developed European countries are represented on the list with Spain, Finland, France and Germany, at the fourth, fifth, eighth and tenth spots respectively.

Working for you

The research and analysis work conducted for preparing this index was powered by the retention automation firm Cpattern.

This is the latest publication from the FM Traffic Indices – a new cross-industry benchmark created with a methodological formula that matriculates data from three main sources: insider information, our unique database and technological BI tools.

In today’s business world, big-data analysis and access to objective information sources are crucial to success. Unfortunately, until now it has been very difficult and costly, if possible at all, to find any reliable benchmarks for operations in social, FX, binary options and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts that will serve as a valuable knowledge base for your decision making.