Financial technology provider Spotware Systems has just announced that it is introducing three new marketing tools for cTrader that could re-shape the offerings of brokers. With the changes to the Trading Platform and cBroker, clients could get the option to receive Dividends Payments for Equity CFDs, Dynamic Commission Discounts, and some other bonuses.

Commenting on the announcement, the Business Development Manager of cTrader, James Glyde, said: “We have supported these 3 key additions to our product suite which provides new ways for brokers to align our platforms with their marketing strategies all of which are configurable from their Group settings in cBroker.”

The dividend payment/collecting functionality brings a forex and CFDs broker’s offering in the equities space one step closer to being on a par with the offering of a stock broker. The move brings the market closer to the real stock market where investors are compensated with dividends and those who short a stock pay the dividends in a similar way, in that interest is calculated on their positions.

Mr Glyde elaborated: “This tool further strengthens cTrader as a Multi Asset Class trading platform and adds to a variety of tools available from cBroker which allow brokers to totally customize their symbols and how they are delivered through the cTrader platforms.”

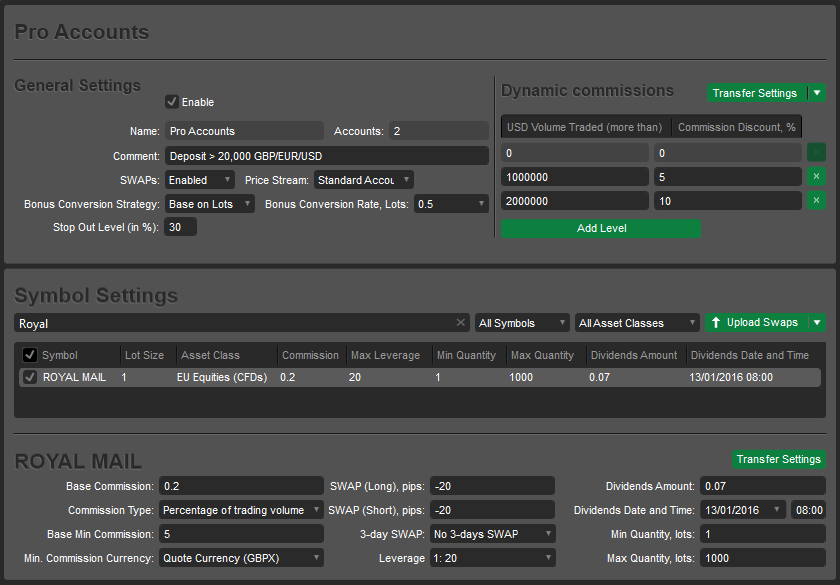

Another widely demanded tool which brokers have been reluctant to use is a dynamic commission discount structure. Different groups of clients will have access to different sets of commission discounts depending on asset classes and groups. The discount will be available for all commission types - on a per million USD volume, USD per lot and percent of trading volume.

one of the best reward schemes you can offer to your high volume traders

cBroker and cTrader will therefore permit brokerages to apply the volume that the trader needs to achieve to receive a predetermined discount for each month or set a minimum commission for each symbol as an additional layer of protection from settings mismanagement.

“This is, in my opinion, one of the best reward schemes you can offer to your high volume traders, producing a welcome incentive to attract and retain these valuable traders to any brokerage,” Mr Glyde explained.

cTrader brokers are also getting access to a new bonus functionality which is designed to be fair to both traders and brokers. Clients may receive bonuses of any size but cannot utilize the full amount of the bonus if it is greater than their cash equity.

Spotware Systems is soon releasing an IB Program

With a number of companies getting in trouble for offering bonuses that have proved to be too high, this functionality could indeed bode well for both the intermediary and the clients. Bonuses are added to a trader’s equity; therefore they are used in conjunction with their cash equity to open positions and cannot be used instead of cash equity.

In turn, brokers will be able to mark bonuses as convertible by setting the requirements to convert $1 of bonus into balance. Conversion criteria can be based on a set number of lots or volume and can be configured on a per group basis.

Mr Glyde added some details: “It is a built in feature of our product suite and now issued as standard to all future and existing cTrader brokers. This new functionality goes side by side with our soon to be released IB Program, as IBs can also give bonuses to their introduced clients to incentivize trading and retain clients.”