[gptAdvertisement]

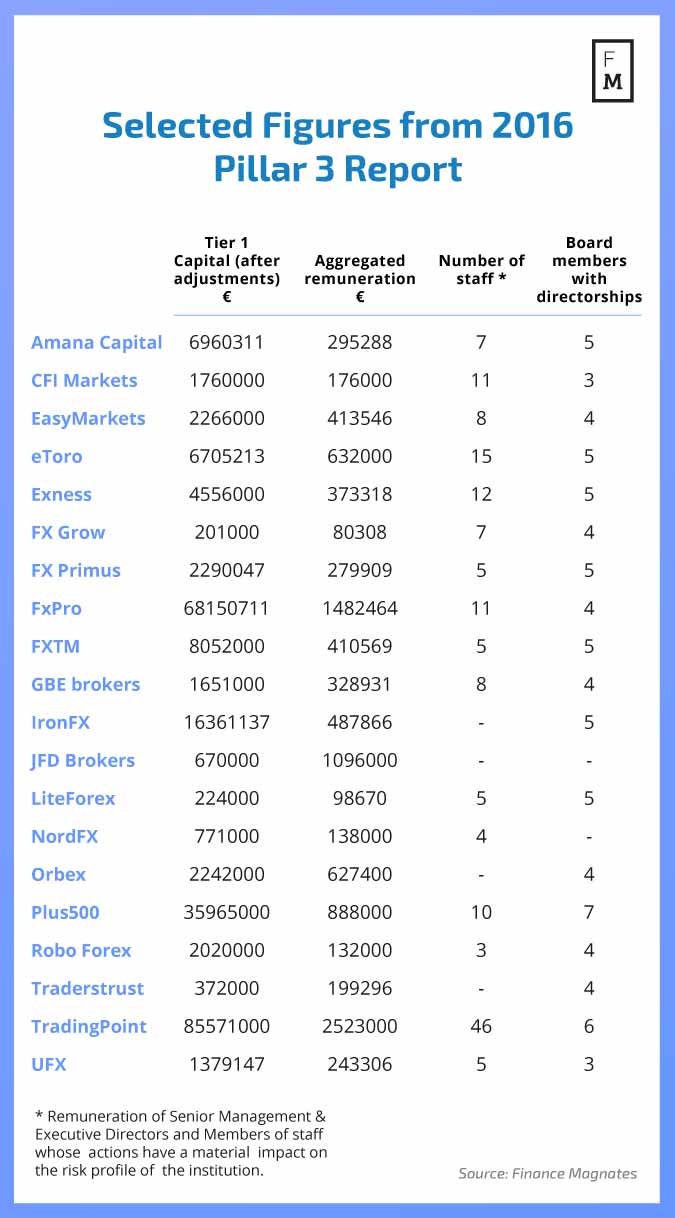

An exclusive new data set created by the Finance Magnates Intelligence Department sheds some light on the real situation in the boardrooms of many of the top FX companies in Europe. Based on the regulatory 'Disclosure and Market Discipline Report' (Pillar 3) of each broker, we chose to highlight two important figures - tier 1 capital and aggregated remuneration.

The London Summit 2017 is coming, get involved!

Tier 1 capital (after adjustments) refers to instruments and reserves (capital instruments and the related share premium accounts, retained earnings, accumulated other comprehensive income) after regulatory adjustments. Aggregated remuneration refers to all the financial compensation of senior management, executive directors and members of staff whose actions have a material impact on the risk profile of an institution. Looking at the Tier 1 capital results, we can see that while it varies greatly from firm to firm it does help to single out a few firms with very large holdings. In order, these are: XM (Trading Point) with €85 million, FXPro with €68 million, Plus500 with €36 million and IronFX with €16 million.

Background

Pillar 3 reports are prepared by brokers in Cyprus in accordance with the Cyprus Securities and Exchange Commission (CySEC ) Directive for the prudential supervision of investment firms, which implements Regulation and the European Directive. Disclosures are made in accordance with EU directives that give effect to the revised capital adequacy framework agreed by the Basel Committee on Banking Supervision. Basel II was built around three 'pillars' which the Basel Committee considers to be complementary: Pillar 1 - minimum capital requirements, Pillar 2 - supervisory review, and Pillar 3 - market discipline. Institutions should publish the disclosures on an annual basis at least. Information should be audited in accordance with the Auditors and Statutory Audits of Annual and Consolidated Accounts Law of 2009 and should be published, where possible, as an annex to the annual financial statements or, where applicable, to the consolidated financial statements of the CIF concerned, or on the CIF’s website. Brokers regulated by CySEC are obliged to publish their Pillar 3 disclosures, required under Part Eight of the Regulation, by the end of April each year, and submit to CySEC the external auditors’ verification report by the end of May each year at the latest.