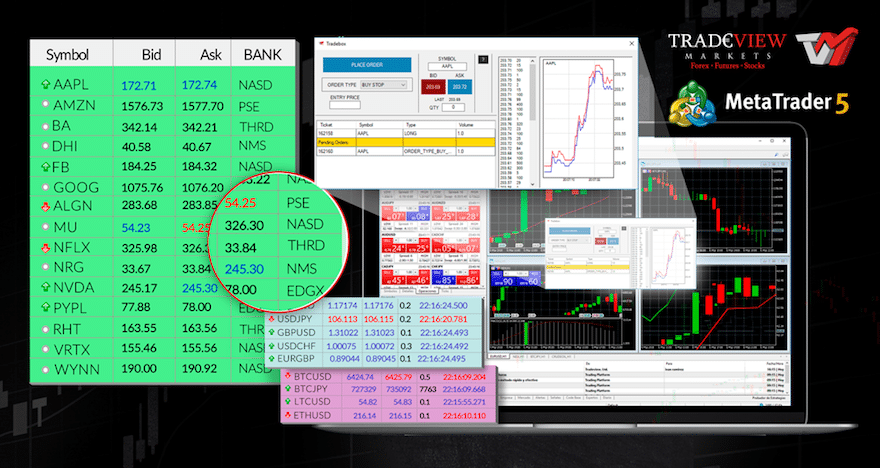

Tradeview LTD, a broker-dealer regulated in the Cayman Islands, announced on Wednesday that it has added US equity trading onto the MetaTrader 5 platform. This means, traders now have direct market access (DMA) to stocks listed on the New York Stock Exchange, NASDAQ and the American Stock Exchange.

In the foreign exchange (FX) industry, many brokers give their clients access to equity contracts for difference (CFDs). However, the instruments added by Tradeview are on-exchange equities. The difference here is that traders who purchase these equities become shareholders and are therefore entitled to dividends distributed by the underlying company.

According to the statement, when trading the on-exchange equities through Tradeview, traders will have access to globally disseminated level 1 quotes. At a given point in time, a level one quote is the best real-time bid/ask.

Commenting on the announcement, Tim Furey, the CEO of Tradeview LTD said: “Integrating real equities onto MT5 gives Tradeview a major competitive advantage and truly differentiates us from all other FX brokers. We aimed to give Tradeview clients the best and most complete trading experience and integrating equities onto this particular FX platform accomplishes that goal.”

In the past 12 months, the firm has been developing technology that is compatible with the MT5 platform. This includes co-location of servers on the NY4 data center, low latency driven solutions, order routing and connectivity to major exchanges.

Furthermore, the Forex broker also coded and programmed its own order entry box. According to the statement, when executing short orders, the entry box distinguishes between easy-to-borrow and hard-to-borrow stocks.

“Our custom order entry box, along with Tradeview’s overall infrastructure and technology expenditure is a testament to our commitment to ensure that traders receive the best Execution for their orders so client’s trading profits are maximized,” Furey added.

Tradeview Partners with FINRA Member

Tradeview also revealed that it has partnered with a member of the Financial Industry Regulatory Authority (FINRA). While the company has not revealed who the name of its partner, the firm did state the alliance gives it access to prime brokerage clearing solutions, which is a key component to providing access to the US equity markets, the FX broker said.