This article is part of a series of in-depth discussions of Social Marketing in the FX Broker industry by Media Group London, a full-service marketing agency specializing in financial services marketing.

Twitter is a channel with a wide distribution among Forex traders, and out of all social marketing tactics it is the most widely employed by brokers. While we believe Twitter should be a part of an overall Social Marketing strategy including Facebook, a Research & Commentary site, YouTube video channel and a Trade Following program – we hope this article will be a useful look at the Twitter landscape by itself.

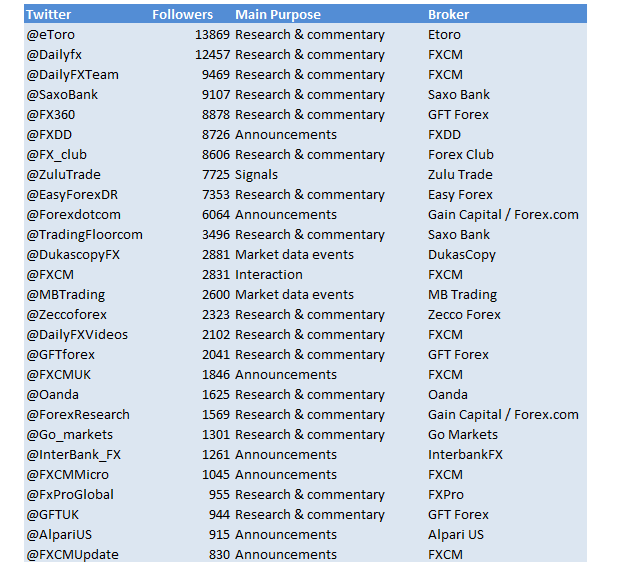

The brokers’ Twitter accounts discussed are used for a variety of purposes that can be divided into five categories; Announcements, Market Data Events, Research and Commentary, Signals and Interaction.

Announcements are those accounts mainly used for marketing messages and the promotion of the company; Market Data Events are those accounts that are mainly used to disseminate market data events such as NFP, BOE interest decisions or currency rate information. Research and commentary is more in-depth information about the market and where it is heading, and interaction accounts are those that talk to traders on a pro-active basis. Signals are those Twitter accounts that give actual trade recommendations.

If we accept that the end purpose of any communications program is to get people trading, we can assert that the closer the information gets traders to actually placing a trade the more likely they are to do so. While there is certainly a place for Announcements and Market data Events, they are further up the stream and should thus be part of and not the main purpose of any Twitter marketing.

So, in terms of how close these sites bring the trader to actually trading, below graphic shows how these types rank - from Announcements to Signals.

Distance to trading

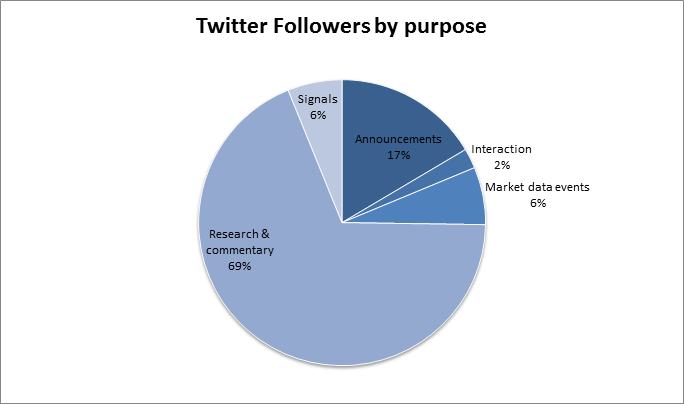

When we take a look at the number of followers by main account purpose we see that the vast majority of followers are to those accounts with research and commentary content, followed by Announcements and Market Data events.

If we take brokers’ followers as a sign of popularity we can see below that FXCM is the most effective in their social media strategy. eToro, Saxo Bank and GFT Forex are also fairly popular Twitter accounts. Besides eToro these numbers seem to largely follow the number of accounts a broker has. eToro has Social at the heart of their marketing strategy and as such has a disproportionate amount of followers (we will discuss them later on in this series).

No broker seems to currently employ all four tactics described but FXCM seems to touch upon the most of them, and also has by far the greatest reach.

Recommendation:

If a broker wants to get the maximum out of Twitter and the users’ attention and get closest to a trading action they should employ all four tactics. To minimize clutter and confusion they could do so with separate accounts; one for research & commentary, one for interaction, one for signals etc. Feel free to contact info@mediagrouplondon.com for any questions or comments, or if we can put together a more practically oriented proposal for you.

An overview of broker Twitter accounts, their followers and the accounts’ main purpose is shown below. Please keep in mind; we only discussed English language accounts, some of the brokers discussed might be clients of MGL and this overview is not meant to be a complete or scientific one.