The Cyprus Securities and Exchange Commission (CySEC ) today announced that it has continued the suspension of the Cyprus Investment Firm (CIF) UBFS Invest, backed by broker Moneychoice Brokers Ltd.

As reported by Finance Magnates in May, UBFS Invest was initially flagged for non-compliance and had its license temporarily suspended by CySEC following several allegations of multiple violations. The watchdog then extended the firm’s suspension in June followed by a further extension in August, 2016.

Take the lead from today’s leaders. FM London Summit, 14-15 November, 2016. Register here!

Today the regulator announced that the company authorization continues to be suspended due to suspicions of violations of the Investment Services and Activities and Regulated Markets Law 2007. What is more, CySEC this time has announced its initiation to withdraw the Cypriot Investment Firm (CIF) license of UBFS Invest. However, the process is underway to investigate grounds for a “possible” withdrawal i.e. no decision has been made yet as the company is given a deadline to meet certain provisions as part of the license suspension.

UBFS Invest is a provider of FX trading systems for individual and institutional customers. It also offers portfolio management to its clients powered by Moneychoice Brokers Ltd.

In particular, UBFS Invest is being accused of noncompliance, in that it did not properly protect or provide safety of its clients’ funds. In addition, UBFS Invest appears to have a problem with capitalization, as its own funds have fallen below the requisite capital requirements set by CySEC. By extension, the group’s total capital ratio is also below the necessary requirements, based on European regulatory measures as well as the necessary levels set by CySEC.

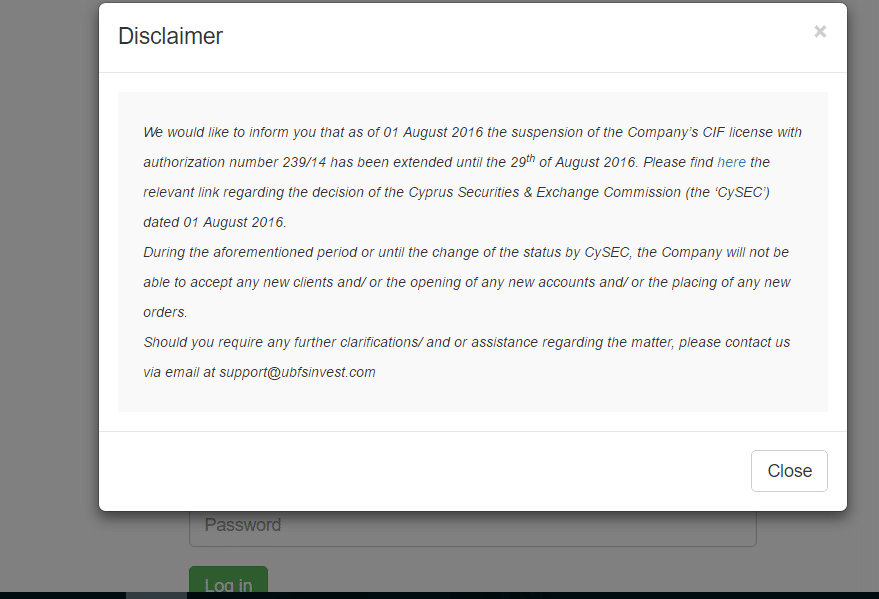

A visit to the UBFS Invest website now shows the following pop-up. However, this has yet to be updated to reflect the continuation of the suspension.

Counter to the regulator’s laws

According to the latest announcement from CySEC, which was translated from the Greek language: “Further to the announcement dated August 9, 2016, the Commission announces that the suspension of the Service license of CIF UBFS Invest powered by Moneychoice Brokers Ltd ('the Company'), No. 239/14, has been automatically extended while we have started the process of whether to withdraw the authorization under Article 26 (4) (b) of the Investment Services and Activities and Regulated Markets Law of 2007, as in force ( 'the Law'). The operation of the Company's license will remain suspended until the Commission decides to withdraw the license or not.”

UBFS Invest is obliged to take action in order to comply with the necessary provisions within one month. But while the license suspension is in force, the company is not permitted to enter into a business relationship with any person, accept any new customer or provide any services.

More specifically, pursuant to section 26(5) of the Law, the company cannot receive, transmit and execute any orders from clients for buying financial instruments, cannot provide any investment services in Cyprus or outside Cyprus, and is not allowed to advertise itself as an investment services provider.

In addition, the company must, if existing clients so wish, close any open positions in relation to clients’ contracts (on time or earlier if the client wishes so). It will be also required to return to existing clients all of their funds and profits earned, if and when the clients so wish.