Theresa May has suffered a major defeat with her election gambit, throwing into disarray Brexit negotiations and the strategy that her government had chosen. The ‘Hard Brexit’ card didn't play right with the voters and the only viable option for the Tories to remain in power is to form a coalition government with the Democratic Unionist Party (DUP) from Northern Ireland.

Brokers appear to have weathered the storm with two major camps forming before the election - those who raised margin requirements and those that didn't. Contrary to popular perception, indices did not materially suffer from the vote.

[gptAdvertisement]

The Brexit negotiating position of the UK is suddenly looking weaker than before the election. In the words of Theresa May, she wanted a mandate from the UK voters to carry out the negotiations. Two months later, she is struggling to hold a government together and clearly hasn't been given her mandate.

The UK Independence Party didn't get a seat this time around, leaving the Tories with only one possible option for a coalition, with the DUP. All of this signifies more uncertainty going forward.

Instead of a clear mandate to lead negotiations, Theresa May barely won the vote and is hoping to form a government with a majority of 2 seats (assuming that the DUP joins the Tories).

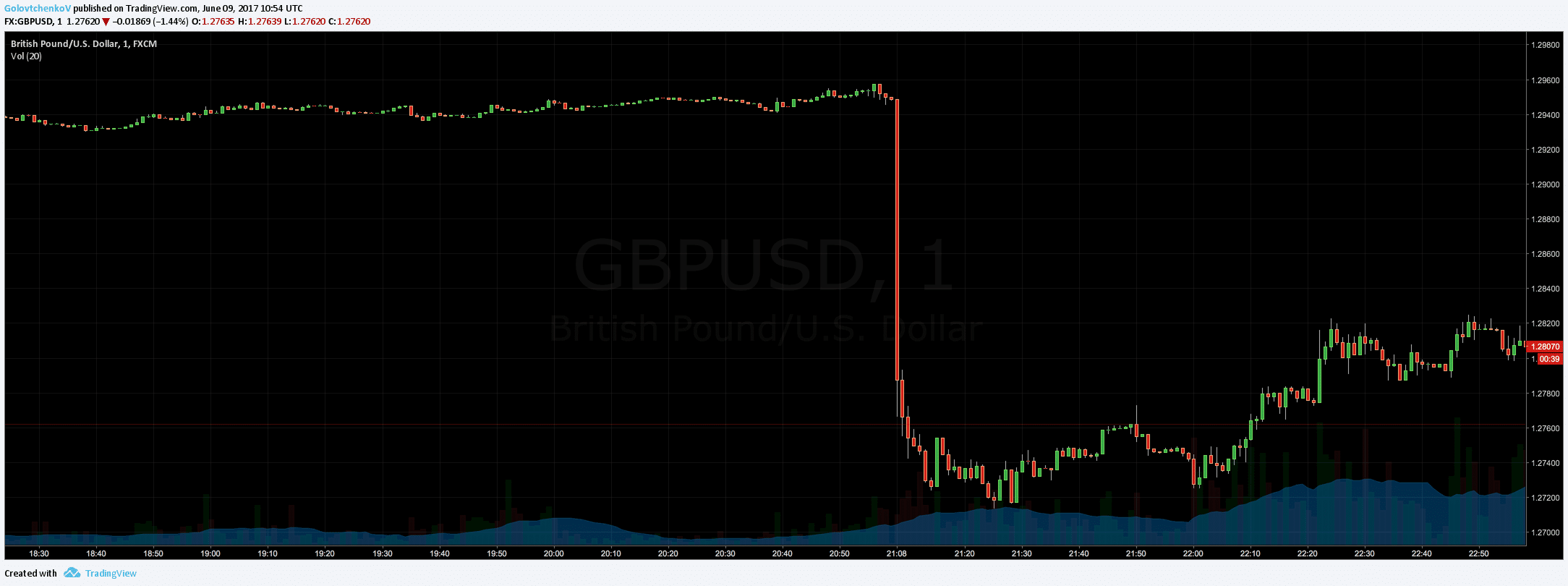

Market Impact - 1 Minute Havoc

Brokers that didn’t raise margin requirements might have been somewhat surprised by the sharp moves after 10:00 PM BST yesterday. The sharp drop in the first minute after the publication of exit polls triggered liquidation of long positions, leading to a drop of over 2 percent across the board.

GBP/USD chart in the aftermath of the exit polls publication

Due to the lack of Liquidity at that particular moment, a number of positions could have been materially affected in a negative way. The systems have been stress tested for similar events, and for the time being no material complaints about execution have been voiced by traders.

A New Theresa May Government Could Lead to Hard Brexit

The hard Brexit card that was played by the Tories is forcing them to stick to the manifesto which the party published during the campaign. With the majority gone, now Theresa May will have to listen to every critic of the government within her own ranks. This is likely to lead to an extraordinary number of challenges in an effectively hung parliament.

Citizens of the UK essentially voted for a soft Brexit last night, giving May little trust to carry out the critical negotiations. At present, the British pound is discounting a hard Brexit scenario with the current Prime Minister remaining in power.

Hung Parliament Attests to High Brexit Skepticism

The British pound’s tumble this morning accurately reflects how difficult the UK’s position is as it prepares to embark on an intense two years of Brexit negotiations. Not only there is no clear majority to lead negotiations, but there is also little time left for UK politicians to come to the negotiating table with the EU.

Labor has pledged a soft Brexit, but has a leader that is leaning towards the populist Left. In the meantime, Theresa May’s “strong negotiating hand” in EU negotiations is everything but at present.

Prime Minister May is heading to Buckingham Palace this afternoon to ask for a mandate to form a government.