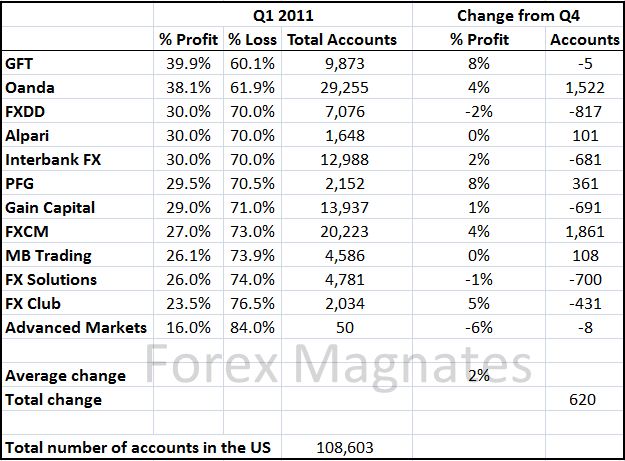

This is the first profitability report for 2011 and there are several interesting changes since last quarter's US forex brokers profitability report: first of all IG Markets is no longer in the list as it is no longer operating directly in the US while Tradestation Forex will join this list next quarter.

The second notable change is the drop in Oanda's client profitability. Oanda had to remove accounts which are only paid interest from the calculation as this was a new requirement set out by CFTC. This resulted in Oanda's profitability number dropping from 51% in Q3 2010 to 43.5% in Q4 2010 and now to 38%. Oanda has also removed almost 20,000 accounts from the total number of accounts and now shows slightly less than 30,000 accounts - still by far the largest broker in the US. This means that interest-only accounts are no less than 40% out of total Oanda's accounts.

GFT now is the most 'profitable' broker in the US - this means that on average its clients are more profitable than others. Whether this actually means that clients have better chances at being profitable when trading with the 'top' brokers in this list - is a topic for a very long and perhaps a philosophical debate.

Oanda's updated number of accounts also changes the total number of active (per CFTC 's definition) accounts in the US. Oanda has recaculated the number of its active accounts retroactively which puts the total number of US accounts in Q4 2010 at 107,983 (excluding IG Markets) and the current number of US accounts at 108,603 - a growth of only 0.5%. Biggest gainers in this report are Oanda and FXCM which jointly gained more than what FXDD, Interbank FX, FX Solutions, FX Club and Gain Capital lost.

As usual Advanced Markets stands out with an extremely low numbers of accounts - only 50 this quarter, however we now finally have an explanation for this - its clients are the biggest in the industry in terms of average balance. In February Advanced Markets reported $3.4 million in client capital which divided by 50 accounts results in an astonishing average $68,544 balance per account - 18 times higher the US industry average of $3800 (revised figure). On the other hand its clients are also the least profitable, which is only more confusing.

Perhaps the most remarkable figure in this report is the average growth in overall clients profitability. Almost all brokers have reported better profitability numbers in this quarter compared to the previous one, and this is in line with my predictions. Overall clients were 2% more profitable this quarter than in the previous one (to exclude Advanced Markets effect we can use a weighted average which would give an increase of 3% in profitability instead of 2%). Comparisons such as the one I'm making here is one of the reasons behind this - brokers are trying to improve their image and as a result their profitability results are improving quarter-on-quarter. Perhaps this is what CFTC had in mind when they introduced this quarterly profitability reporting requirement.