Last Friday, we got the first glimpse of an acquisition by one of the big heavyweights in the industry that was set to be confirmed on Monday. The Danish multi-asset brokerage Saxo Bank has recommitted to its strategy of providing trading in multiple asset classes and bought a discount stock broker by the name of BinckBank.

The move did not come as a surprise to some of the insiders in the Dutch industry, who shared their thoughts on the matter with Finance Magnates last week. The primary reason for that is the rather benign technological development of BinckBank when compared to Saxo Bank.

The Danish company has been aggressively expanding its product offering for years and committed substantial resources to cement its technology offering, raising an additional €100 million from its shareholders to finance the deal. Fournais Holding A/S, Geely Financials Denmark A/S and Sampo Plc have all committed to the equity raise.

The massive competition for attracting traders, coupled together with the increased regulatory scrutiny are motivating big players to get even bigger. While many brokerage companies offered for sale are currently “unreasonably” priced (as quoted by several senior executives we spoke with at the London Summit), the regulatory changes are slowly starting to force firms to shut their doors.

Expanding into Stocks

The expansion into stocks is seen as the first logical step for retail Forex and CFDs brokerage companies. The success of Robinhood across the Atlantic has already inspired companies like Trading 212 and BUX to start similar offerings for EU clients.

CMC Markets, on its part, focused its expansion into stock trading on Australia after announcing a partnership with one of the biggest banks in the land down under, ANZ.

The next logical step for well-capitalized companies like IG Group, for example, is also to attempt to enter the space. While no official information has been published by the company, the next logical step for the brokerage is to follow suit into stocks.

Saxo Bank’s move to acquire BinckBank is only the next proof of the direction that heavyweights in the brokerage industry are taking.

What about Smaller Companies?

For now, smaller companies are not interested in venturing into stock trading. Some technology providers do have solutions in place that can accommodate such offerings. The companies seem worried for three main reasons - the different crowd trading stocks, the lack of leverage on trading physical stocks, and their experience with stock CFDs.

Any brokerage that has been offering CFDs on stocks to its clients knows how much trading volumes are generated via the asset class. Until they see no proof that traders are flocking into shares for some reason, the likelihood that they will adopt a change in the product mix is subdued.

Cryptocurrencies have been another point of diversification for retail forex and CFDs brokers. However, the recent regulatory changes publicized by the FCA are preceding a likely shutdown of crypto CFDs.

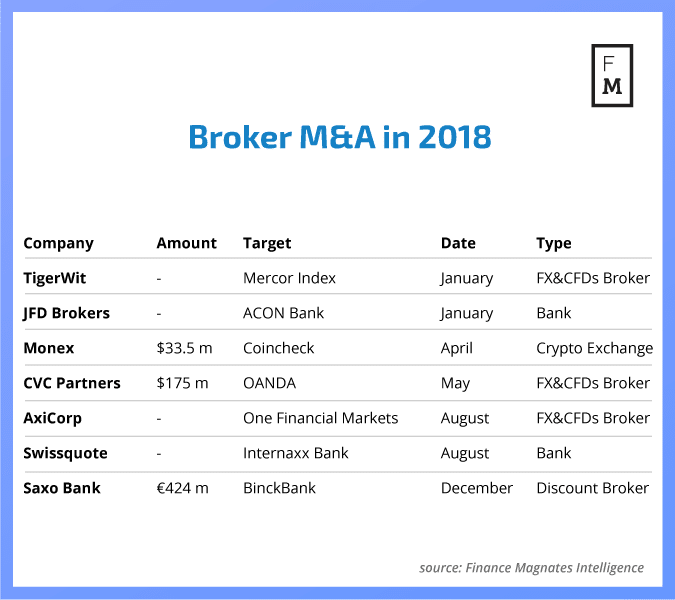

Brokers M&A in 2018

As we saw in 2018, smaller brokerages have also been keen on acquisitions. JFD Brokers acquired a controlling stake in a German bank, while TigerWit and AxiCorp have committed to some smaller deals.

If anything, last year’s tough regulations prompted companies that can afford it to expand. Next year is unlikely to be any different as the firms continue to face the tough reality of the new European regulatory regime.

Saxo Bank Cost Savings & Restructuring

As to the Saxo Bank deal, the cost savings the company publicized are indisputable. Saxo Bank’s technology meets BinckBank’s large customer base, and the companies can well execute on keeping the best suitable offices across Europe.

The Dutch office of BinckBank in Amsterdam will be the hub for the central-European market. In France, the Saxo Bank and BinckBank offices are going to be merged, while in Italy the Dutch company’s office will get integrated into Saxo Bank's operations. The Belgian and Spanish locations will for now remain untouched.

As to the brand names across different regions, BinckBank will be kept for the Netherlands and Belgium. For France and Spain, BinckBank and Saxo Bank are yet to consider the best use of the brands, while in Italy the newly merged entity will use Saxo Bank.

The optimization of Saxo Bank’s costs across different regions is preparing it for a new era, where regulatory scrutiny plays a key role in the industry’s consolidation. In the meantime, smaller brokers are looking for ways to reduce their reliance on Europe and are focused on growing their offshore subsidiaries.