Online foreign exchange and CFDs brokerage XTB (X-Trade Brokers Dom Maklerski S.A.) successfully got listed on the Warsaw Stock Exchange (WSE) today. The company placed a touch under 16.5 million shares for public trading, valuing the company at $349 million at the market open. The share offering constituted the biggest IPO listing on the WSE for 2016.

A mid-April report by Finance Magnates hinted that the company was looking to raise up to $400 million. The initial price of the offering is closer to the lower range of the expectations set out on the IPO prospectus, however the first trading day looked promising.

Earlier in April, bookmakers cited by Reuters estimated a valuation of about $600 million.

Shares of the company traded higher on day one, closing at 12.05 Polish zloty (PLN) which totals to $3.10 according to current exchange rates. The close was at the top end of the daily range with the high marked at 12.06 PLN. For context, the broad WSE market closed only 0.82 per cent higher.

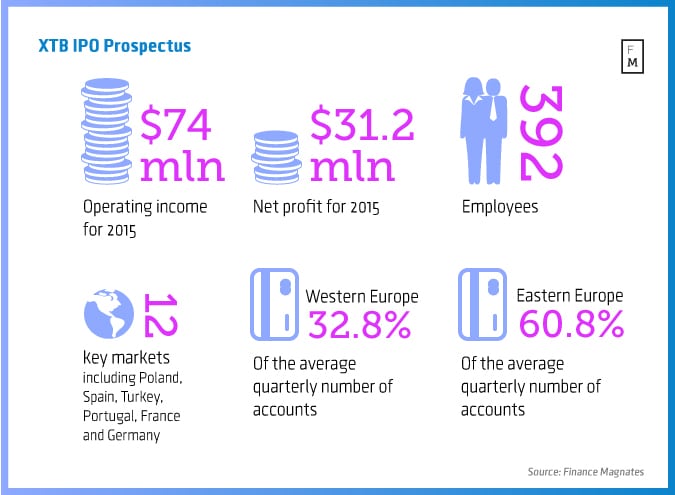

Key figures from XTB's IPO prospectus, Source: XTB Group

Preparation for XTB’s IPO Process Started Last Summer

Speaking to Finance Magnates, the CEO of X-Trade Brokers Dom Maklerski S.A. Jakub Maly shared that the company started the IPO process during the summer of 2015. At the time the valuation of the firm cited by sources close to Reuters was $224 million. Commenting on the listing, Maly stated: “We are very pleased with how the initial public offering went. We had to wait for the right timing, but after all we successfully placed all the offered shares.”

Elaborating on the preparatory process, he explained: “We have started the preparation last year around summer time. As you can imagine, it has been a long process getting the company public and we’ve spent several months preparing for the debut. We had to wait out tough market conditions, but now we are successfully there.”

The costs of the IPO are going to be disclosed in an upcoming public reporting package which XTB will release.

XTB’s Plans for Growth and Expansion

After XTB has become a publicly traded company, the firm is gaining additional marketing momentum with its retail and institutional clients. Many explained that raising the prominence of the value of the brand was one of the main aims of the whole process.

“We feel that clients want to know who they trade with, and being public adds additional transparency to the company,” he elaborated.

With the company focusing on growth, we have asked the CEO of XTB about the immediate plans of the brokerage.

“We would like to mainly increase our efficiency in the E.U., develop our institutional part of the group and expand geographically to regions where Regulation will allow. The dynamics of our business dictate that we have to assess every opportunity in real time based on the historical data, public data and our experience. The same applies in the case of selecting new markets.”