Polish brokerage house X-Trade Brokers (XTB) decided to debut on the Warsaw Stock Exchange in May 2016. Although it has been a year since then, no other retail broker has dared to take a similar step. In April, Finance Magnates had the opportunity to talk with newly appointed CEO, Omar Arnaout, who answered questions about potential market consolidation.

The London Summit 2017 is coming, get involved!

Two months later, the founder and owner of XTB, Jakub Zabłocki, in an exclusive interview with Finance Magnates comments about the decision to leave the Turkish market, increased brokerage activity in Latin America and responds to questions how regulations affect the retail part of the industry. Recent acquisitions suggest that the largest Polish FX/CFD services provider wants to focus its future development activities outside of the Old Continent.

[gptAdvertisement]

Finance Magnates

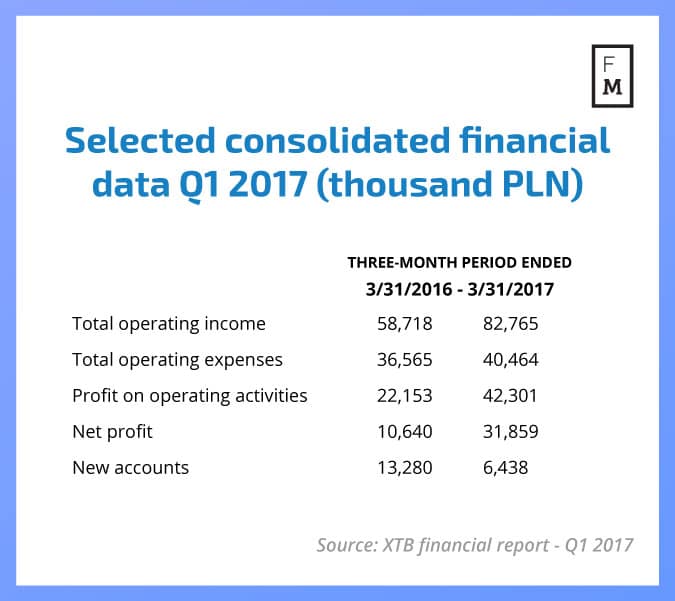

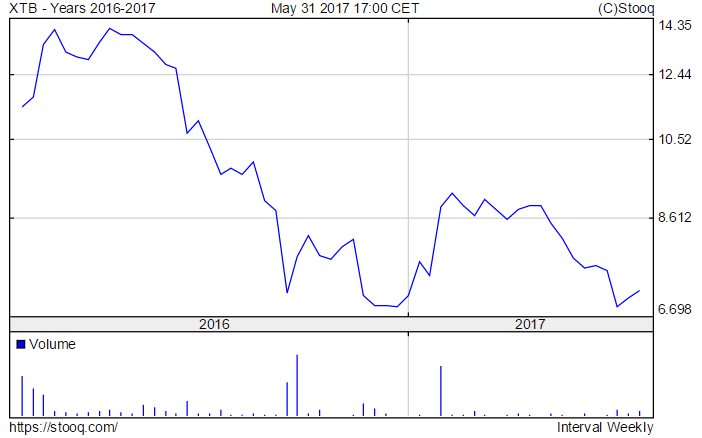

According to the latest financial report, for the first three months of 2017, XTB posted a total of $15.1 million (PLN 58.7 million) worth of revenues. The figure is lower by 29 percent when compared to the same period of last year on a constant currency basis. This negatively affects the valuation of shares, which has lost more than 50% since the IPO.

Warsaw or London - which is closer to you now? At this point, do you focus more on overseeing the retail (XTB) or institutional (X Open Hub) part of the business?

On an everyday basis I live and work in London. However, I travel to Warsaw quite often to see how the business is going and consult key decisions with the Board and higher management with regard to both the retail and institutional business.

We had an opportunity to talk just after XTB’s decision to leave the Turkish market. Although rumors of the move came just after regulatory changes in Turkey, Omar Arnaout said in a recent interview with Finance Magnates that the decision was not taken into account. What has happened during the last two months to make you change your mind?

Well, after the legal changes came into force, we tried to optimise our operations and adapt to the new market situation, which suddenly had become far more difficult for doing business. We simply wanted to give it some time and see how the market would consolidate and what that would mean to us. However, analysis conducted by XTB showed that limitations implemented by the Turkish Regulator resulted in a relevant decrease in the number of clients and as a consequence in significant limitation of XTB Group’s operations in Turkey. Our current approach is that if a business unit is not working or does not have perspective we cut it off quickly.

Regulatory changes are occurring all over Europe. In the past month the Polish watchdog set new rules to fight unlicensed entities offering IPO investments. Will the latest regulatory action be able to cure this plague, or will it become just another dead letter?

Regulatory changes are necessary to keep the market safe for the investors. However, we should focus on solving real problems and threats. What I mean is that regulators should focus on the unethical sales and marketing approach of many brokers and on the other hand impose more control over unlicensed entities. As for latest KNF’s decision I believe it is a step in the right direction.

The risk is always there, when it comes to financial markets and investing in financial instruments, especially as complex as derivatives.

As an investor with many years of experience, would you like regulations to be as sharp as possible, or should supervisory committees give traders a choice?

Like I said before, regulatory changes are required and they should keep the market in order and protect the investors from bucket shops, crooked brokers and fraudulent practices.

I believe that the trader should always have a choice and be able to decide what offer to choose and what broker to trade with. The risk is always there, when it comes to financial markets and investing in financial instruments, especially as complex as derivatives.

Recently, XTB faced some internal problems - you had to take the role of an interim CEO for a moment. Are you satisfied with the new CEO?

At the beginning of 2017 the Supervisory Board decided to make changes in the Management Board’s composition. We believed that the pace of strategic goals realization and the capital group’s development has not been sufficient. I am satisfied with the progress that has been developed by the company under Omar Arnaout’s supervision. We finally got a new blood to our organisation and I really like the new board’s spirit.

In the newest financial report covering the first quarter of 2017, we see a recurring pattern - an increase in the number of new accounts, but a decline in revenues and profits. What is the main cause? In the same report we read about the reduction of operating costs by about 10% compared to last year.

The first quarter of 2017 in terms of new clients was very good for XTB in comparison to previous quarters. Volumes in the first quarter were also higher than in the last quarter of 2017 but the lower revenue was mainly based on the lower profitability per lot. Taking into consideration the growth of our client base, trading activity and deposits I am confident that operationally we are heading in the right direction. As to costs then due to changes that are taking place in the industry, we believe that it is the time of market consolidation where only the most effective companies will remain on the market. The decrease of costs comes from various area’s of our business and is based on thorough analysis of where funds can be saved without having a significant influence on the business as a whole.

In addition to presenting results for the past quarter, XTB also reported on its developments in Latin America, focusing on Chile and Belize. Is Latin America a new area of focus?

We have been observing the Latin America market for a long period of time. We see potential for development of the Forex/CFD business in this part of the world.

We believe that only a few strong and ultra efficient players will stay on the market.

Are you ready for further market consolidation and takeovers in 2017? Can you share any plans?

We believe that 2017 will be the year of marked consolidation. A lot of brokers have problems with costs and getting new clients. Marketing is extremely expensive and not effective nowadays. We believe that only a few strong and ultra efficient players will stay on the market. The rest of the brokers will be acquired, merged with others or will have to leave the market. I think that XTB is a great platform for medium size brokers to join forces and merge into one of the top players of the FX and CFDs market. We are one of the most technologically advanced company, with low cost base. What is more we are publicly listed company which makes our shareholders liquid. Currently we are scanning the market and looking for potential partners who are the most complimentary to us and with whom we could get the best economies of scale.

Do you think that market volatility is an important factor affecting brokerage activity? Do such events as Brexit , the US/French elections, and flash crashes attract investors to the market, or do they prefer more quiet periods with stable price fluctuation?

In principle, the level of XTB revenue is positively affected by higher volatility on financial markets due to the fact that in the periods of increased volatility clients see more trading opportunities. On the other hand what is important for companies in our industry is not volatility itself but the clarity of market trends. When markets move in horizontal trends it is more difficult for clients to anticipate future market movements and that is why clarity is very important in terms of market movements.

The latest observations show that mobile trading is gaining on desktop solutions - institutional traders are also joining the growing trend. Are you also noticing a technological change among your clients? What are the statistics?

With the proliferation of smartphones and tablets, as well as mobile data consumption, mobile trading is gaining popularity, especially among people on the move. Those who use computer terminals for trading, do so because of the extended facilities like sophisticated charting tools and more. However, mobile trading platforms are constantly evolving and adopting newer technologies that could provide users with more feature-rich access.

At XTB we strongly believe in mobile trading - we’ve developing our own technology for several years now and we provide our clients with mobile trading solutions, that enables them to trade from a smartphone, tablet or even a smartwatch. At the moment, more than 50% of our active clients use the mobile trading solutions.

Staying on the topic of hot market trends, Bitcoin has recently become one of the main economic themes. In view of the growing popularity of Cryptocurrencies , are you considering offering BTC?

That is true that Bitcoin and other cryptocurrencies have gained in popularity especially because of the dynamic growth in value and clear trends as I mentioned previously. We obviously observe the demand of our clients and what else can be provided to them both from the technological but also from the product perspective. Concluding we constantly observe new potential products and markets that can be added to our offering.

The company’s listings on the Warsaw Stock Exchange are currently far from the historical highs achieved just after last year’s IPO. Are you forecasting any improvements in financial performance and investor confidence in the coming quarters?

The price of our stock has declined over the last months, that is true. The decrease in profitability results from the characteristics of the XTB Group's business model, which is characterized by high revenue volatility in a short term. It causes that profitability per lot in particular quarters may be subject to significant fluctuations. It's visible based on the results for 2016. The longer the analysis horizon, the more stable the results are. We will do our best effort to maximize the turnover and thus increase the confidence of our investors.