The United Kingdom-registered entity of Capital Markets Elite Group, a broker specializing in forex and contracts for differences, released its financials for the last fiscal year as it generated an annual turnover of £449,772.

A Loss Making Broker

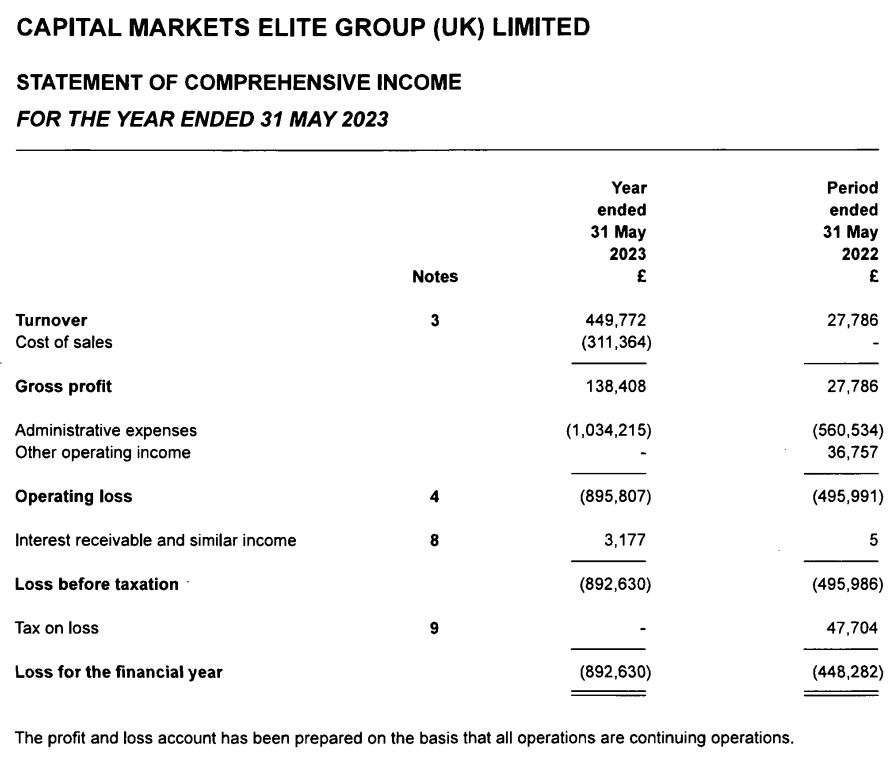

The figure for the fiscal year, which ended on 31 May 2023, was reported following a year when it recorded a turnover of £27,786. After considering £311,364 in cost of sales, the brokerage operator's latest gross profit amounted to £138,408.

However, the administrative expense of the UK-registered company exceeded £1.03 million, compared to £560,534 in the previous year. The costs also pushed the company towards an operating loss of £895,807, deepening it from a loss of £495,991 in the previous year.

The net loss of the broker from its UK operations for the year totaled £892,630, while this figure was at a loss of £448,282 in the previous year.

A Multi-Regulated Broker

Apart from its operations in the United Kingdom, the broker brand also operates with another entity licensed in the Cayman Islands, which is owned by a holding company registered in Saint Lucia.

“The firm continues in business using its existing financial service regulated permissions. The firm offers brokerage and execution services for both equities and derivative products. The firm’s focus to date has been to the equity markets targeting mainly retail clients based in the UK and Europe,” the latest Companies House filing stated. However, it is not clear how the brokerage has any other licenses from any European Union member to operate within the bloc.

The latest filing added that the client onboarding program of the UK entity added close to 1,000 new accounts in the last fiscal year, and about half of them have “progressed to funding.” It further highlighted that the client demographic is predominantly “retail.”