CMC Markets Plc, a publicly-listed online trading platform (LSE: CMCX), reported its highest net operating income since the COVID-19 pandemic for the fiscal year ended March 31, 2024. The London-based company saw adjusted profit before tax jump 52% as it benefited from robust client trading activity and ongoing diversification efforts.

CMC Markets FY24 Net Operating Income Hits £332.8M

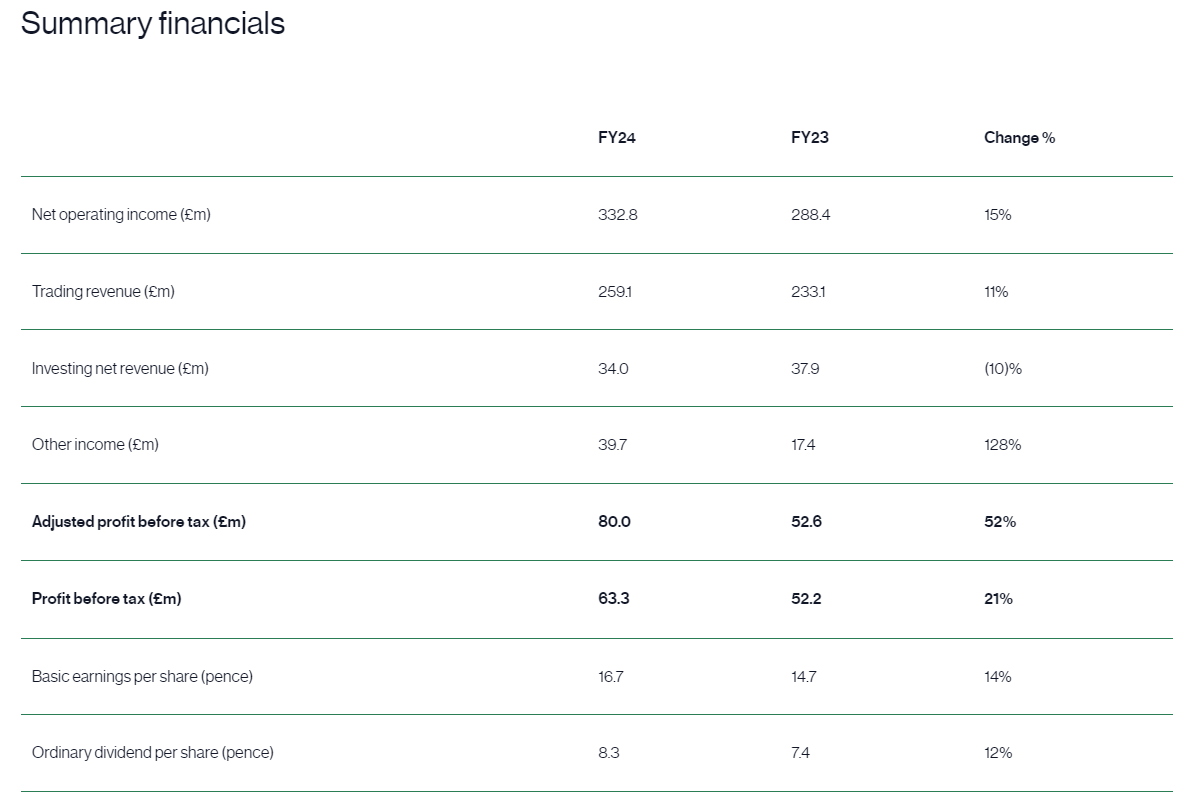

Net operating income rose 15% to £332.8 million, driven by an 11% increase in trading net revenue to £259.1 million. The strong performance spanned the business's retail and institutional segments, with the latter accounting for a growing share of overall net revenue. Investing net revenue dipped 10% to £34.0 million, primarily due to currency headwinds from a weaker Australian dollar.

"Over the past year, a recovery in client trading combined with our diversification strategy through B2B technology and an institutional first approach has delivered strong growth and opened up many opportunities for the company around the world," said CMC Markets CEO Lord Cruddas.

The firm's statutory profit before tax rose 21% to £63.3 million, reflecting the solid top-line growth and initial steps to optimize costs. Adjusted profit before tax, which excludes one-off charges, surged 52% to £80.0 million.

CMC Markets said it made significant progress on operational efficiency during the year, launching a cost review program to drive synergies across product and business lines. The company also established a centralized Treasury Management Division to optimize cash management, currency exposure and liquidity.

Earlier this year, the company twice announced that its income for FY24 would exceed previous forecasts. Initially, in January, it suggested that the income would be in the range of £290-310 million, a projection it confirmed again in March. The final result proved to be even higher.

Looking ahead, Cruddas struck an optimistic tone, saying "CMC Markets Connect has added a new fintech dimension to our offering and there is no higher endorsement of our company than when a major bank or financial institution trusts our technology to deliver a service to their valued clients."

The company is guiding to fiscal 2025 net operating income of £320-360 million on a cost base, excluding variable compensation and one-time items, of approximately £225 million. CMC Markets declared a final dividend of 7.3 pence per share, bringing the full-year payout to 8.3 pence, up 12% from the prior year.

The outlook for the coming quarters appears positive. CMC Connect, the institutional arm of CMC mentioned by Cruddas, has established a strategic partnership with Revolut this week. The company will provide the retail trading giant with back-end infrastructure, enabling Revolut's customers to access the broker's trading universe directly through the neo-banking app.

Meanwhile, CMC has promoted Michael Bogoevski to the role of Head of Institutional APAC and Canada, based in Sydney, Australia. Previously, he served as Head of Distribution in the same region.