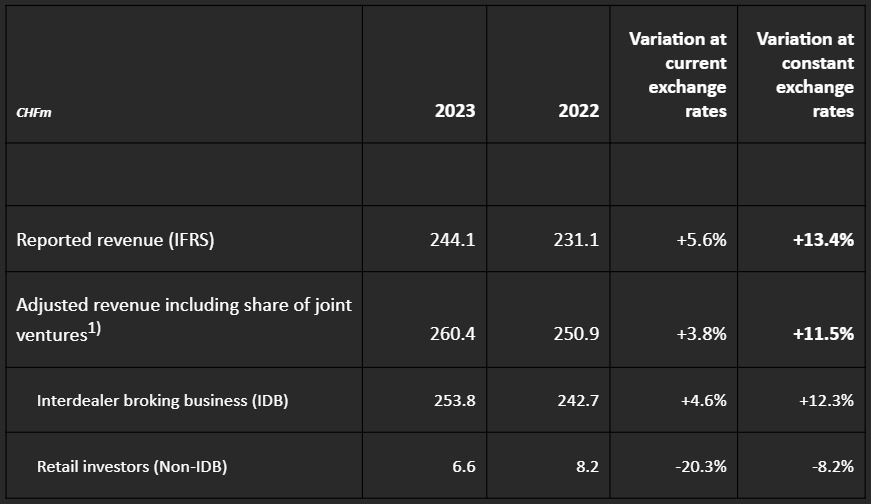

Compagnie Financière Tradition (SWX: CFT), an inter-dealer broker and operator of a Japanese retail foreign exchange (forex) trading platform, closed its fourth quarter of 2023 with a reported revenue of CHF 244.1 million, an increase of 5.6 percent and 13.4 percent in variable and constant currencies, respectively.

Impressive Quarterly Numbers

According to the official figures posted today (Thursday), the company's adjusted revenue for the three months between October and December came in at CHF 260.4 million. Year-over-year, the figure increased 3.8 percent in variable currencies and 11.5 percent in constant currencies.

CFT is headquartered and listed in Switzerland and operates an interdealer broking venue. It also manages Gaitame, one of Japan's latest retail forex brokers.

The quarterly revenue from its interdealer broking business (IDB) came in at CHF 253.8 million compared to CHF 242.7 million in the corresponding quarter of the previous year. The non-interdealer brokering business (non-IDB), the retail trading operations in Japan, brought in CHF 6.6 million, down from CHF 8.2 million.

Yearly Performance Stays Strong

Considering the full-year performance, the Swiss company generated CHF 982.4 million in annual reported revenue, while the adjusted figure reached over CHF 1.05 billion. In the previous year, these figures were at CHF 947.4 million and CHF 1.02 billion, respectively.

Again, the IDB revenue at CHF 1.02 billion brought in a significant portion of the total annual figure, while non-IDB revenue declined to CHF 31.4 million from CHF 33.9 million.

“The normalization of the monetary policy of central banks with the increase in interest rates during the year followed by an observation period in the search of the balance point that combine the control of inflation and a soft landing of the economy, all in an already complex geopolitical environment, were supportive to the Group's interdealer broking business activities,” the company stated.

“Tradition also benefited from favorable market conditions in the energy and commodity businesses as well as the development of its activity dedicated to market data commercialization.”