There was a significant decline in the number of complaints against the derivatives and foreign exchange dealers received by the Australian Financial Complaints Authority (AFCA) in the last fiscal year ending 30 June 2023. However, there was a significant increase in the overall number of complaints climbing from 69,785 to 92,915.

Complaints against Aussie Financial Service Providers

According to the latest data, AFCA received a total of 197 complaints against derivatives dealers operating in the country, representing a significant drop from the 418 complaints in the previous fiscal period. Similarly, complaints against forex dealers decreased to 93 from 622, marking a substantial decline. This sharp decrease can be attributed to the 543 complaints filed against Union Standard International Group in FY22, a company that has since entered liquidation.

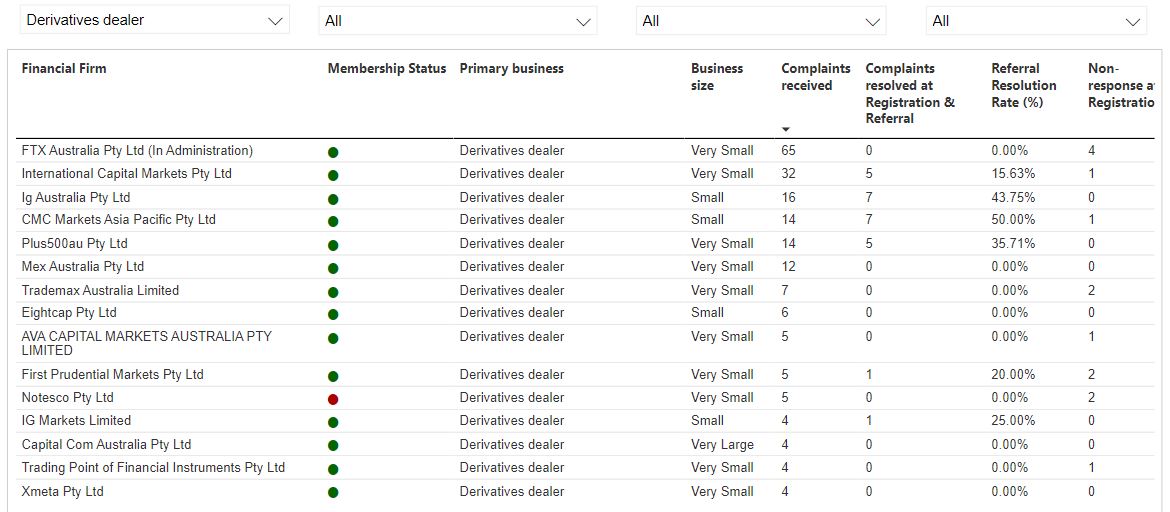

Among derivatives dealers, the Australian branch of FTX, which is currently under administration, had the highest number of complaints in FY23, totaling 65. It was followed by IC Markets with 32 complaints and a subsidiary of IG with 16 complaints. The Australian divisions of CMC Markets and Plus500 each received 14 complaints.

While FTX did not address any complaints lodged against it, most of the other prominent derivatives dealers with double-digit grievances managed to resolve some of the issues, albeit in single digits.

Companies Are Also Resolving Complaints

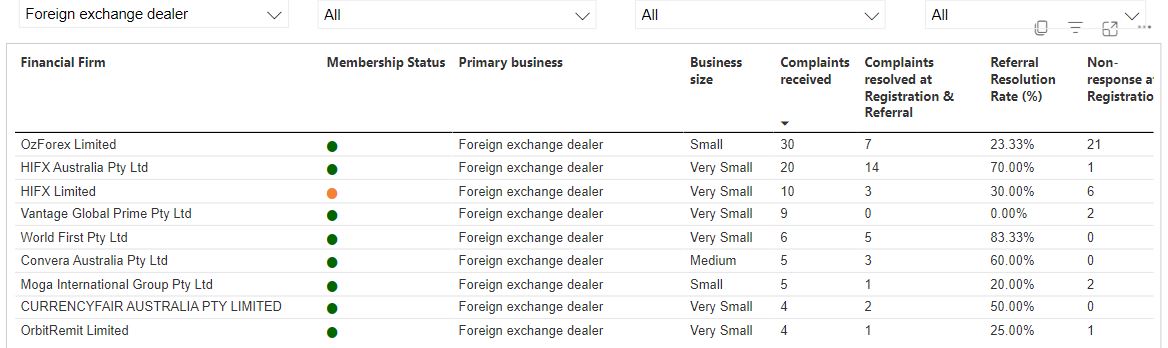

Turning our attention to forex dealers in the country, OzForex garnered the highest number of complaints, totaling 30. Meanwhile, two subsidiaries of HIFX registered 20 and 10 complaints, respectively. The Australian subsidiary of Vantage reported nine complaints, none of which have been resolved.

AFCA Datacube only includes companies that received at least four complaints in the financial year.

Although the overall resolution rate across all sectors remains at 52 percent, the figure dropped to 19 percent for derivative dealers and 39 percent for forex dealers.

“The amount of time that the financial firm has to respond depends on the type of complaint and what’s happened previously, including whether the financial firm has had an opportunity to complete its internal dispute resolution process,” AFCA stated.