CPT Markets UK, a brokerage specializing in forex and contracts for differences (CFDs), has disclosed its financial performance for the fiscal year ending December 31, 2023, in its latest submission to Companies House.

Operational Improvements Despite Increased Expenses

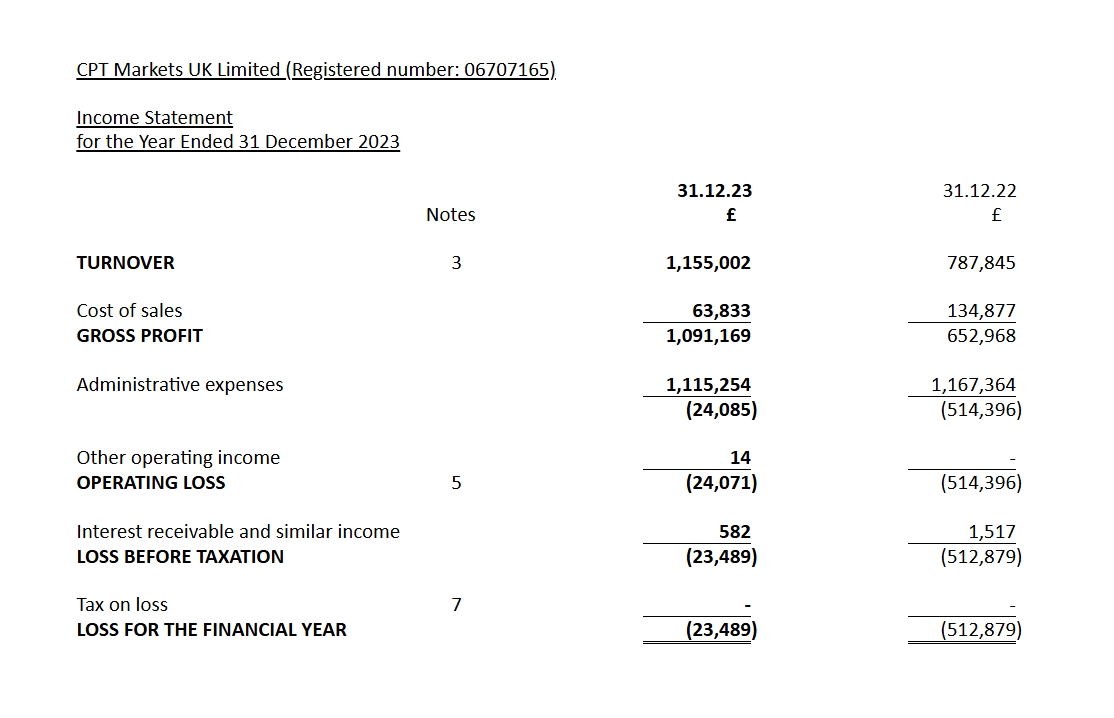

According to the report, the company experienced a significant rise in turnover in 2023 compared to the previous year. Turnover for the year amounted to £1,155,002, showing notable growth from the £787,845 recorded in 2022. Similarly, gross profit for 2023 stood at £1,091,169, reflecting an increase from £652,968 in the preceding year.

Despite the increase in turnover, administrative expenses for 2023 totalled £1,115,254, slightly lower than the £1,167,364 incurred in the last fiscal year. This resulted in an operating loss of £24,071 for 2023, which marks an improvement from the operating loss of £514,396 reported in the previous fiscal year.

Focusing on Customer Service

Interest receivable and similar income contributed £582 in 2023, down from £1,517 in the previous fiscal year. After accounting for taxation, the company reported a loss before taxation of £23,489 for 2023, a decrease from the loss of £512,879 in the preceding year. The final loss for the financial year 2023 amounted to £23,489, showing a decrease from the loss of £512,879 reported in the last fiscal year.

Company filing stated: “We aim to grow our customer base in a crowded market, dominated by big global brands, by providing an excellent service to our customers.”

“We acknowledge that, in order to progress to the next phase in the company's future, we will explore adding additional asset classes to our existing product range and expanding our service proposition to clients. In doing so, our twin aims are to maximise the company's ability to grow profits and market share whilst returning the highest possible value to the shareholder.”