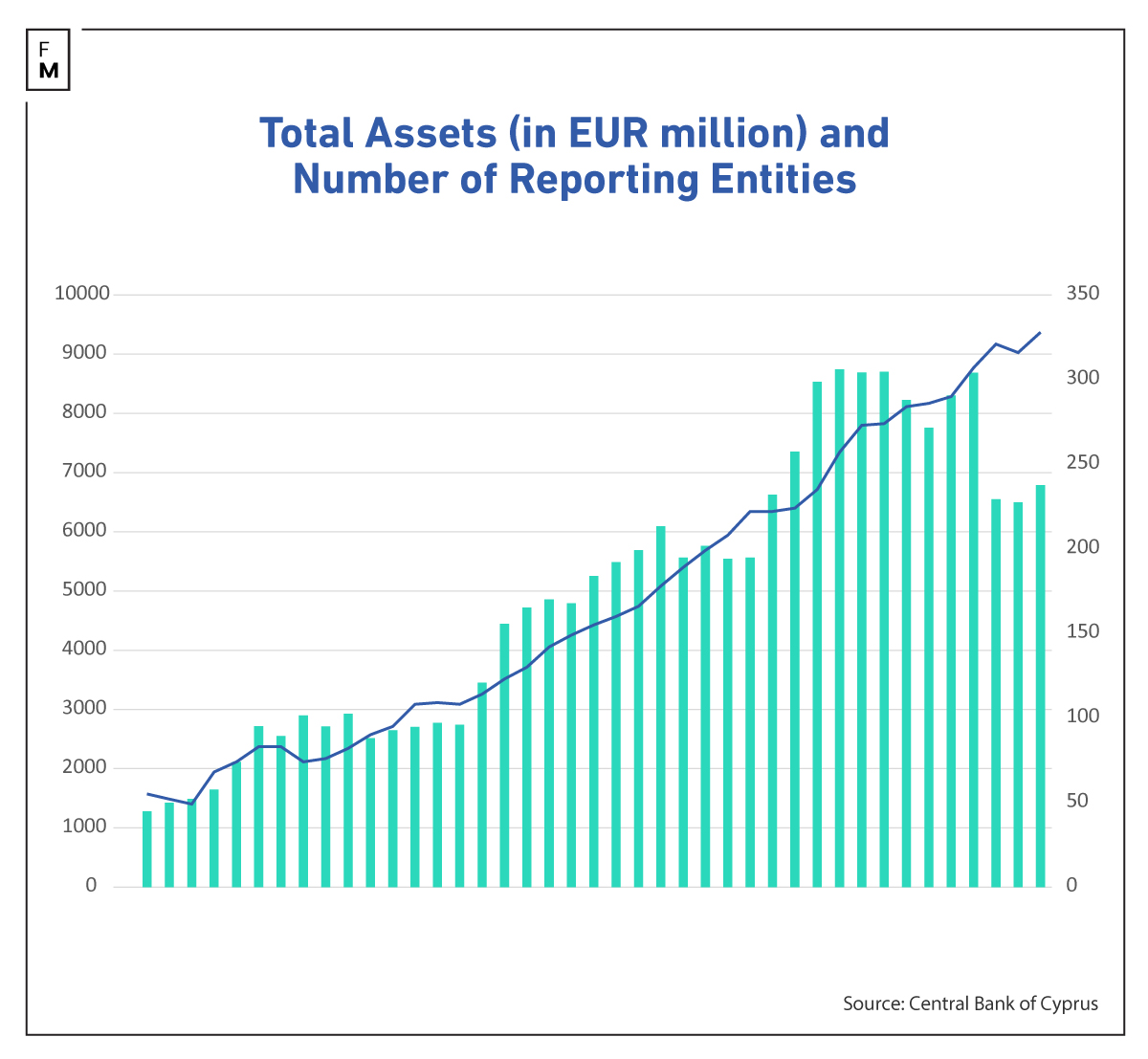

The investment funds industry in Cyprus demonstrated resilience in the first quarter of 2024, with total assets under management increasing for the first time after two consecutive quarterly declines, according to the latest statistics from the Central Bank of Cyprus.

Cyprus Fund Assets Rise 4.5%, Ending Two-Quarter Slide

As of March 31, 2024, the total assets of Cypriot investment funds stood at €6.79 billion, a 4.51% increase from €6.50 billion at the end of December 2023. The number of reporting fund entities also grew to 328, up by 12 compared to the previous quarter.

“The number of investment funds increased from 316 in December 2023 to 328 in March 2024,” the Central Bank of Cyprus commented in the newest statistic release from last week.

Investment fund shares and units accounted for the lion's share of the industry's liabilities at 96.74%, with loans and other liabilities, including derivatives, making up the balance.

“Despite the challenging economic conditions and the looming threat of a potential recession, the investment funds industry in Cyprus continues to draw the formation of new funds, demonstrating resilience,” commented the Cypriot-based SALVUS Funds, a boutique advisory.

SALVUS attributes the local funds' resilience, among other things, to the actions of the Cyprus Securities and Exchange Commission (CySEC ), the local regulatory authority. A few months ago, it presented an updated regulatory agenda for the current year, prioritizing oversight of firms engaged in cross-border activities to mitigate risks in complex financial products, such as Contracts for Difference (CFDs).

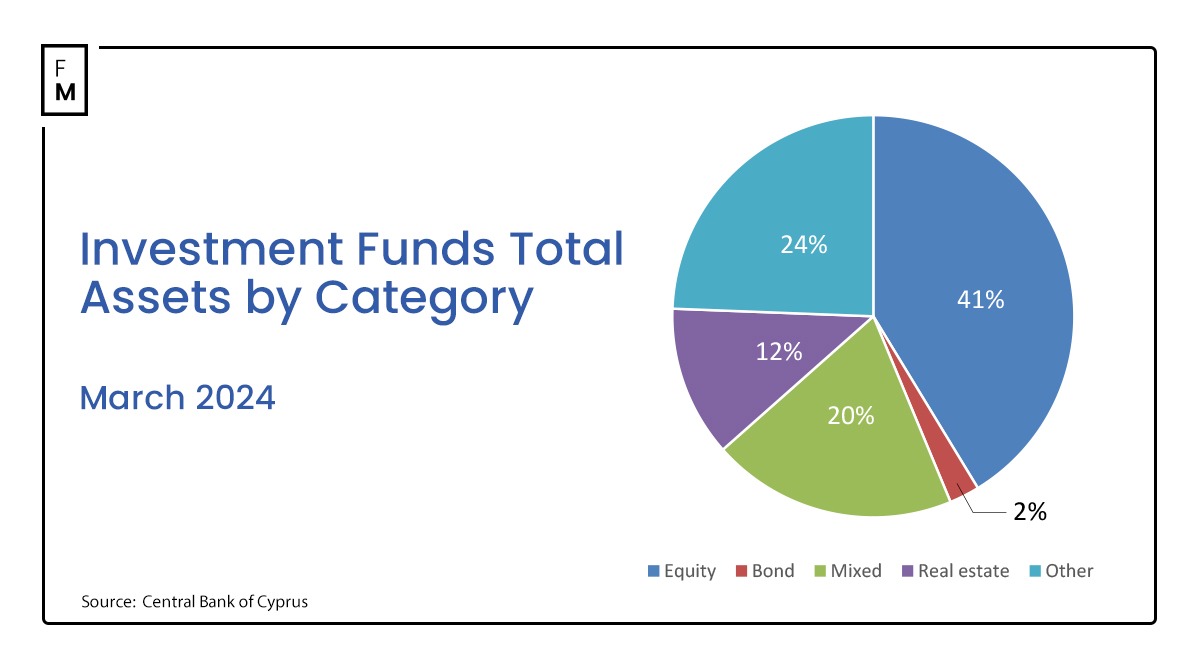

Equity and Real Estate Funds Lead the Charge

Broken down by investment strategy, equity funds saw the biggest jump in assets, rising 6.24% quarter-over-quarter. Real estate funds also posted strong growth of 5.50%. Bond, mixed, and other fund strategies all notched increases as well.

Open-ended funds, which allow investors to redeem their holdings on demand, comprise the bulk of the Cypriot fund industry at €6.48 billion in assets. However, closed-end funds, which restrict withdrawals, surged 14.25% to €309 million, perhaps signaling rising interest in illiquid and longer-term strategies.

Funds structured as EU-regulated UCITS (Undertakings for the Collective Investment in Transferable Securities) recorded their sixth straight quarter of asset growth. Meanwhile, the larger non-UCITS segment, which includes alternative investment funds, climbed to €6.24 billion.

Attractive Domicile for Fund Managers

Industry observers attribute Cyprus' momentum to the efforts of local regulators and trade groups to establish the island as a cost-effective EU fund domicile.

With its English common law heritage, eurozone membership, and competitive tax regime, Cyprus has gained traction recently as an alternative to fund hubs like Luxembourg and Ireland, especially for smaller and specialized managers.

The country has proven particularly popular for real assets funds focused on areas like real estate, infrastructure and natural resources across Europe and the Middle East. Cyprus is also home to a thriving shipping and maritime fund industry.