The retail trading brand Brokereo is no longer a member of the Investors Compensation Fund (ICF) managed by the Cyprus Securities and Exchange Commission (CySEC), the regulator announced today (Tuesday).

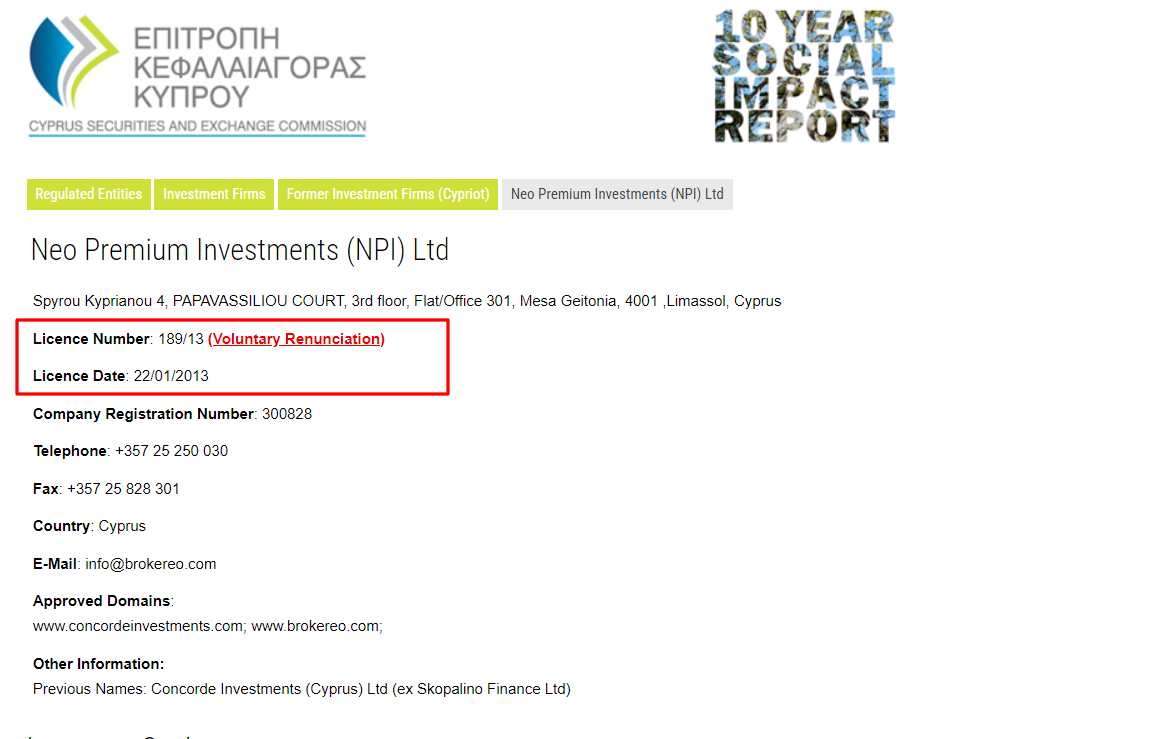

The removal of Neo Premium Investments (NPI) Ltd., which offered its retail FX/CFD trading services through the brokereo.com website, follows CySEC's earlier decision to revoke the Cypriot Investment Firm (CIF) license held by the company.

After CIF License, Neo Premium Investments Struck off ICF

According to a document published by CySEC on February 13, the loss of ICF membership status does not mean that clients have lost their rights to maintain any compensation arising from the past activities of Brokereo or NPI.

"The Cyprus Securities and Exchange Commission wishes to inform the public that, the Investors Compensation Fund has withdrawn the ICF membership of the member Neo Premium Investments (NPI) Ltd.," CySEC stated in an official announcement.

The regulator also reminds that this is a natural step after the earlier decision to withdraw the CIF license, which the company had been utilizing since 2013 (license number 189/13). The decision, announced last November, was not due to any misconduct by the company but was based on its own decision to renounce the authorization.

ICF Membership List Narrows

The ICF roster continues to shrink as NPI becomes the latest firm to be removed from the ICF registry this year. Mid-January saw CySEC revoke the membership of four other companies: Stone Edge Capital Ltd, Holiway Investments Ltd, FXBFI Broker Financial Invest Ltd, and KAB Strategy Ltd.

For KAB Strategy, the license withdrawal came in the latter half of 2023, subsequent to the firm's own decision to give up its license. Similarly, FXBFI Broker Financial Invest voluntarily surrendered its license, a decision coming in the wake of a series of regulatory actions taken against the company previously.

The regulatory body highlighted that the company failed to implement adequate anti-money laundering and counter-terrorism financing policies, controls, and procedures necessary to mitigate and manage risks. Consequently, FXBFI, which operated 101investing, was fined €50,000.

The cancellation of licenses for Stone Edge Capital and Holiway Investments was precipitated by investigations from CySEC that uncovered violations of CIF authorization terms by these entities. In May, CySEC noted that Stone Edge Capital had fallen short of meeting organizational requirements, lacking adequate systems to detect transactions that could be linked to money laundering. Furthermore, it failed to establish internal reporting systems and procedures.