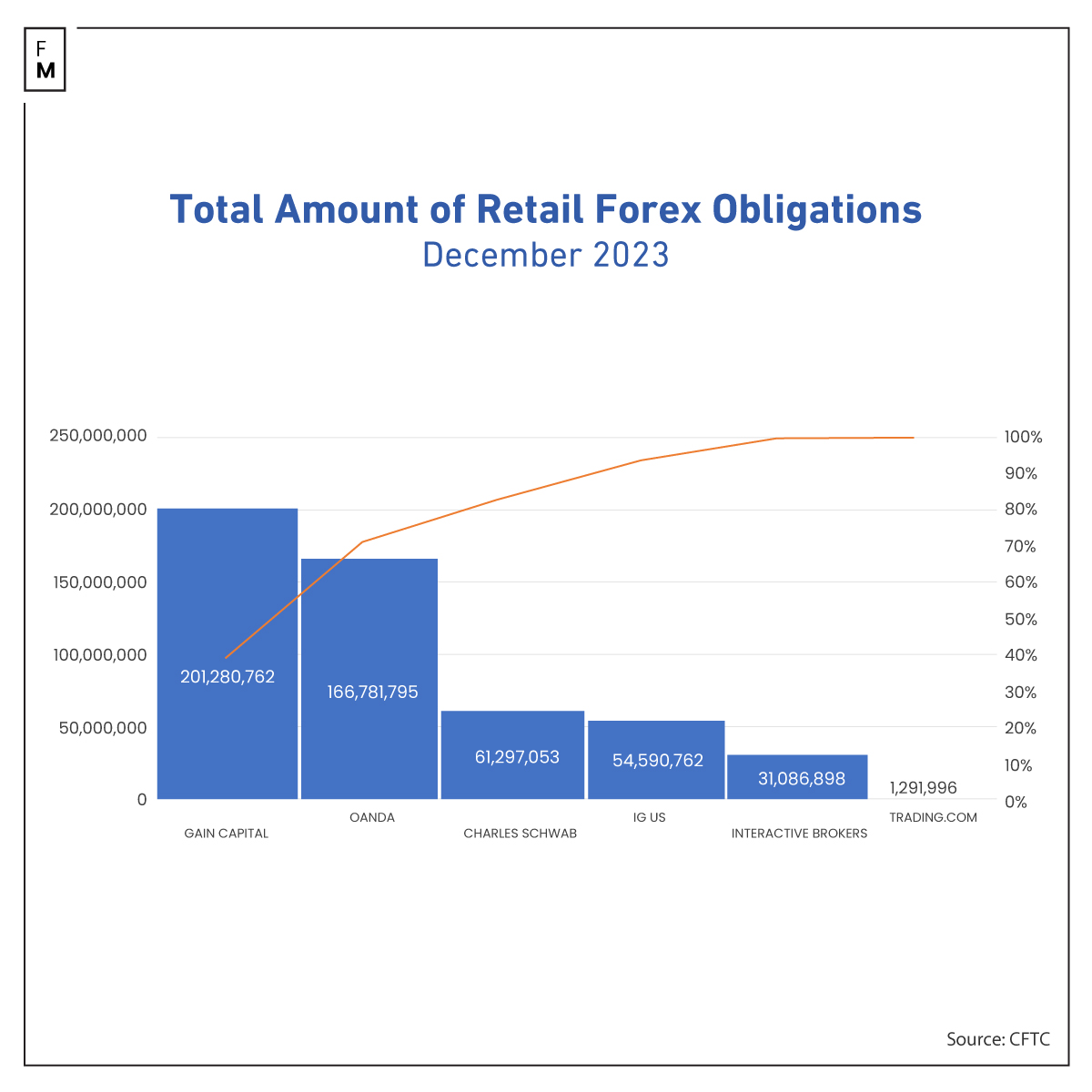

The value of funds deposited by retail FX clients in the USA with the six largest brokers in the local market has fallen for the second consecutive month to $516 million, according to the latest data published by the Commodity Futures Trading Commission (CFTC) for December 2023.

US FX Deposits Shrunk at Year-End

The total value of deposits in December amounted to $516,235,266, dropping almost $2 million (0.4%) compared to November's value of $581.2 million. This marks the second consecutive decrease in value and one of the lowest readings recently.

Gain Capital remains the largest firm in terms of FX deposits, collecting nearly $202 million in December. OANDA came in second with $167 million, and Charles Schwab third with $61 million.

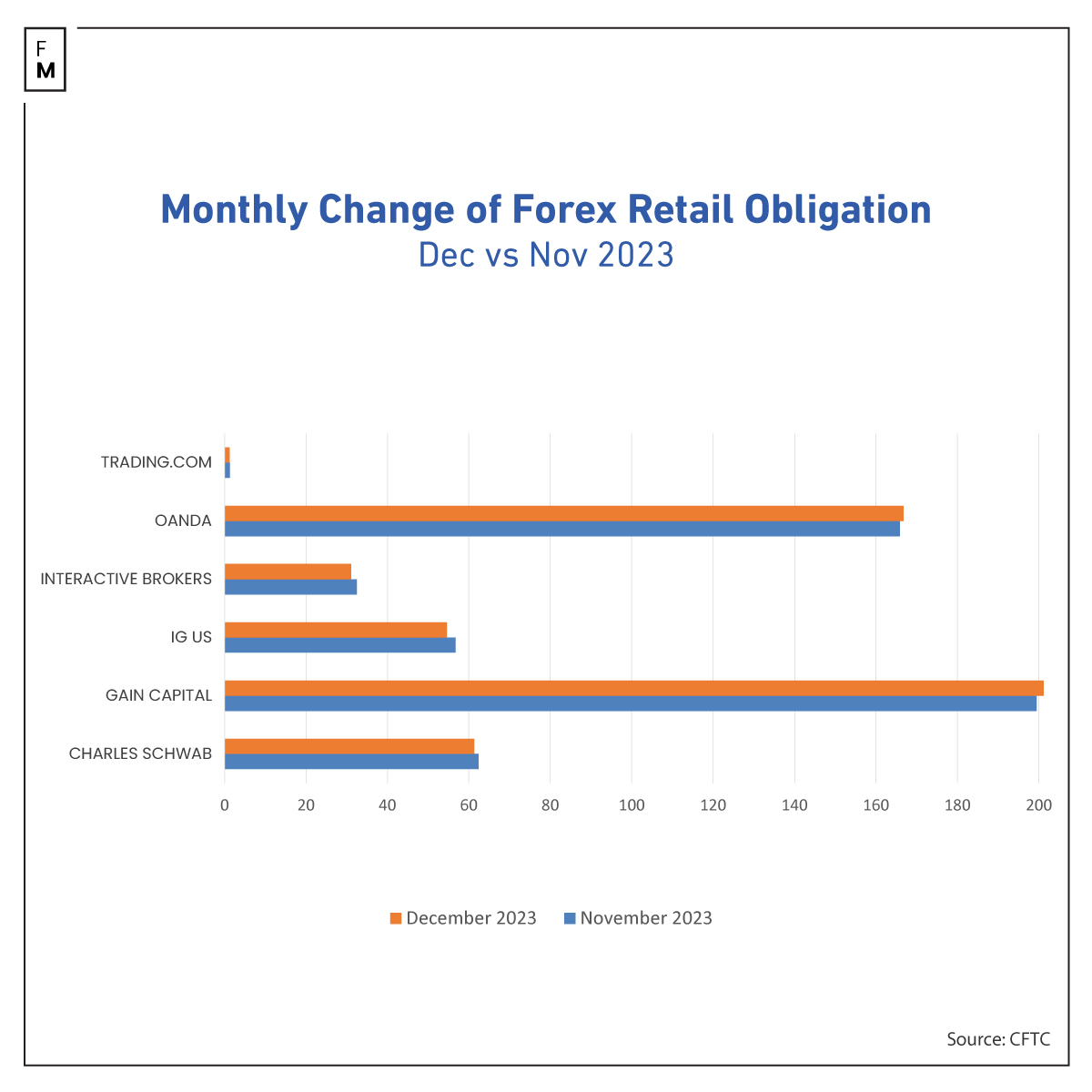

In December 2023, nearly all of the six retail firms operating in the American market experienced a decrease in deposit values. The exceptions were Gain Capital, which saw an increase of 0.9% ($1.8 million), and OANDA, with an increase of 0.6% ($0.9 million).

The most significant decline was noted by IG US, with deposits shrinking $2.1 million to just under $55 million, and Interactive Brokers, where the decrease was 4.4% ($1.4 million).

Finance Magnates independently analyzed retail investor trends using CPattern's insights. The analysis focuses on tracking the historical fluctuations in average deposits, withdrawals, and initial deposits. The recent study revealed a continued growth trend, with the average monthly deposit increasing from $13,504 to $15,248.

CFTC Report Data Overview

According to the regulations established by the CFTC , all Retail Foreign Exchange Dealers (RFEDs) and Futures Commission Merchants (FCMs) must submit monthly financial status reports. These CFTC reports include crucial financial details like adjusted net capital, customer assets, and total retail forex obligations.

Retail forex obligations refer to the total funds, including cash, securities, and other assets, held by an FCM or RFED on behalf of retail forex customers, after adjustments for gains and losses.

Out of the 62 registered RFEDs and FCMs, only six, namely Charles Schwab, Gain Capital, IG, Interactive Brokers, OANDA, and Trading.com, are involved in activities necessitating the publication of obligation data.