The European financial markets regulator has prepared 40 questions that it directed to firms offering retail investment services wanting to find out what their operations look like in the era of trading digitalization. The document addresses issues of gamification, the use of financial influencers, and above all an important note regarding contracts for difference (CFDs).

In its discussion paper, the European Securities and Markets Authority (ESMA) stated that brokers and retail platforms should more clearly inform investors which product is the underlying instrument and which is only a contract.

CFD or Real Share? ESMA Draws Attention to Unclear Offers

The issues raised by ESMA regarding clearer marking and informing about derivative instruments concern, above all, the increasingly popular dual-stock offers in recent times, both in the form of real stocks and CFD stocks.

ESMA argued that European brokers often mark these instruments similarly, which can mislead investors. ESMA suggested that information on which instrument is the underlying issue and which is the derivative should be more legible, clearer and easier to identify.

Firms "may market these products alongside 'typical' shares or bonds on the same webpage, listing them in the same tab or webpage, including presenting them as equal or similar alternatives," ESMA explained.

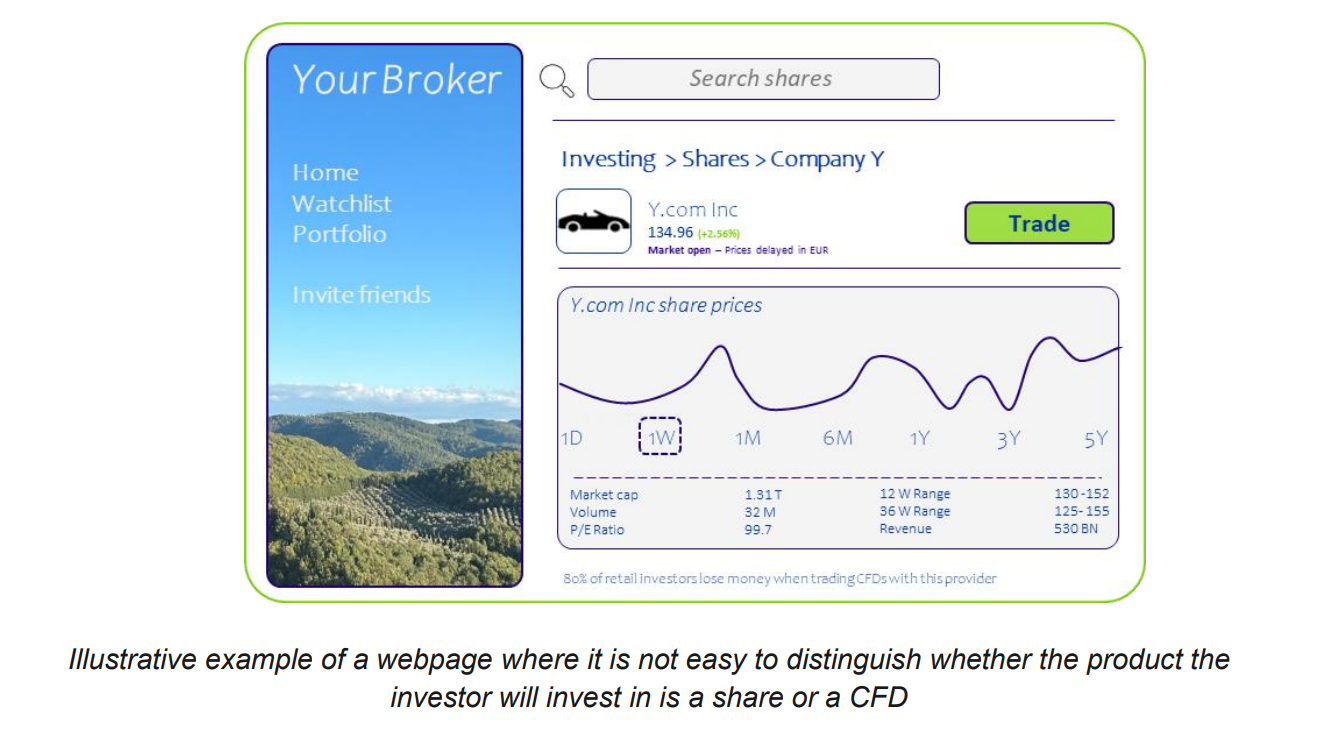

In the discussion paper, the pan-European regulator shows an illustrative example of a broker's offer, from which it is difficult to read whether the offered instrument is a stock or a CFD. The regulator believes that many platforms present their offer in this unclear way.

"Furthermore, marketing communication may be structured in such a way that does not facilitate distinguishing whether the instrument marketed is a CFD, retail structured product or its underlying," the regulator added.

ESMA also draws attention to the fact that brokers often present offers to trade significantly different instruments in one place: regulated stocks, along with commodity contracts and unregulated cryptocurrencies .

"This may lead to mis-selling of such products, especially if the unregulated products and/or services are provided on the same webpage as regulated ones," ESMA warned.

Financial Influencers and Gamification

The discussion paper further addresses a number of other issues, including the role of financial influencers (finfluencers) in promoting the offers of trading companies, social features of investment apps, and the progressive gamification of the entire investment process.

Regarding influencers, ESMA refers to research from Australia and Poland showing that more and more young people are learning to invest from finfluencers, from YouTube channels and websites.

"Customers search for information online, including short videos, as they need fast, packaged and synthesized information on demand," ESMA wrote and claimed that this can be a dangerous approach. France, among others, seeks to tackle financial influencers independently, as does the UK outside the European Union.

Moreover, a similar danger can be generated by the gamification process, which, according to ESMA and external research, encourages investors to overtrade. It can be detrimental to their financial results and lead to loss of deposit.

ESMA is waiting for the responses to the 40 questions presented by 14 March 2024. Feedback "will support ESMA's convergence work and prepare it for potential mandates for technical advice or standards in these areas."