2024 witnessed a dramatic change in top FX executive salaries in Cyprus: FX Executive Directors on the island face salary reductions, while Compliance Heads see substantial gains. Meanwhile, Dubai maintains its allure with consistent executive pay and is getting head-to-head with London. This year's findings underscore the evolving dynamics in the FX industry, spotlighting the increasing value of compliance roles and the strategic focus on regulatory expertise.

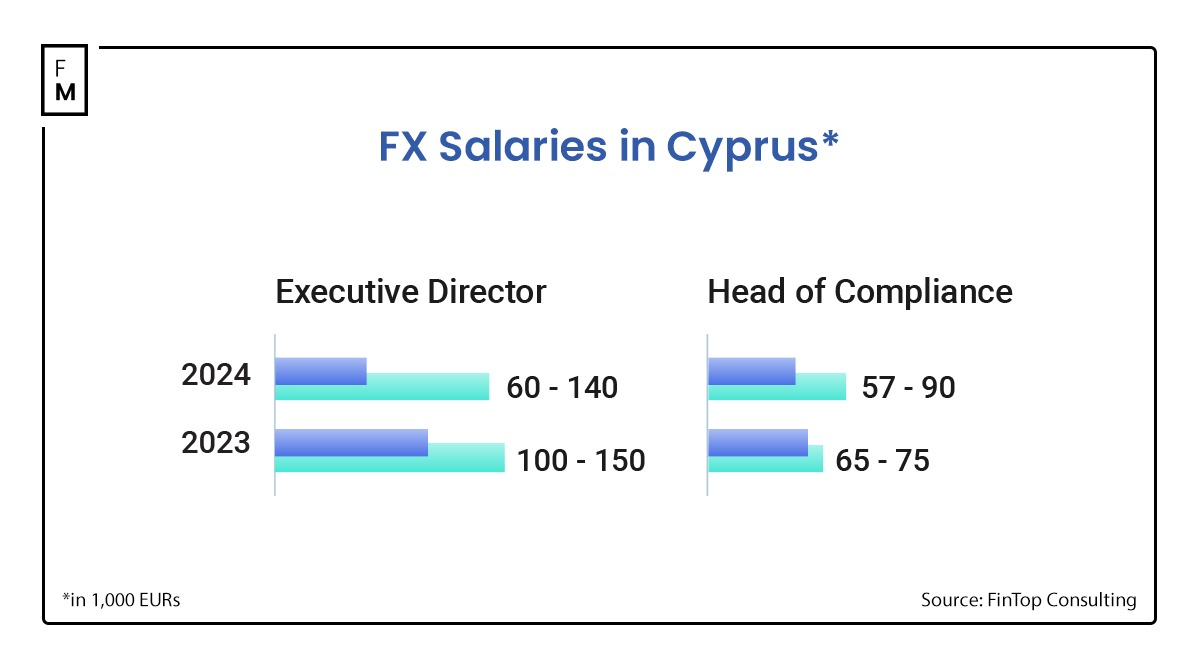

According to the Yearly Fintech Market Report by FinTop Consulting, shared exclusively with Finance Magnates, the salary range of Executive Directors in Cyprus dropped to the range of EUR 60,000 and EUR 140,000, compared to the previous year’s range of EUR 100,000 and EUR 150,000. Meanwhile, Compliance Heads received a massive salary boost.

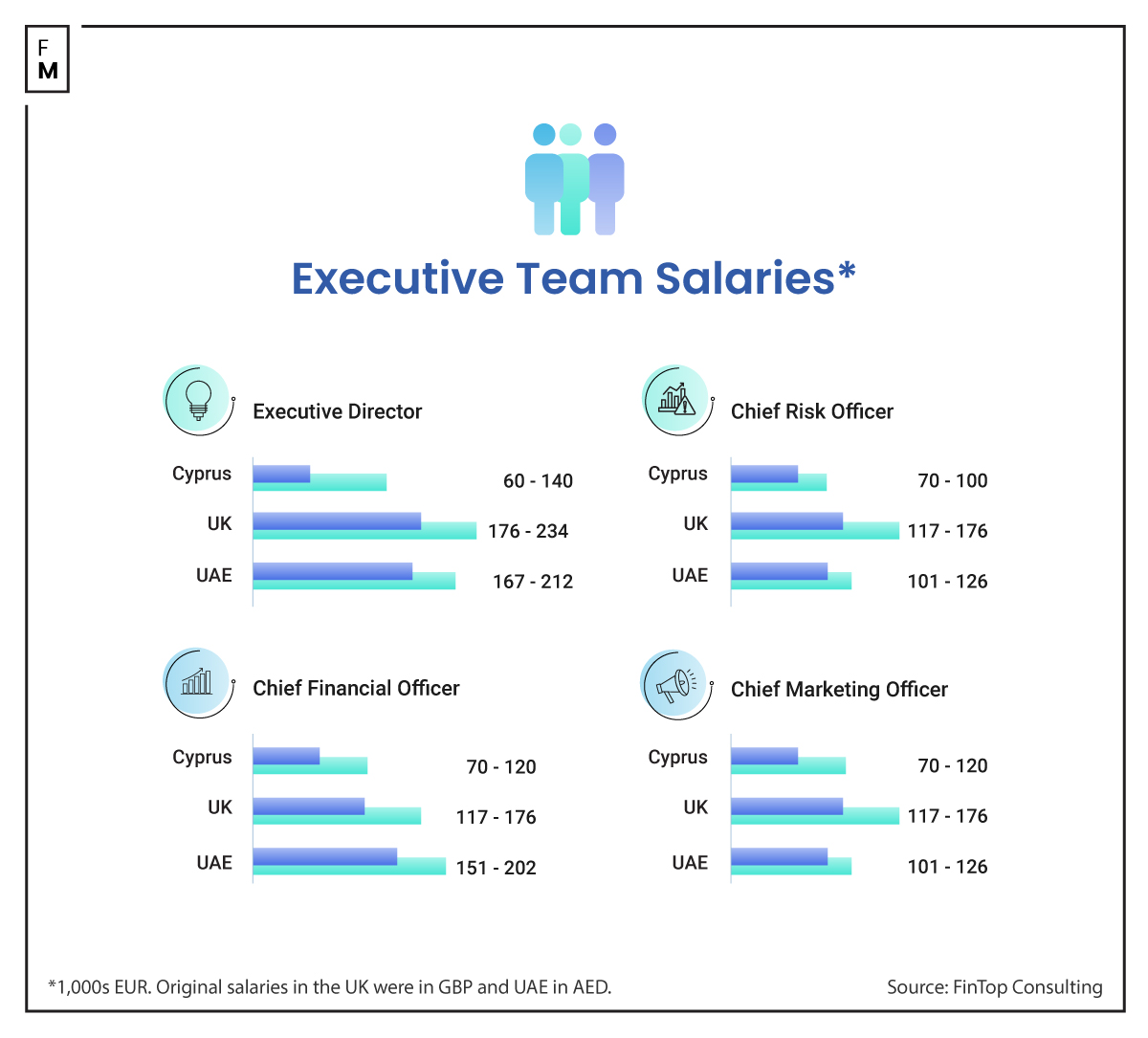

In the UK and the UAE, the salaries range of Executive Directors remained the same for the last two years, between GBP 150,000 (EUR 176,000 at current exchange rate) and GBP 200,000 (EUR 234,000), and between AED 660,000 (EUR 167,000) and AED 840,000 (EUR 212,000), respectively. Executive Directors are the highest-paid employees in all three jurisdictions.

Despite the high salaries of executives, the trend remained in the hiring of the revenue generating roles.

"Most sought-after skill sets have been direct revenue-generating roles, specifically New Business Sales professionals on both the Retail and Institutional side of the business, with the addition of Software Developers, specifically C# Developers," Director at FinTop Consulting, Reece Pawsey, told Finance Magnates. "Following the aftermath of 2023, companies seem to [be] eager to continue their growth and gain market share."

The report by FinTop Consulting, revealed the salaries in three top FX locations: London, Limassol, and Dubai. "The info is devised from the information we have gathered from our candidates, clients and market research," Pawsey added.

"London is still one of the markets largest financial hubs and leads the way in FX Trading volume, especially in the European time zone. However, whilst London is still an attractive employer, Dubai is a growing market with a highly skilled workforce."

Do Lucrative UK Salaries Truly Reflect High Compensation?

The highest absolute salaries in the UK can be justified as Dubai is about 39 percent cheaper to live in than London. Limassol, the city of Cyprus where most FX and CFDs brokers are registered, is the most affordable among the three.

“Salary differences vary widely across the typical locations for FX, which are London, Cyprus, and Dubai,” the Director at FinTop Consulting, said. “The cost of living is something to take into consideration when discussing this topic.”

“Whilst working in London may seem more attractive as you can earn a higher salary, the average cost of living is significantly higher than in Cyprus. Although, regions such as Dubai, which offer higher salaries, may find it easier to attract top talent from other areas.”

He highlighted that: “Dubai continues to have consistent year-on-year growth, offering a highly skilled workforce and tax-friendly benefits for both companies and their employees. We have seen an increase in companies opening new offices in the UAE.”

The salaries of other executive roles, including Chief Financial Officers, Chief Risk Officers, and Chief Marketing Officers, remained the same in all three locations over the last two years.

Compliance Experts Are in Demand in Cyprus

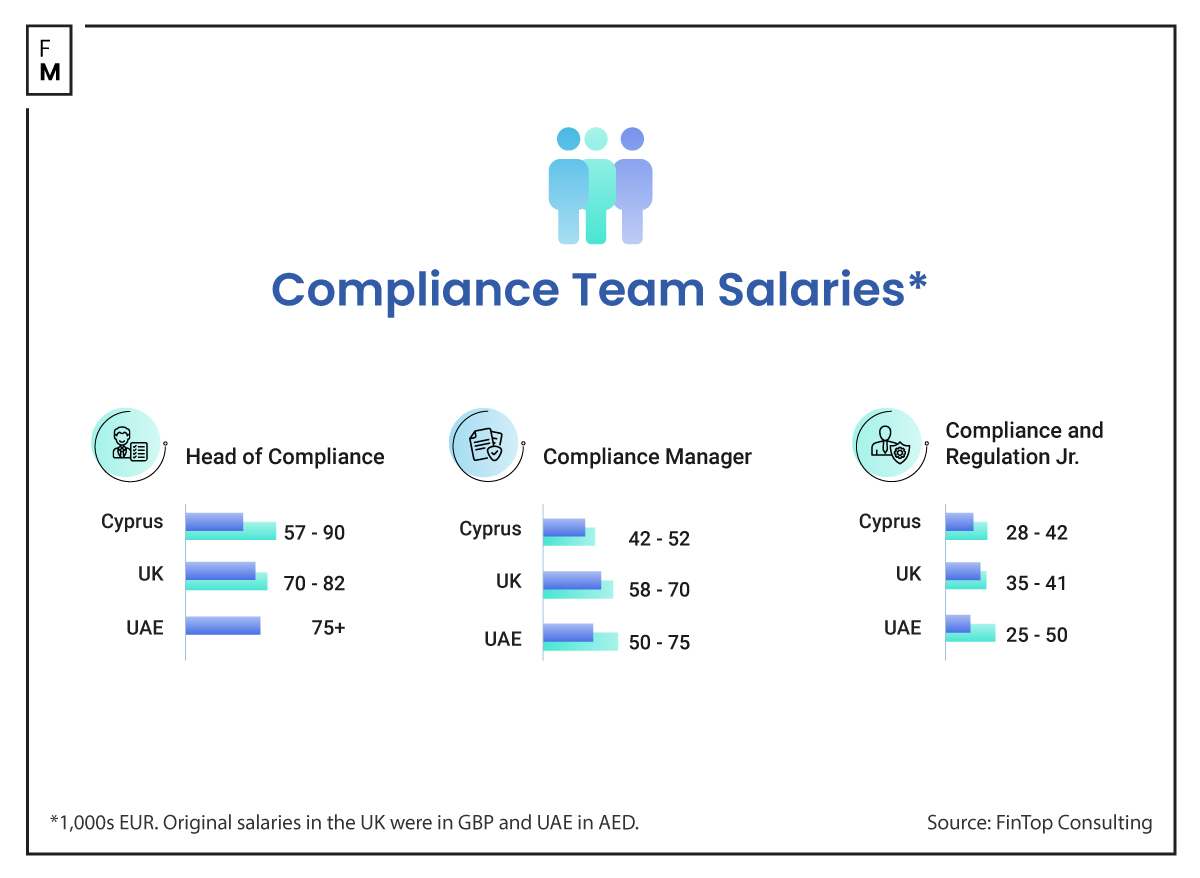

One of the areas where Cyprus offers very competitive salaries is the compliance-centric roles. The latest salaries of Cyprus-based Head of Compliances are between EUR 57,000 and EUR 90,000. The salary for this role has increased significantly from EUR 65,000 to EUR 75,000 a year before.

However, the compensation of the Heads of Compliance in the UK was reduced substantially in a year from a range of GBP 90,000 (EUR 105,000) and GBP 100,000 (EUR 116,500) to the range of GBP 60,000 (EUR 70,000) and GBP 70,000 (EUR 81,000). Dubai-based Compliance Heads continue to make a minimum of AED 300,000 (EUR 75,000).

The Compliance Managers in Cyprus also received a salary bump ranging between EUR 42,000 and EUR 52,000, from between EUR 36,000 to EUR 46,000 a year before. The trend was the same for Compliance and Regulation Juniors in the Mediterranean island who earn between EUR 28,000 and EUR 42,000.

On the contrary, the salaries of the UK-based Compliance Managers declined drastically to a range of GBP 50,000 (EUR 58,000) to GBP 60,000 (EUR 70,000). A year before, the salary for this role was between GBP 60,000 (EUR 70,000) and GBP 70,000 (EUR 81,000). The salaries of the Dubai-based compliance managers declined from a range of AED 300,000 (EUR 75,000) and AED 400,000 (EUR 100,000) to between AED 200,000 (EUR 50,000) and AED 300,000 (EUR 75,000).

“New regulatory changes will increase the demand for compliance professionals. This can include professionals with expertise in areas such as regulatory compliance, anti-money laundering, know your customer requirements, and data protection laws,” Pawsey added. “As the demand for compliance professionals grows, salaries for these roles may increase due to higher demand and competition for qualified candidates.”

“We may also see an increase in the need for regulatory affairs and specialist compliance professionals… Salaries for these roles may be influenced by factors such as the level of demand for specialized skills, the complexity of regulatory requirements, and the competitive landscape for talent in the market.”

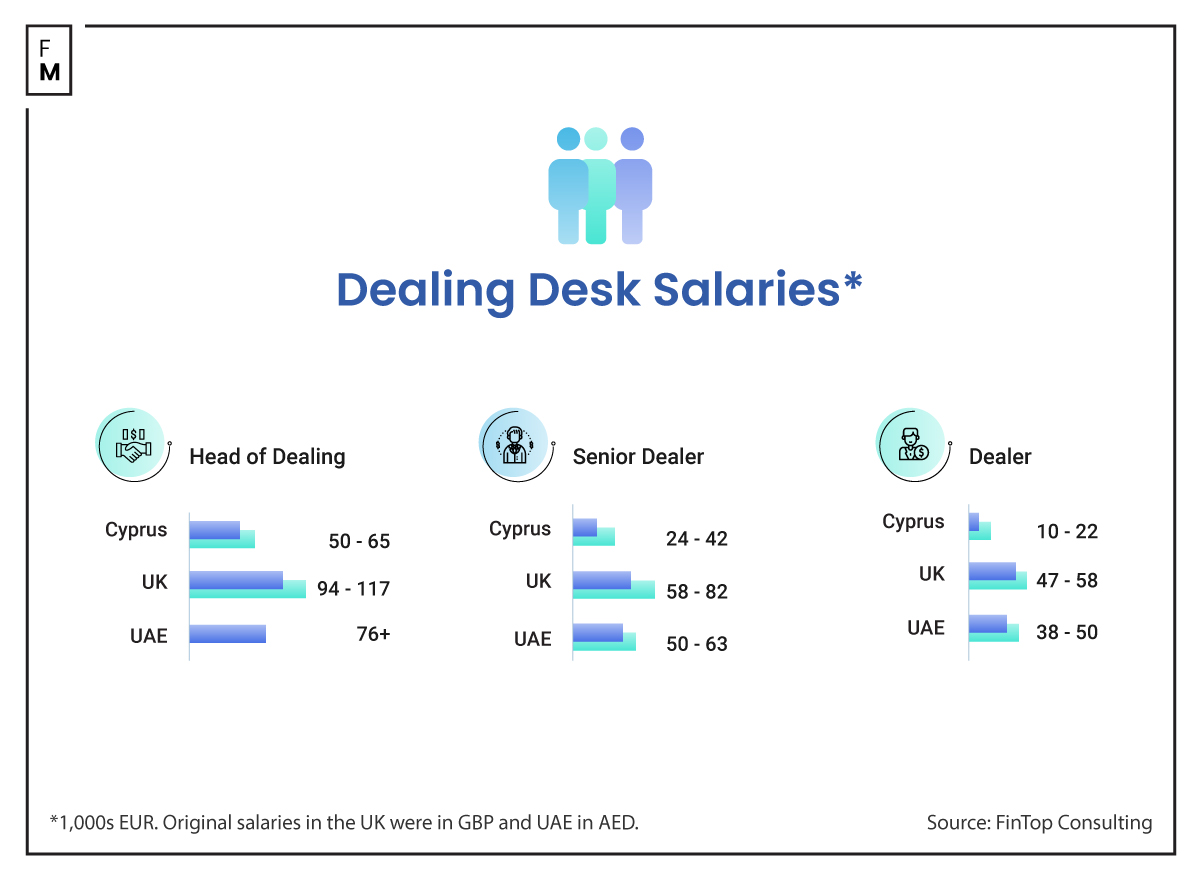

When it comes to the Head of Dealing, the range of salaries increased in Cyprus to between EUR 50,000 and EUR 65,000 from the previous year's range of between EUR 55,000 and EUR 60,000. However, in the UK and the UAE, the compensation for this role remains the same as last year in the local currency. Senior Dealers in the UK are still making GBP 50,000 (EUR 58,000) and GBP 70,000 (EUR 81,500), which is the highest in the three locations.

The entry level Dealers in Cyprus remained the lowest paid in the industry with an annual salary range between EUR 10,000 and EUR 22,000. These roles in the UK are being offered salaries between GBP 40,000 (EUR 47,000) and GBP 50,000 (EUR 58,000), while the range in Dubai is between AED 150,000 (EUR 38,000) and AED 200,000 (EUR 50,000).

The Revenue Generation Roles

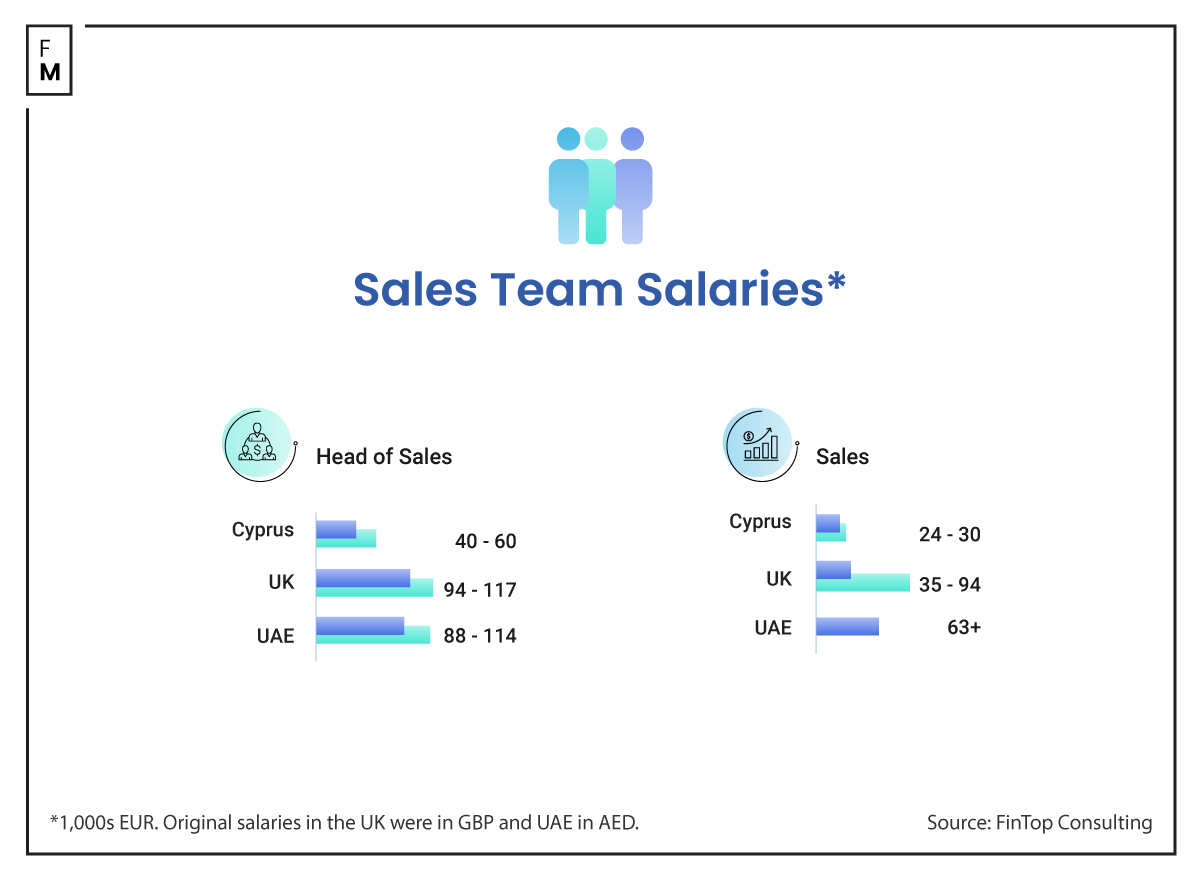

Interestingly, the Cyprus-based sales roles received a pay cut. The salaries of the Head of Sales on the island dropped to between EUR 42,000 and EUR 60,000, from the previous year’s figures that were between EUR 48,000 and EUR 60,000. The top end of the compensation of other sales roles in Cyprus dropped to EUR 30,000 from EUR 36,000.

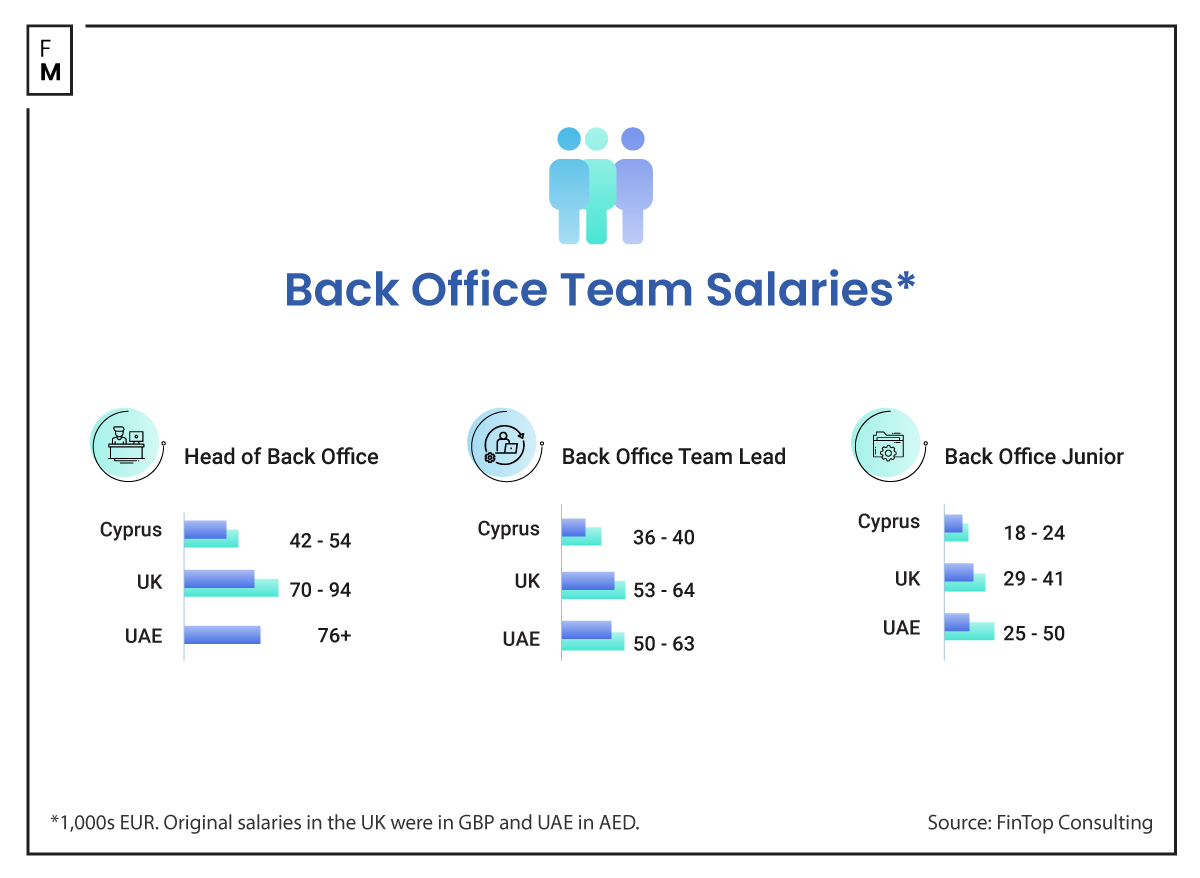

Similar to most of the other roles, the compensation for sales roles in the UK and UAE remained the same. The back office roles in all three locations also remained the same.

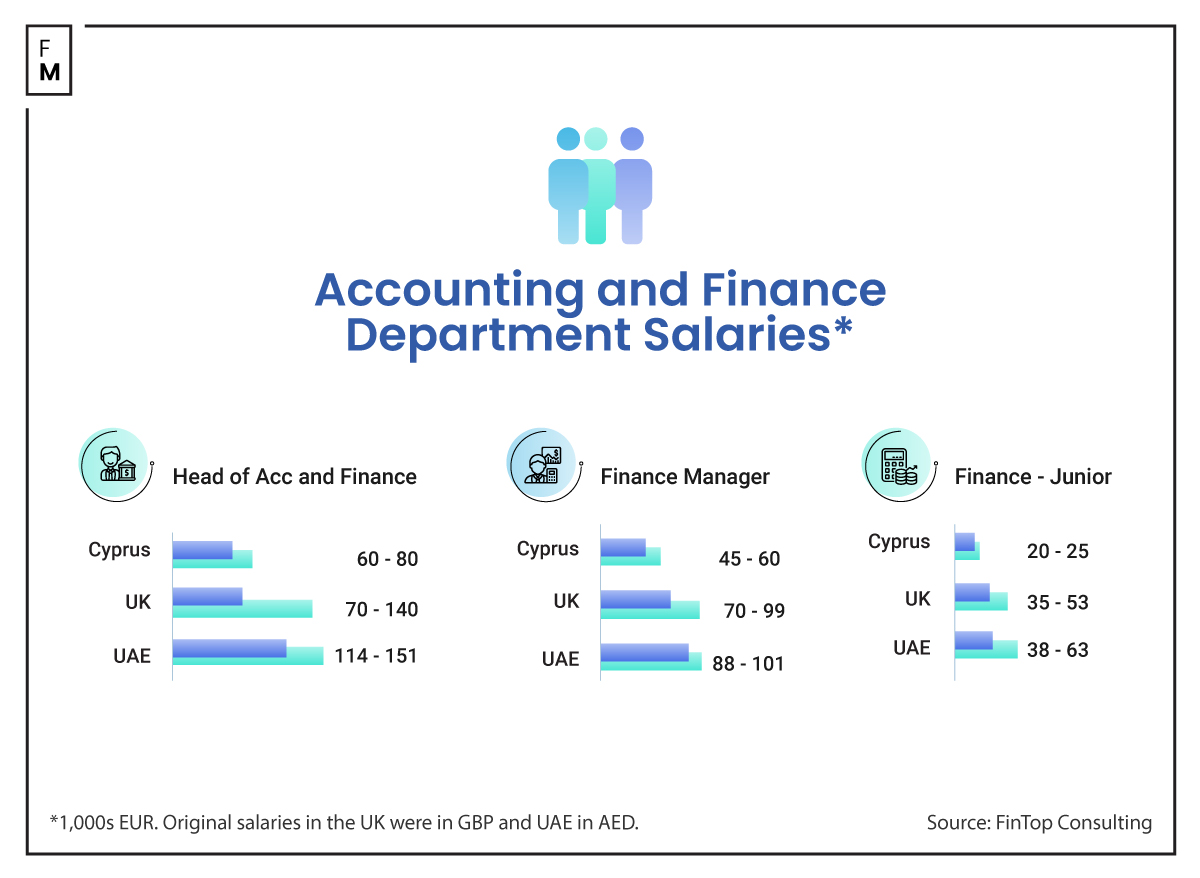

Apart from the top management, the Accounting and Finance Heads are among the top earners, with the salaries for those based in the UAE ranging from AED 450,000 (EUR 114,000) to AED 600,000 (EUR 151,000), which has been consistent for the past two years. Salaries for similar roles in Dubai surpass those offered by UK-based firms.

UAE-based Finance Managers earn between AED 350,000 (EUR 88,000) and AED 400,000 (EUR 101,000), while those in Cyprus remain the lowest paid with a salaries ranging between EUR 45,000 and EUR 60,000.

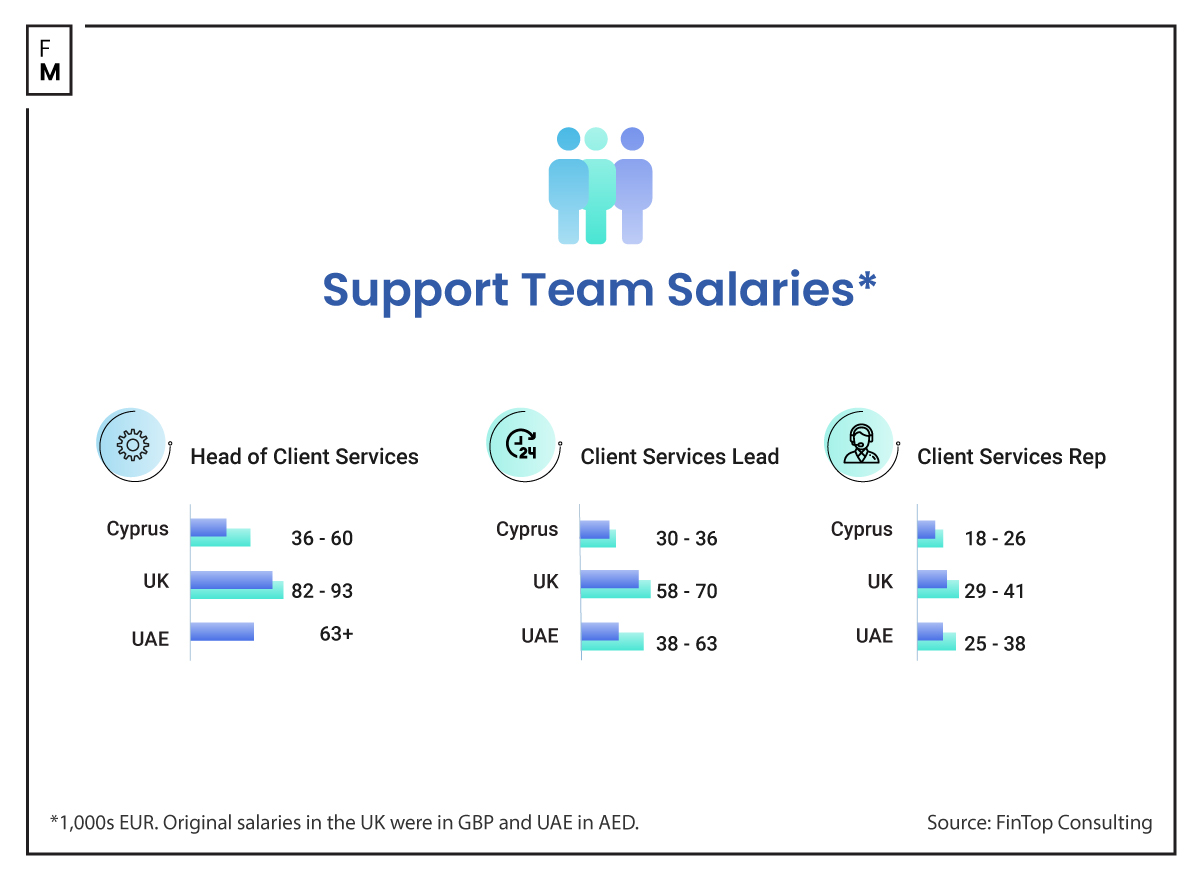

Support teams are another crucial department every customer-centric company needs. However, there were no big changes in the salaries of the support department roles in the three key locations. The Head of Client Service in the UAE are making at least AED 250,000 (EUR 63,000), while the ones in the UK are receiving salaries between GBP 70,000 (EUR 82,000) and GBP 80,000 (EUR 93,000). There was no drastic change in the support team salaries over the last couple of years.

In Cyprus, the Client Services Heads are making between EUR 36,000 and EUR 60,000, same as the previous year.

“Across the wider fintech space, as Companies continue to innovate and disrupt the financial industry. We have seen a growth in the need to hire data science, cybersecurity, blockchain, and software engineering professionals,” added Pawsey.

Highlighting the hiring trends in recruitment, FinTop Consulting’s Director said: “Remote and flexible working is still a hot topic in 2024. Companies are reviewing the need to have employees fixed in certain locations and are open to fully remote workers or, at the very least, reviewing their work-from-home policy. And, to ensure they stay competitive with the market, companies are promoting a better work-life balance.”