The Chief Executive Officer of the online brokerage firm FXCM, Brendan Callan, unveiled a new multi-asset retail trading platform today (Wednesday) during the Finance Magnates London Summit (FMLS:23). Dubbed Tradu, the new platform is a part of Jefferies Financial Group-owned Stratos Group International, which operates the FXCM brand.

According to the official press release, Tradu will offer a variety of asset classes, including listed equities, commodities, cryptocurrencies, CFDs, forex, treasuries, and indices.

FXCM Enhances Multi-Asset Trading Experience

Callan sat with Finance Magnates at the FMLS:23, revealing exclusive details about the new platform. He said that the decision to launch Tradu was driven by client demand and market analysis. The platform aims to fill the gaps existing in the current multi-asset trading options.

Some of these shortcomings include instances where investors are forced to manage multiple accounts across various multi-asset brokers.

Callan mentioned: "We think Tradu is particularly well-placed to offer multi-asset trading the right way. Historically, even now, for the two options for multi-asset trading, we are having a lot of accounts opened at different multi-asset brokers."

Tradu seeks to empower active investors. It focuses on providing access to various markets and essential trading tools. The new offering doesn't aim to push customers towards higher-margin instruments but rather to facilitate trading across a wide range of assets.

Integrated Multi-Asset Trading Expansion

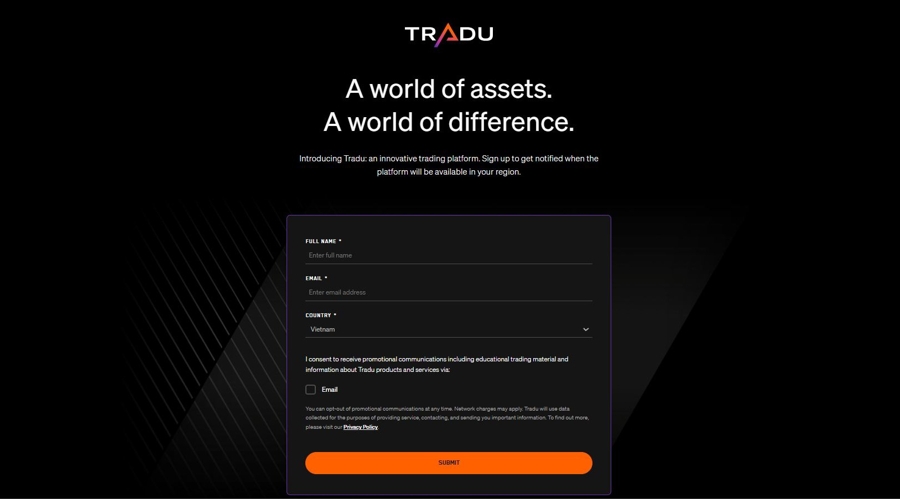

Tradu will be available in the United Kingdom in December and then focus on global expansion over the consecutive months. On its website, the platform only registers interested traders and investors with basic information for future correspondence. FXCM's users will continue using the platform, while Tradu will operate as a new multi-asset offering with integrated banking and payment solutions.

The vision for Tradu involves attracting a broader audience, including equities and crypto traders. A distinctive feature is the integration of an e-wallet solution. The Stratos Group plans to consolidate functionalities like payments and daily transactions into the Tradu app, eliminating the need for separate accounts across various platforms.

Callan said: "Our e-wallet solution is novel since no multi-asset broker currently offers that. Right now, our customers trade CFDs and shares, and they have separate accounts at Revolut, Starling, among others, for daily payments. We'll bring all those functions together inside the Tradu app."