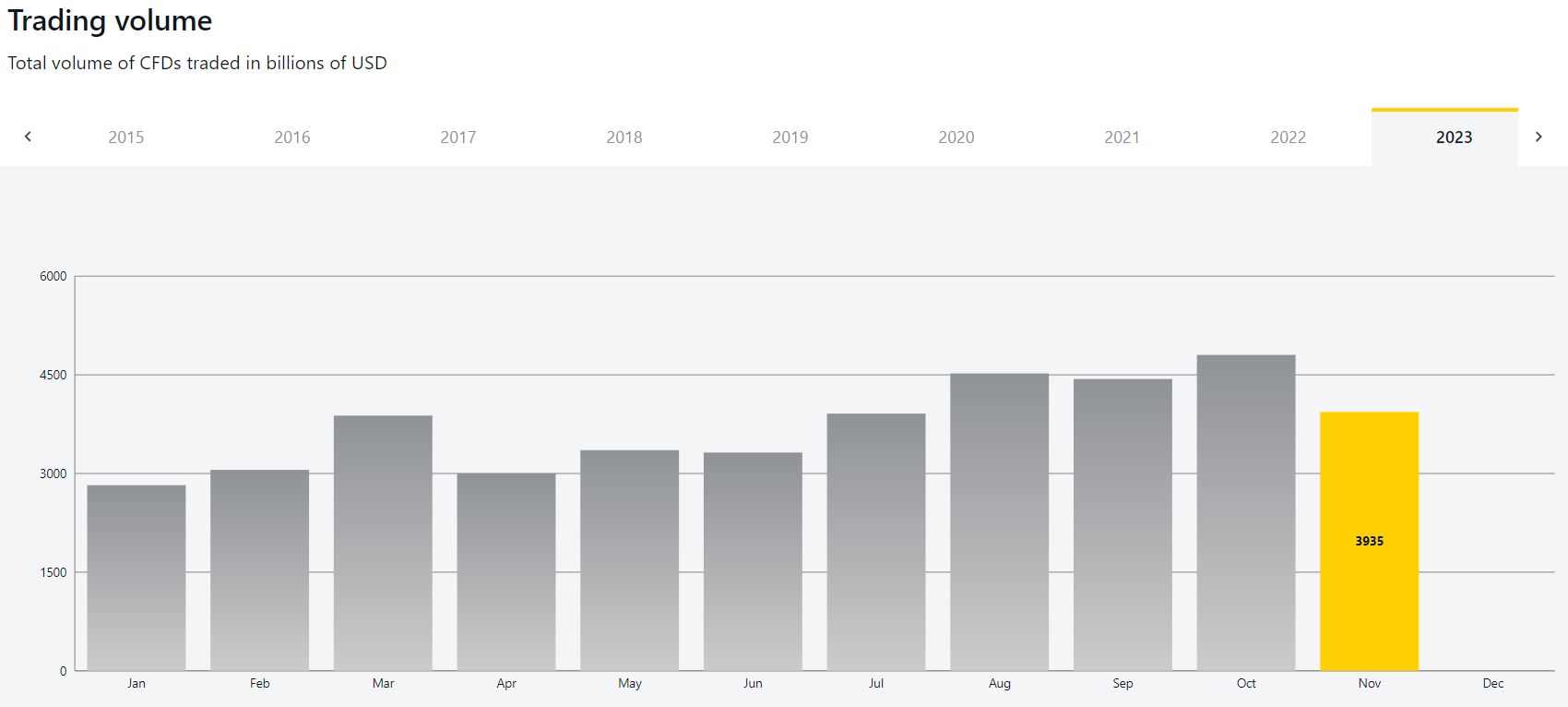

In November, the monthly trading volume on Exness slipped below $4 trillion, a significant correction from the peak in the previous month. According to the latest official numbers, the broker handled $3.93 trillion in trading volume last month, marking a decline of about 19 percent month-over-month.

The decline came after a month when the broker witnessed a record monthly trading volume of over $4.8 trillion. The figure also dropped below the $4 trillion mark after the milestone was crossed for the first time in August. However, the latest figure remains only behind the three previous consecutive months.

Trading Volume Remains Strong

Although the month-over-month decline in trading volume was significant in November, the trading volume showed a substantial year-over-year increase of 62.5 percent when compared with the figure for the corresponding month of the previous year.

The growth trajectory of Exness received a significant boost after the impact of the pandemic on the markets. Trading volume on the platform first crossed the $1 trillion mark in October 2021, only to more than double that number within six months. The $3 trillion milestone was crossed last February.

Marginal Decline in Active Clients

The double-digit drop in trading volume came with a marginal decline in the number of active clients on the platform. Exness revealed that it had 688,245 active traders who “traded and conducted balance operations,” down from the previous month’s 694,006. November still remains the second-best month when the number of active traders is considered.

Exness is headquartered in Cyprus but operates globally in many other countries. Besides establishing its European Union base, the broker aggressively expanded services in emerging markets of Asia, Africa, and Latin America. For its expansion in Africa, it obtained licenses in South Africa and Kenya while establishing its first Latin American presence with an office in Uruguay.