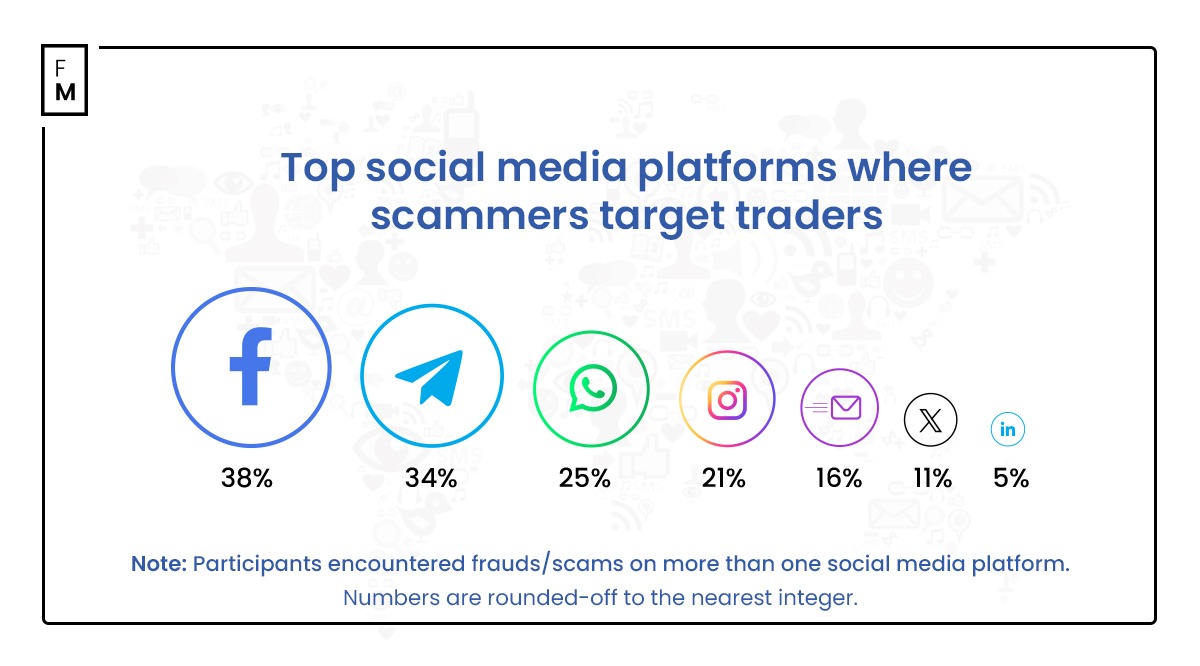

Facebook is the platform where scammers mainly target active traders, according to a survey jointly conducted by Finance Magnates and FXStreet. Out of 631 survey participants, about 35.8 percent encountered financial fraud or scams on Facebook, while 33.8 percent and 24.7 percent witnessed them on Telegram and WhatsApp, respectively. It is to be noted that the survey participants use more then one social media platforms.

Influence the survey outcome: cast your vote here.

Most Traders Trade FX

The recent survey was mainly participated by foreign exchange (forex) traders: 78.6 percent of respondents were forex traders, 46.4 percent traded commodities (like gold and oil), and 26.5 percent and 20.1 percent traded cryptocurrencies and stocks, respectively. Most of the respondents traded multiple assets.

Financial fraud and scams have been rampant for years. Fraudsters have flooded social media with phishing links, impersonating legitimate firms and disguising themselves as regulatory officials. Over the years, regulators and companies alike have issued warnings against such scams.

The survey found that 41.7 percent of traders rely on official regulatory websites as their primary source of information to avoid scams. Meanwhile, 38.1 percent rely on financial news and educational websites, while the rest use social media or community forums.

Traders Are Confident, yet Fall Victim to Scams

Among the novice and expert traders, only 40.9 percent believe that they are very confident in tackling financial scams, while 14.6 percent of them are not confident at all. It is to be noted that 46.3 percent of the survey respondents personally encountered financial fraud or scams on social media, while only 25.8 percent never encountered it.

Furthermore, 39.7 percent of the respondents encountered such scams frequently, while 42.5 percent occasionally encountered them. Only 17.7 percent of traders rarely or never encountered any financial scams on social media. Among the most popular financial scams are clone brokers and signal providers, as a majority of 34.6 percent experienced them. Ponzi schemes and phishing emails or texts consecutively received 31.1 percent and 23.7 percent, respectively.

Out of the total respondents, 51.3 percent even lost funds to online financial fraud. Another 22.6 percent fell victim to scams but did not lose funds.

The awareness drives conducted by regulators and other agencies focus on identifying financial scams. According to the survey, 34.6 percent of the traders identify a potential scam by noticing red flags in the communication, whereas 20.5 percent feel alarmed when asked for excessive personal information, like bank or credit card details.

Responding to the measures the traders would take if fallen victim to financial fraud, a majority of 24.5 percent of respondents would improve their online security measures. Another 20.7 percent would contact their bank or financial institution for assistance, while 17 percent would not act. Only 15.7 percent would go to law enforcement, while 5.7 percent would seek advice for legal action.