The UK's Financial Conduct Authority (FCA) took action against over 10,000 misleading financial advertisements and promotions in 2023, an increase of 17% compared to the previous year, according to a report published today (Wednesday).

Watchdog Cracks Down on Misleading Financial Promotions

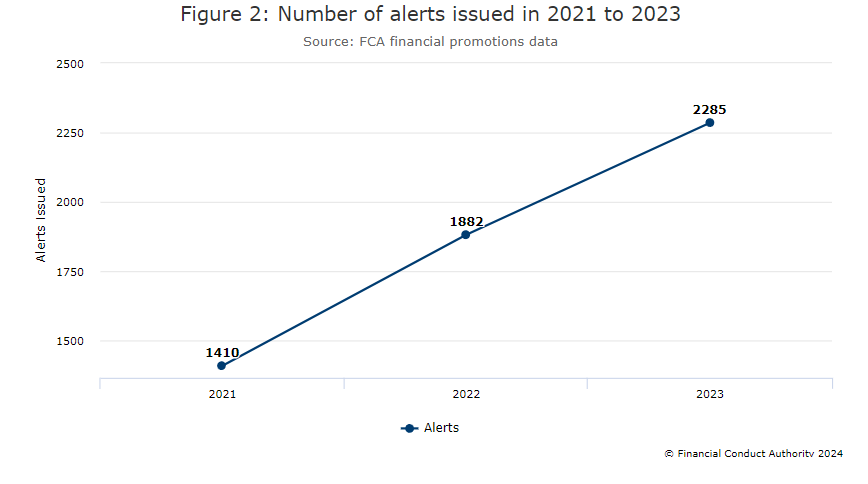

The regulator also released a larger number of consumer alerts about potential scams last year. “For unauthorized firms and individuals, we issued 2,285 alerts in 2023, an increase of 21% from 1,882 in 2022,” the FCA commented. Part of this data was already published by the FCA a week ago.

Since being granted new powers to regulate crypto assets in October 2023, the FCA has issued 450 alerts on illegal crypto promotions targeting UK consumers in just three months. In addition, there is growing unease at the FCA over so-called "finfluencers." These are social media influencers promoting various financial products like loans and investments, often to younger followers.

"People need clear, fair and accurate information to base their financial decisions on. We will continue to intervene and take action when we identify firms not meeting our minimum standards," said Lucy Castledine, the Director of Consumer Investments at the FCA.

The FCA continues running its ScamSmart awareness campaign on investment and pension fraud. Last year it tackled 43 unauthorized debt solution providers, taking down 30 websites and social media accounts.

Back in late December, the FCA revealed that it canceled almost 1,300 unauthorized firms in 2023 and imposed record fines totaling £52,802,900.

New FCA Measures Came into Force

From February 7th, authorized firms now require FCA permission before they can approve promotions from unregulated persons, to ensure adequate expertise. Before the change, firms sanctioned by the FCA were allowed to endorse advertisements for unregulated entities. This practice resulted in disseminating deceptive or ambiguous ads in the retail trading sector. Under the new guidelines, however, firms are required to demonstrate their expertise and comprehension of the products they endorse.

"By introducing these new checks, we will ensure people approving adverts have the right skills and understanding they need to do so," Sarah Pritchard, the Executive Director of Markets at the FCA, commented. "Firms need to make sure people are equipped with the right information at the right time, so they can make properly informed decisions."

This accompanies the Consumer Duty introduced in July 2023, which obliges firms to provide information enabling consumers to make informed choices. As a result, entities regulated by the FCA Authority must adjust their operations to comply with these standards, aiming to safeguard consumer interests. These regulations are applicable to a broad spectrum of financial service providers, including payment processors, asset management companies, insurance carriers, brokerage firms, and others, impacting approximately 60,000 businesses.