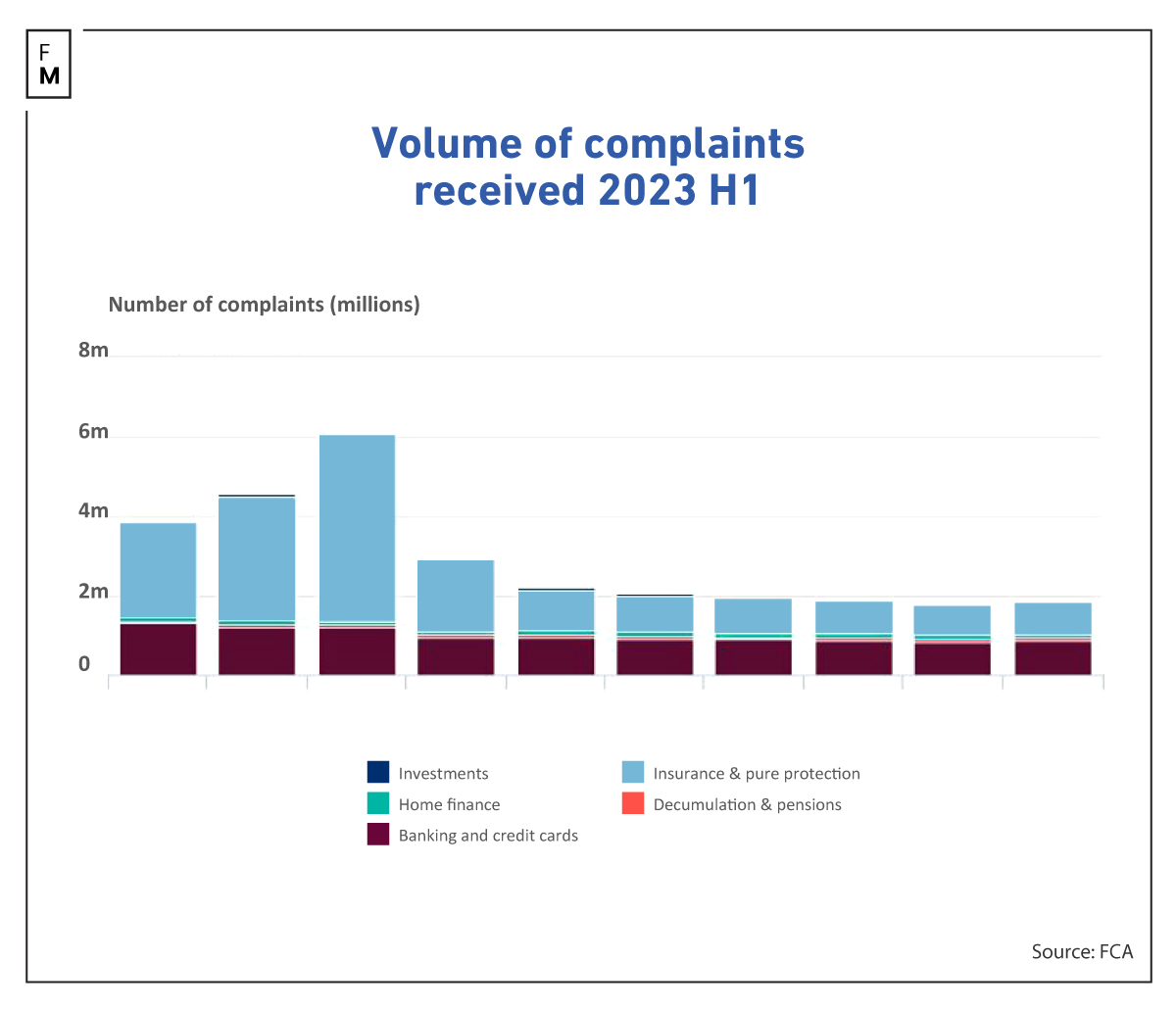

Financial services firms in the UK have seen an increase in complaints in the first half of 2023, according to the latest data published by the Financial Conduct Authority (FCA). Released every six months, the report provides insight into customer complaints within the financial services industry.

Persistent Issue: Current Accounts Top the List of Complaints

In H1 2023, financial services firms received a total of 1.88 million opened complaints, representing an uptick of 5% from the previous reporting period in H2 2022, where there were 1.80 million complaints. The rise in complaints highlights the ongoing challenges faced by the sector in addressing customer concerns effectively.

The report looks into various product groups, identifying areas that experienced a surge in complaints. Notably, decumulation and pensions saw an increase of 20%, while investments and insurance/pure protection both reported a rise of 18%.

Banking and credit cards also registered an improvement of 3% in complaints. However, there was a positive trend in the home finance product group, which noted a reduction of 10% in opened complaints, falling from 101,333 in 2022 H2 to 91,469 in 2023 H1.

The report sheds light on a long-standing issue within the industry, as current accounts continue to be the most complained-about financial product since 2016 H2. The number of complaints related to current accounts progressed from 500,371 in 2022 H2 to 509,923 in 2023 H1, marking a rise of 2%.

Understanding the FCA's Definition of a Complaint

The FCA's data publication provides these key findings. It also offers interactive dashboards containing tables and data visualizations that explore trends related to complaint numbers, redress payments, the type of firms involved, the specific financial products cited in the complaints, and the reasons for those complaints.

The FCA defines a complaint as per its Handbook glossary and mandates firms to report complaints from eligible complainants. These complaints can encompass activities carried out within the UK from an establishment maintained by the firm or their appointed representative.

The data also includes complaints from retail clients, professional clients, and other eligible counterparties. A complaint is considered resolved when the complainant indicates acceptance of the firm's response, whether in writing or otherwise.

This comprehensive report offers an essential resource for the financial services industry, regulators, and consumers, highlighting areas that require attention and improvement to enhance customer experiences and ensure the fair treatment of financial services consumers in the UK.

The FCA's biannual publication underscores the importance of monitoring, analyzing, and addressing complaints effectively to maintain the integrity of the financial services sector.