The number of potential financial scams and activities of unlicensed businesses in New Zealand has significantly decreased since mid-2022, according to the latest report published by the Financial Markets Authority (FMA). However, there has been an increase in websites impersonating registered entities that offer trading and financial services to retail customers.

FMA Publishes 2023 Annual Report

The FMA's report covers a range of significant issues, including major regulatory actions undertaken by the watchdog. A notable case involved Validus, promoting its investment services at offline events. These promotions were found to be dishonest and misleading. In early May, the FMA issued a permanent stop order against Validus and its associates.

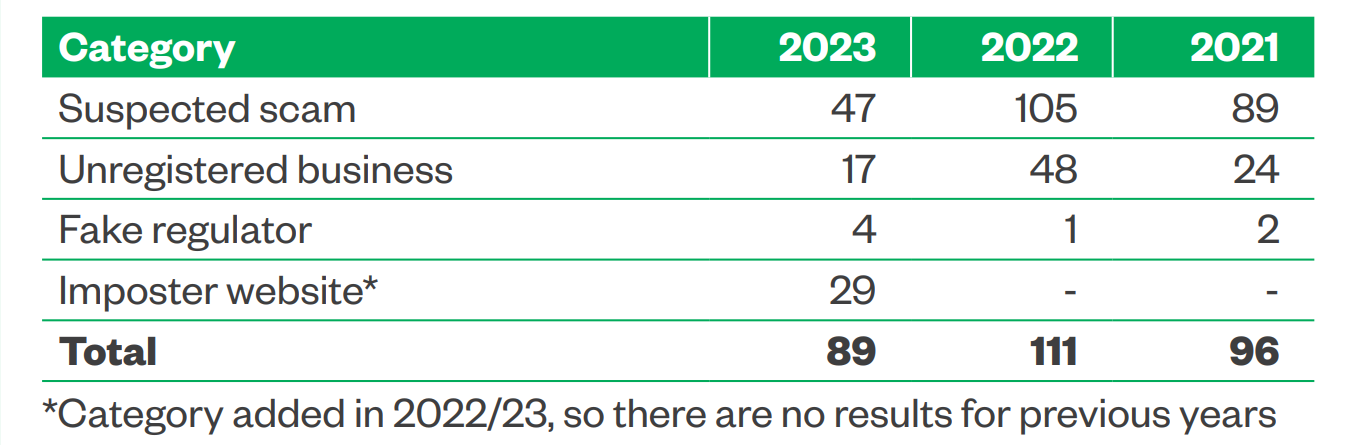

Regarding the prevention and warning against potentially suspicious or unregistered businesses, the FMA remains one of the most active regulators globally. In 2023, the number of warnings and alerts significantly decreased. There were 47 calls related to suspected scams, down from 105 published in the previous year. The FMA issued only 17 warnings against unlicensed businesses, compared to 48 in 2022.

However, the FMA has added a new category, “imposter websites”, to its report, reflecting a substantial increase in the number of companies and dishonest actors impersonating licensed firms. Despite issuing 29 warnings in this category, the total number of alerts in 2023 was 89, a significant decrease from 111 in 2022.

Given the continued activity and effectiveness of the regulator in identifying scams, this trend can be interpreted as an indication of growing safety in the local market.

“In partnership with industry, government, and other stakeholders, we are creating a rock-solid foundation for a genuinely fair financial system, where markets are trusted based on their integrity and transparency, enabling responsible innovation and growth,” Samantha Barrass, the Chief Executive of FMA, commented.

FMA Supports Market Integrity

Accompanying its annual report, the FMA published its “Ease of doing business” survey. This study is based on feedback from key stakeholders and industry participants, aiming to gauge the effectiveness of their interactions with the FMA and their perceptions of the FMA's overall success in fulfilling its responsibilities.

92% of respondents acknowledged the FMA's role in supporting market integrity. An impressive 95% agree that financial markets are effectively regulated under the FMA's oversight. Additionally, 89% of the surveyed individuals believe that the FMA plays a significant role in elevating the standards of market conduct.

One of the latest cases included in the report is a fine of $900,000 that Tiger Brokers (NZ) Limited had to pay for violating anti-money laundering laws.