Criminals are increasingly targeting victims of previous scams with promises of financial recovery, according to recent warnings from Australian authorities. The National Anti-Scam Centre reports a 129% increase in such cases over the past six months, with total losses exceeding $2.9 million.

ACCC Warns of Millions Lost in Six Months to Recovery Fraud

ACCC Deputy Chair Catriona Lowe described these "money recovery scams" as "damaging and cruel," noting that criminals often prey on people who have already fallen victim to scams and are desperate to recover their losses. The scammers pose as trusted entities such as government agencies, lawyers, or charities, offering to recover stolen funds for an upfront fee.

Australians aged 65 and older were identified as the most vulnerable group, reporting the highest number of incidents and suffering the largest average losses. Scammers often obtain information about previous victims by selling or sharing data on criminal networks.

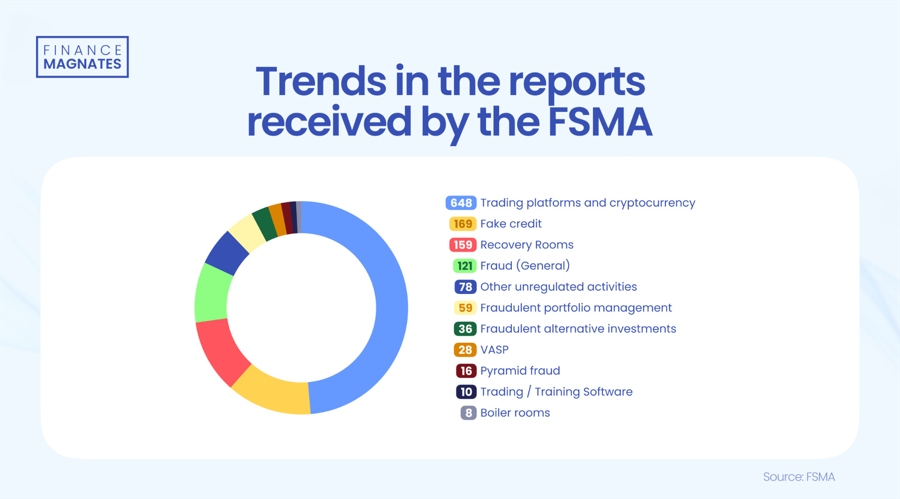

A separate report by Belgium's FSMA published this month showed that "recovery room" frauds increased by 59% compared to last year, making them one of the most common reasons for complaints and grievances to the regulator.

“Criminals prey on people who have already been victims of a scam who hope to get their money back. They are another example of scammers’ willingness to exploit people’s desperation at a vulnerable moment,” added Lowe.

The scam typically operates by contacting victims through various channels, including email, phone calls, social media, or text messages. Criminals may also use online advertisements to lure potential victims. They request personal information, upfront fees, or even remote access to devices under the guise of facilitating the recovery process.

The National Anti-Scam Centre advises against using services claiming to recover stolen money and encourages victims to report incidents to the police and their financial institutions.

Common Problem of Recovery Scams

As it turns out, Australians are not the only ones exposed to fraudsters operating recovery scams. Similar practices occur virtually worldwide, and in recent months, regulators from New Zealand, among others, have warned about them.

Scammers were impersonating the UK's Financial Conduct Authority (FCA ) and contacting New Zealand residents, claiming they could help recover lost funds. The Reserve Bank of New Zealand (RBNZ) believes scammers specifically target those who have fallen victim to financial fraud, as they may be particularly vulnerable and desperate to recover their lost savings. This predatory technique gives scammers credibility by impersonating a real authority.

The Hong Kong Financial Commission also highlighted this issue in February, when scammers impersonated institutional representatives to mimic legitimate digital wallets and deceive victims into paying for services.

A case that made headlines at the end of last year involved several hundred Polish traders who were defrauded by recovery scammers for over 2 million dollars. The Warsaw regional prosecutor's office, along with the police central investigative bureau, announced that they had dismantled a gang of fraudsters posing as law firms, offering their services to retail investors previously cheated in the forex (FX) and crypto markets.