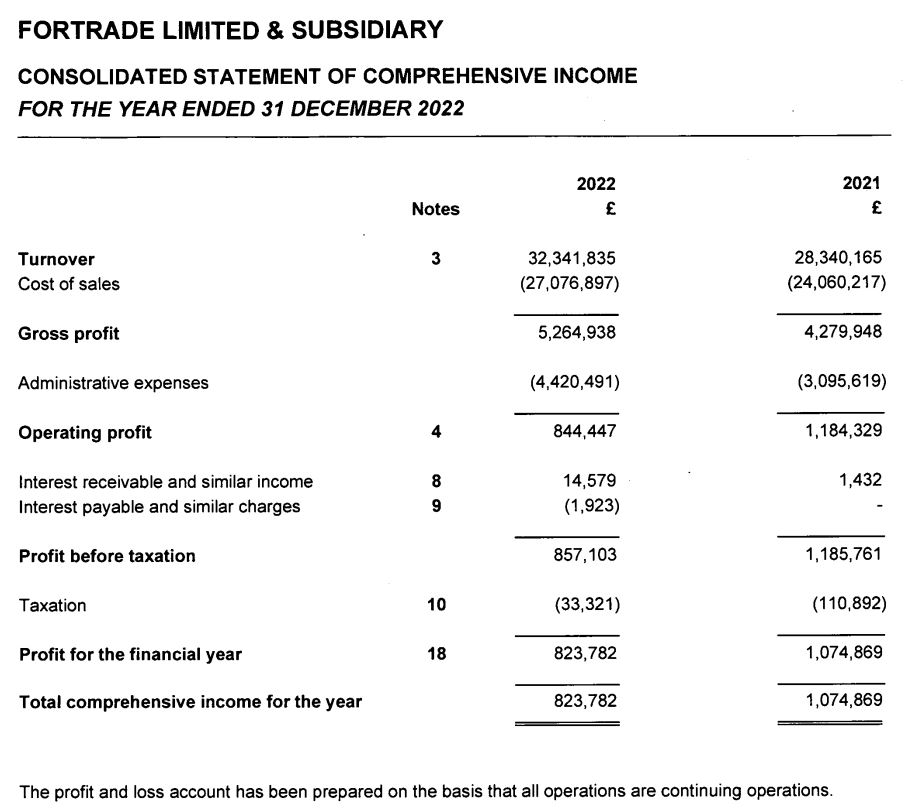

The revenue of London-based Fortrade continued to rise as the forex and contracts for differences (CFDs) broker reported the figure to be at £32.3 million, a year-over-year jump of about 14.1 percent, for the fiscal year 2022.

Profits Could Not Follow the Revenue

Despite the revenue jump, the profits of the broker decreased in the fiscal year. According to the latest Companies House filing, Fortrade Limited & Subsidiary ended the year with a pre-tax profit of £857,103, a decline from the previous year's £1.18 million. After taxes, the net profit dropped to £823,782, which is 23.3 percent below the previous year's figures.

"The results for the year and financial position at the year-end were considered satisfactory by the directors given the difficult trading conditions and increasing competition in its core market," the filing stated, adding that the group "continues to look for opportunities overseas although the directors expect that the group's future profitability will be primary from its existing core market."

A Global Broker

Established in 2013, Fortrade offers CFDs trading services with forex , stocks, indices, commodities, and US treasuries. It targets both retail and institutional clients. Although the broker is headquartered in London, it operates globally with licenses from regulators in countries like Canada, Australia, Cyprus, Belarus, and Mauritius.

The cost of sales additionally followed the revenue growth of the group, as it elevated to £27 million from £24 million. The administrative expenses also improved significantly to £4.4 million from £3 million. Although the operating profit of the brokerage group came in at £844,447, it added another £14,579 from interest income. However, before evaluating the pre-tax profits, the group considered £1,923 in "interest payable and similar charges."

Meanwhile, the group company maintained a strong balance sheet with a net asset of £7.55 million, surpassing £6.7 million in 2021, ensuring that it is "well placed to achieve its long-term strategy."