The Financial Services and Markets Authority (FSMA) has released its dashboard for the first semester of 2024. The dashboard provides statistics and an overview of the main trends regarding investment fraud.

Crypto Scams Dominate Reports

The latest edition of the dashboard highlights several key points. Fraudulent trading platforms and cryptocurrency scams still represent about half of the reports about unlawful activities received by the FSMA.

"Recovery room" fraud, a type of scam where victims of previous frauds are contacted and promised help in recovering their losses for a fee, is on the rise. There has been a 59% increase in this type of fraud compared to the same period in 2023.

Earlier, FSMA warned of risks posed by prop trading firms, targeting consumers with promises of risk-free trading opportunities but leading to financial traps, as reported by Finance Magnates.

These firms allow trading in various products without requiring personal capital, yet exploit consumers through costly, mandatory courses. Many participants end up paying for multiple courses without accessing real trading, highlighting concerns over transparency and consumer protection in the industry.

FSMA Sees More Reports

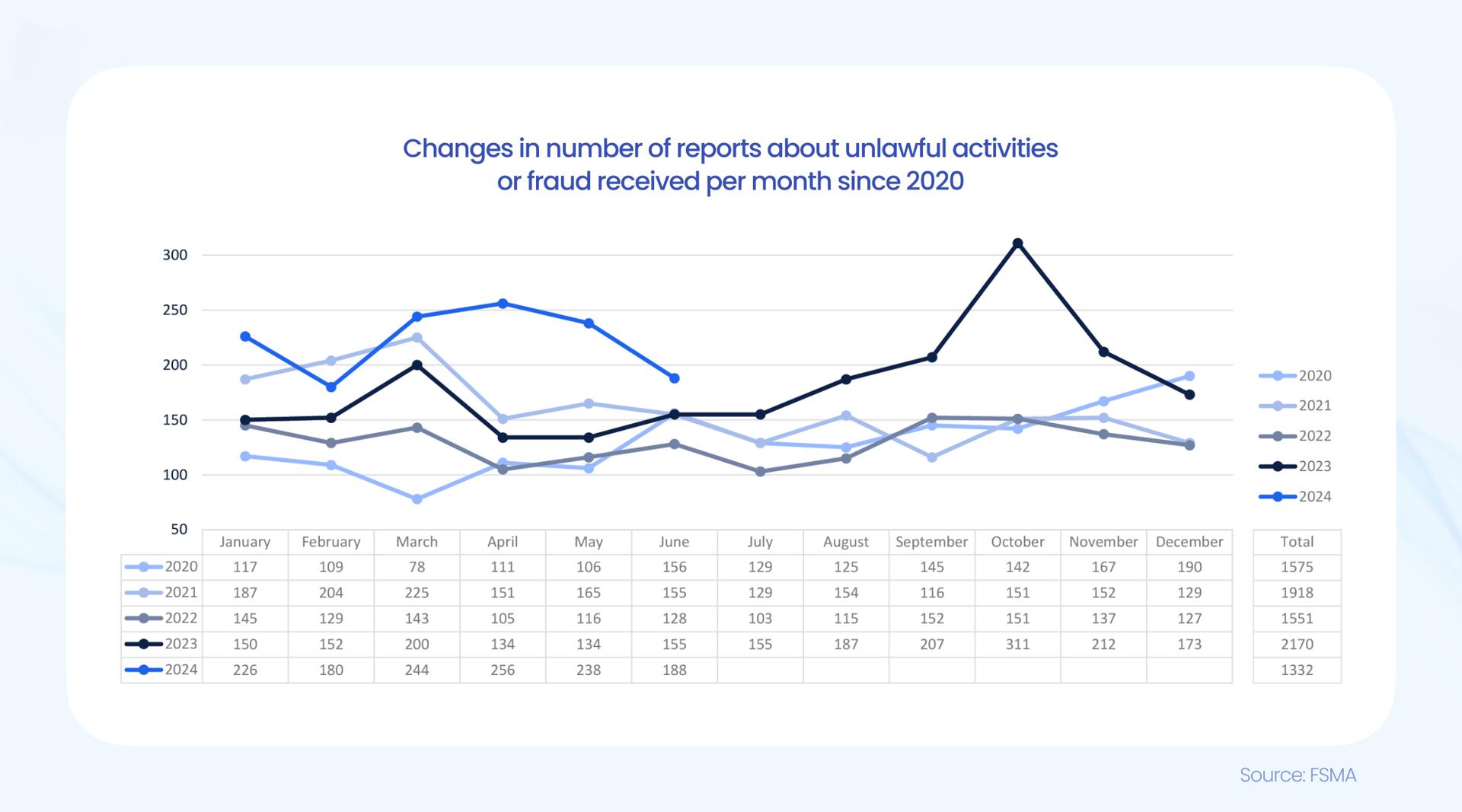

The FSMA has noticed a significant increase in the number of consumer reports in the first half of 2024. In the first six months of 2024, the FSMA received 1,332 consumer reports about unlawful activities. In 2023, the FSMA received a total of 925 reports in the first half of the year. This represents an increase of 44%.

Of these reports, 52.3% were complaints from consumers who had lost money because of investment fraud or false offers of credit. The remaining reports were questions from consumers who asked the FSMA for information about unlawful activities or suspicious market participants, but who had not yet paid any funds.