Gaining popularity in the prop trading industry clearly comes with significant risks. The provider of the TradeLocker trading platform, which has recently gained traction in the prop trading space, learned this the hard way. According to information confirmed by TradeLocker, the platform fell victim to a DDoS attack during Wednesday's trading session.

As a result, the platform was offline for more than an hour, impacting both clients and investors of brokers and prop trading firms.

TradeLocker May Have Fallen Victim to DDoS Attack

Information that TradeLocker may have fallen victim to a DDoS attack began to appear after clients of prop trading firms that use this platform started reporting an inability to access their accounts.

After the recent controversies surrounding MetaQuotes’ MetaTrader 4 and 5, many brokers migrated to TradeLocker, wanting to continue offering their services to clients, including those from the US.

Among the firms that migrated were Tradddo, Funding Traders, TopTier Trader, and the largest of them, Funding Pips. According to information published by the latter, the platform was unavailable for a little over an hour between 13:12 and 14:25 UTC.

"Taking into account that the incident was out of our control, we take full responsibility for the situation. Unfortunately, we have no data during the platform downtime. However, we have the equity level before and after the outage which we will utilize to rectify impacted accounts," commented Khaled Ayesh, the CEO of Funding Pips, on Discord.

A moment later, he added on X (formerly Twitter) that TradeLocker most likely fell victim to two DDoS attacks. "Please keep in mind that we added this lovely platform because the community requested it," he stated in response to criticism over the platform's failure.

However, TradeLocker did not confirm the information about falling victim to a DDoS attack for a long time, and such confirmation appeared only a day later, as in the case of X.

"Hi everyone, yesterday, our platform faced downtime due to DDoS attacks and a high load on the public API," TradeLocker commented. "Our developers successfully resolved this issue, and you were able to continue your trading activities."

The company added that the attack affected the ability to access demo and live accounts for "some users," but all pending orders were operational, so "the SL&TPs" were being executed.

Additionally, the platform decided to introduce enhanced precautionary measures to combat future attacks or issues. "We've enhanced our protections, so you may encounter additional verification checks," it explained. "This means you might notice a few extra human verification checks during your use."

From MetaTrader to TradeLocker

It's worth recalling that Funding Pips was one of the first prop trading firms that suspended its operations in February after Blackbull Markets terminated its agreement with the prop trading firm as MetaQuotes forced the broker into this situation.

A week later, the company was back on its feet after a quick migration to the Match-Trader platform. It informed US traders in early March to "stay tuned for a major comeback." This comeback was made possible by adding the TradeLocker platform.

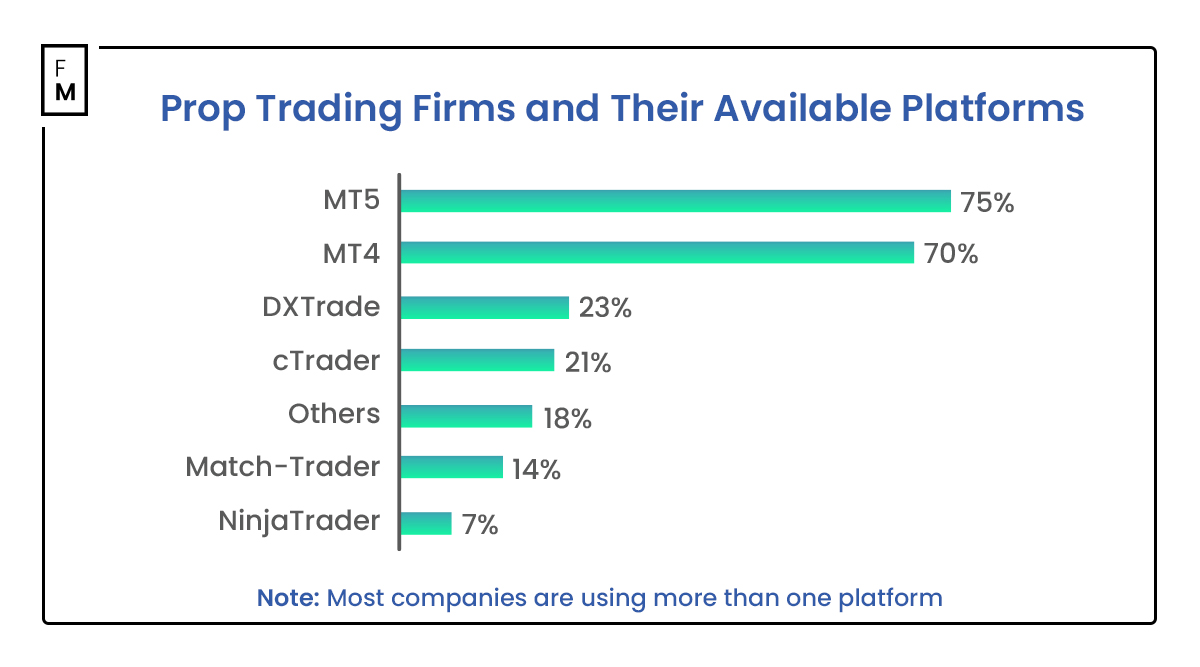

Check our table, illustrating the current operations of prop firms and those catering to clients from the USA.