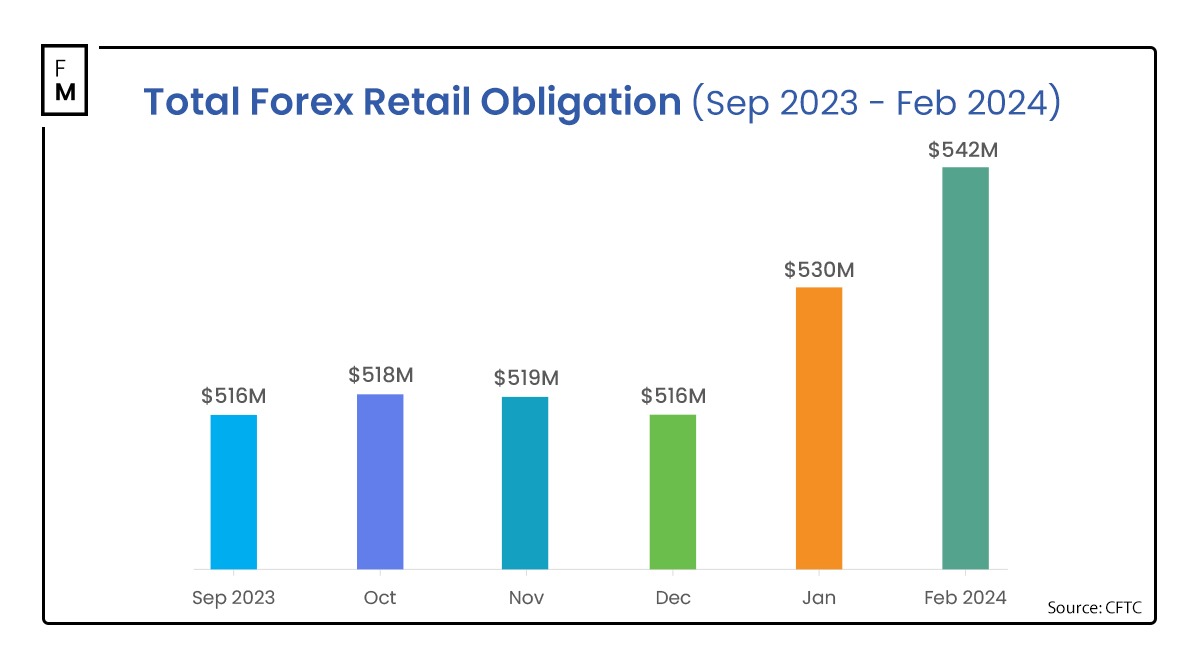

The positive trend of the largest FX brokers continues for the third consecutive month, as reflected in the total client deposits. Their combined value rose in February to over $542 million, marking an improvement of 2.3% compared to January's figures, as the Commodity Futures Trading Commission (CFTC) reported.

Forex Deposits in the US Strongly Enter the New Year

The exact value of FX deposits in the US reached $542,302,015, growing by nearly $13 million compared to January 2024, which was one of the strongest months in recent times.

Consequently, this statistic marks the sixth month of recovery from the September lows, when it hit the level of $516 million.

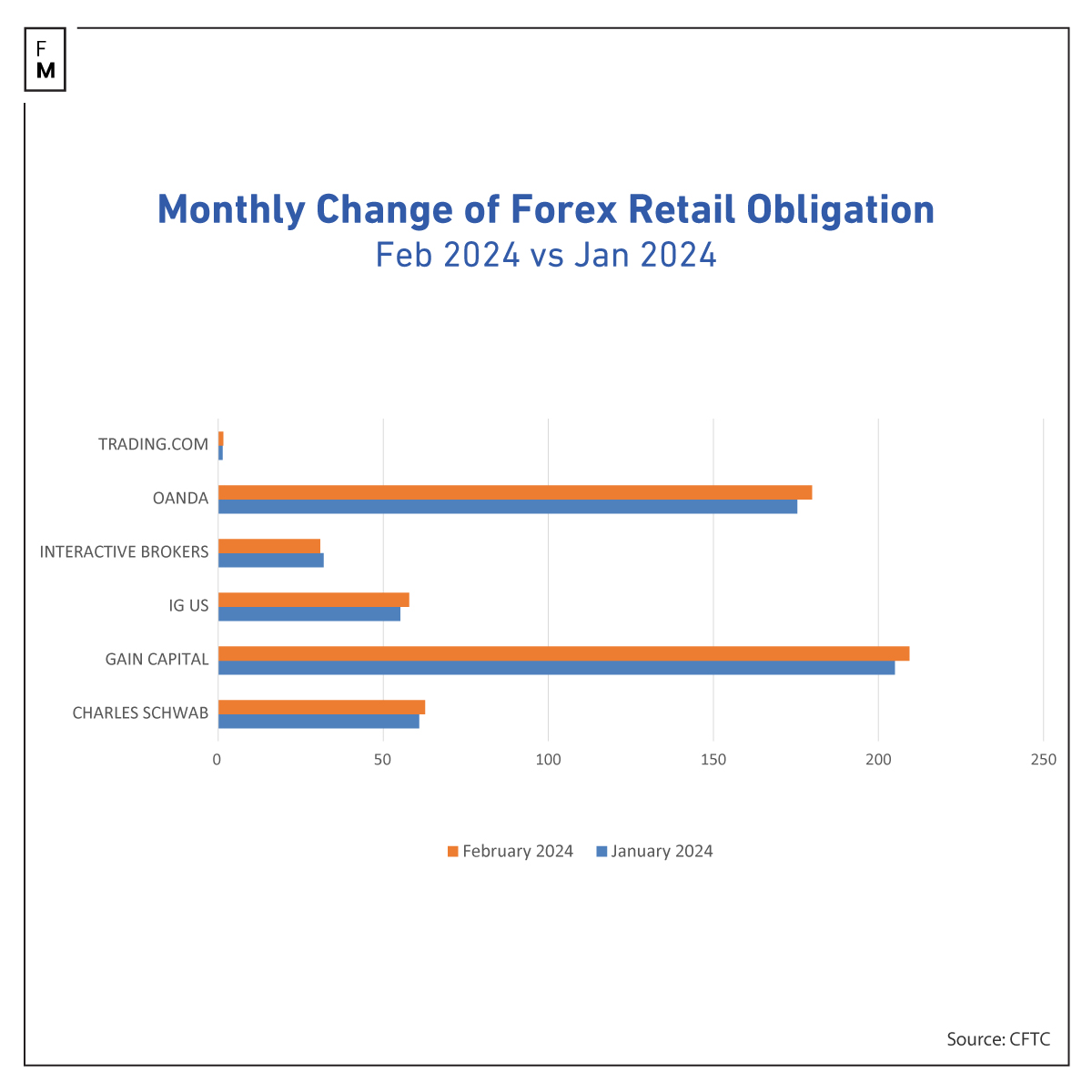

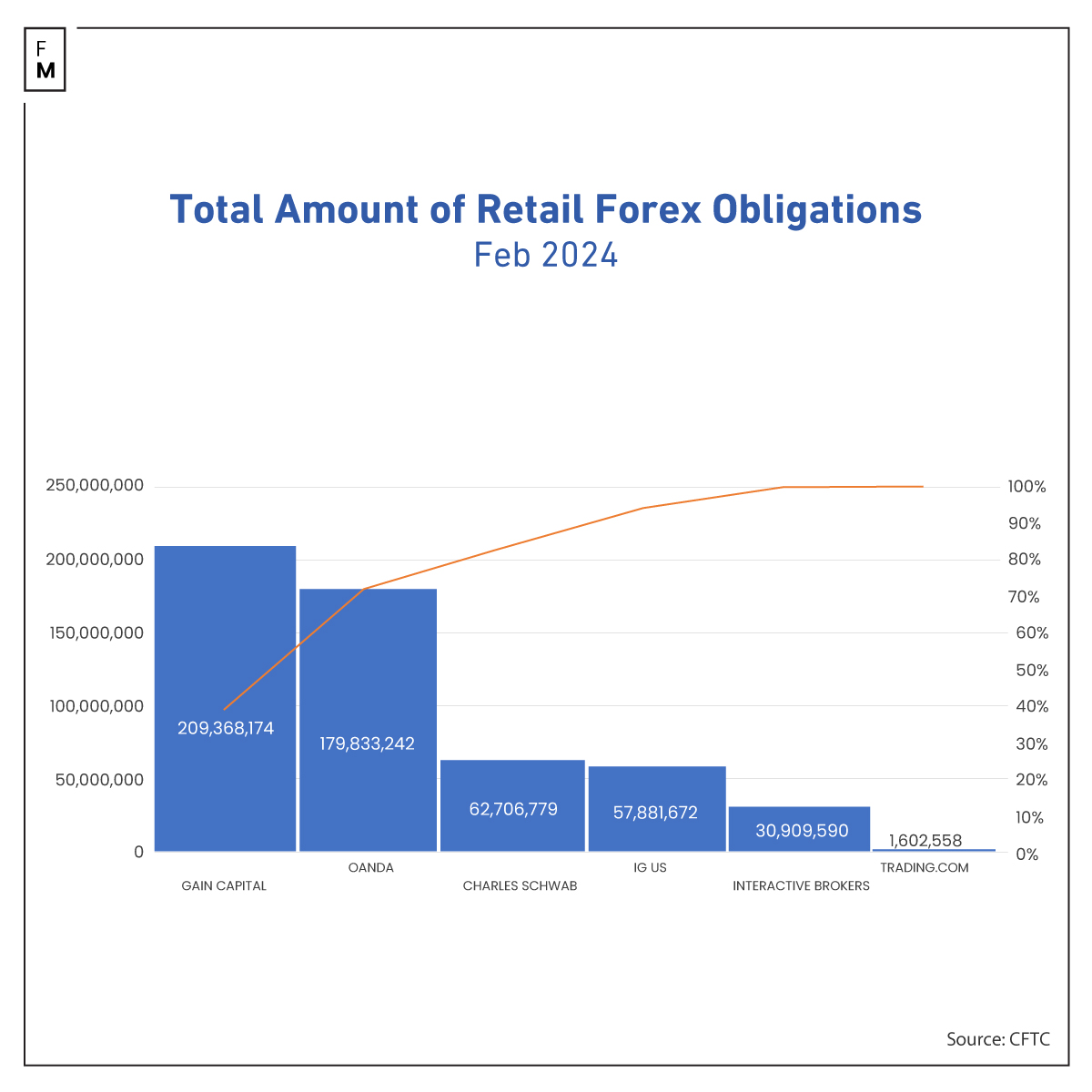

Gain Capital remains the leader in the ranking, with deposits at $209.4 million, which increased 21%, or $4.4 million, over the month.

The most significant percentage uplift for another consecutive month was recorded by Trading.com, whose deposit value grew 14%. However, it's worth noting that they are the smallest nominally, totaling $1.6 million. This percentage jump thus translated into a boost of nearly $224,000.

Deposits at IG US saw a significant rise, increasing 4.6% to $57.9 million. IG financial network's tastytrade announced Tuesday a significant expansion in Chicago and the opening of a new office.

Only Interactive Brokers reported a decrease in FX deposits, with the value falling $1.1 million (3.6%) to $30.9 million. The company recently reported strong results for the last quarter, with net revenue reaching $1.14 billion, significantly growing compared to the same period a year earlier.

CFTC Regulatory Reporting Summary

The Commodity Futures Trading Commission required that Retail Foreign Exchange Dealers (RFEDs) and Futures Commission Merchants (FCMs) submit monthly reports detailing their financial status. These compulsory reports to the CFTC include crucial financial details like adjusted net capital, client assets, and total retail forex commitments.

Retail forex commitments represent the overall resources, such as money, securities, and other valuable assets, held by FCMs or RFEDs on behalf of their retail forex customers, adjusted for gains and losses.

Out of the 62 registered RFEDs and FCMs, a specific subset of six (Charles Schwab, Gain Capital, IG, Interactive Brokers, OANDA, and Trading.com) are involved in activities necessitating the public disclosure of their financial obligations .

According to a recent Finance Magnates report, FCMs are increasing their investments in front-end technology. This move aims to enhance operational efficiency and secure a competitive advantage in the increasingly tight and competitive derivatives market.