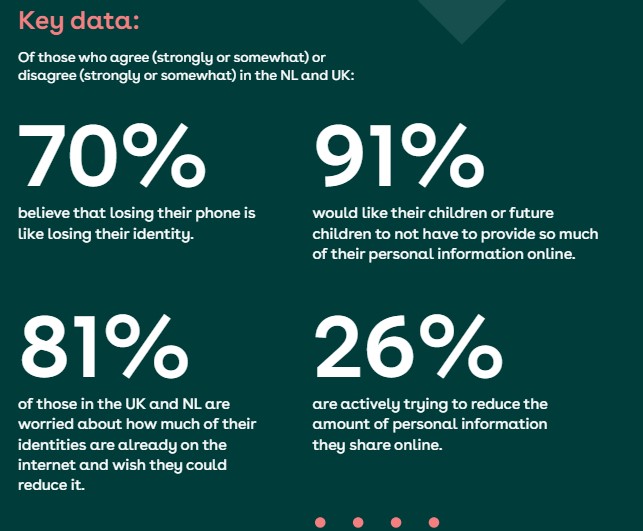

Women are more cautious than men about sharing personal information online, with 84% of those recently surveyed expressing concerns compared to 78% of men. These findings were highlighted in a survey by Digidentity that focused on digital platform users in the UK and the Netherlands. The study found that gender, age, and nationality play significant roles in shaping individuals' attitudes and behaviors toward online privacy and security.

Online Identity Protection

While concerns about data breaches and identity theft are prevalent across all demographics, there are notable differences in how various groups approach and perceive these issues. 80% of respondents aged between 16 and 24 are worried about identity theft, while 90% of those aged 55 and above care about identity theft.

There is a lower likelihood of women oversharing personal details to reduce their vulnerability to identity theft. Additionally, women are less inclined to trade personal data for expedited online access than men, further highlighting their cautious approach to online privacy.

Besides that, younger individuals, growing up in a digital-first environment, are more accustomed to sharing their identity online. While they express worries about the extent of their online footprint, they are also less concerned about potential risks such as scams compared to older generations.

However, both younger and older age groups exhibit significant levels of concern about data breaches and fraud, albeit with differing degrees of intensity. 78% of the respondents aged 16 and 24 expressed concerns about data breaches, while 92% of those aged 55 years and above care about this aspect.

Marcel Wendt, the Chief Technology Officer and Founder at Digidentity, mentioned: "Gen Z have grown up in a digital-first world, so are used to their identity existing online. This could explain why they are the least likely age group to reduce their online presence."

"However, there is a clear disconnect between concern and action amongst this generation. This could point to users' lack of control over their digital identity, especially among younger generations. Not only does work need to be done to ensure consumers are aware of the risks involved with sharing too much personal data, but also to put users first and in control of their data."

National Variances in Identity Anxiety

The research indicated notable differences in online identity concerns between countries, with the UK exhibiting heightened apprehension compared to the Netherlands. UK citizens expressed greater worries about unauthorized access to online banking services, identity theft, and data breaches, reflecting a more cautious approach to online privacy.

Despite widespread concerns about online privacy and security, a significant proportion of individuals do not actively take steps to minimize their online footprint. While the UK emphasizes data privacy, it lags behind the EU in adopting digital identity wallets. Challenges include reconciling convenience with privacy concerns and aligning with the emerging EU framework.