26 Degrees Innovates Offering: Launches 'Pairs CFDs' for Brokers

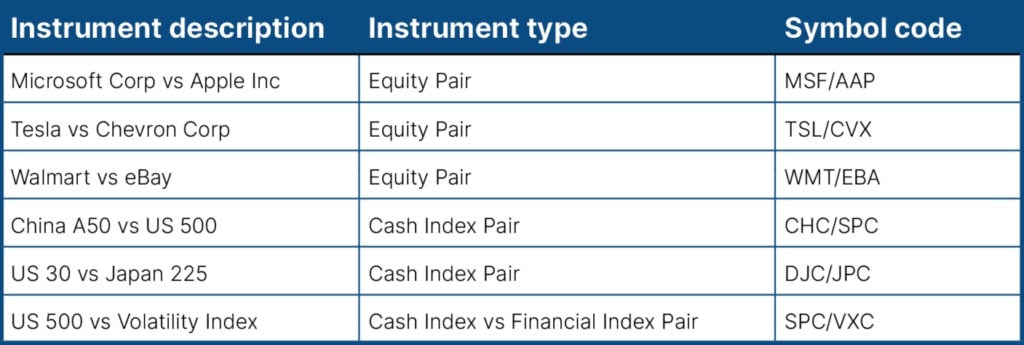

26 Degrees Global Markets, previously Invast Global, launched Pairs CFDs, a new offering that allows the trading of index vs. index, commodity vs. commodity, or equity vs. equity, similar to forex pairs. The products promise a simpler and more effective trading experience than traditional instruments.

Developed in-house, these new products only target broker-dealers, who can then market them to retail traders. The company has launched the product with 20 Pair CFDs and plans to add new instruments in response to client feedback. 26 Degrees will provide the instrument via API from its trading servers in LD4, NY4, and TY3.

Plus500 Feels EURO 2024’s Heat: Q2 Revenue Jumps YoY, but Dips QoQ

Plus500 generated revenue of $182.6 million in the second quarter of 2024, which increased 14% year-over-year. However, the figure dropped by 15.3% when compared to the $215.6 million generated in the first three months of the year. EBITDA also followed the same trend, improving by 11% to $81.3 million year over year and declining by 20.7% quarter over quarter.

The quarter's EBITDA margin was 45%, two percentage points lower than the corresponding quarter of the previous year. The report also revealed that the Israeli broker added 24,810 new customers between April and June, compared to 22,248 new customers in the corresponding quarter of 2023. The firm expects its revenue and EBITDA for the ongoing financial year to be in line with the current market expectations, which are $697.8 million and $314.6 million, respectively.

NAGA and CAPEX.com Merger Receives Regulatory Greenlight

The merger of two brokerage brands, NAGA Group, and CAPEX.com, received the necessary regulatory approvals this week. The merger was first announced in December 2023. In April, the shareholders approved the deal of the publicly listed NAGA. With the final regulatory approvals, the companies expect to close the merger by the end of August 2024.

The merger is strategic as the two brokers will reportedly benefit from their expertise domains and market reach. The duo expects to generate $250 million in revenue over the next three years and save about $10 million annually. The firms already have around 1.5 million registered users across more than 100 countries, and the roadmap of the merged entity aims to add over 5 million registered users by 2025/26.

🚀 #NAGA Group & #CAPEX.com have secured regulatory approval for their merger, signaling a major shift in financial trading. Led by Octavian Patrascu, the new entity boasts 1.5M global traders. This merger promises groundbreaking synergies and financial innovation! pic.twitter.com/50ssHdreis

— forexpolicy (@forexpolicy) July 10, 2024

Australia's Defunct Broker Prospero Markets Discloses $25M Claims

Nearly two months after an Australian federal court ordered Prospero Markets' closure, the company's liquidators released a report estimating its assets at $4.5 million and $20 million in client trust funds, with an additional $400,000 held in Singapore. Prospero Markets, incorporated in 2010, was a key player in OTC foreign exchange and derivatives trading before it took a downturn following the prosecutions of its key managers of alleged involvement in a money laundering scheme.

The firm's client trust claims, estimated between $19.1 million and $25 million, represent the majority of the company's liabilities. The liquidators are scrutinizing these claims, including larger-than-expected submissions from Australian clients and claims from Prospero Markets LLC, a related entity that is also now in liquidation. They believe that some of these claims may not be valid, potentially reducing the total liability to around $19.4 million.

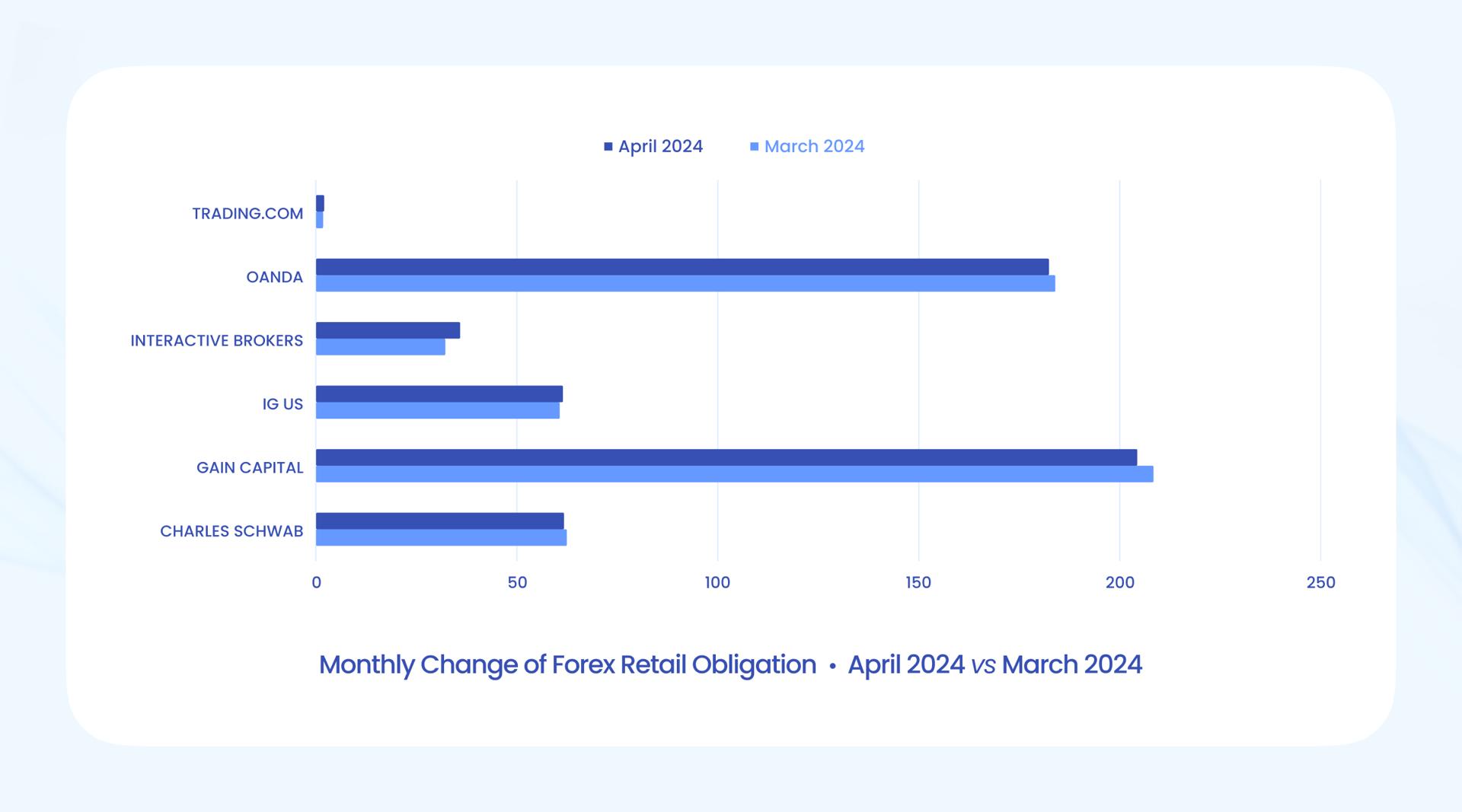

Interactive Brokers' Forex Deposits in the US Plunge 24%, While Others Hold Steady

Meanwhile, despite a second consecutive month of decline, retail investor forex deposits in the US continue to maintain long-term highs. A significant drop was experienced only in the case of Interactive Brokers, whose "total forex retail obligation" in May fell by 24%.

According to the latest data from the Commodity Futures Trading Commission (CFTC) for May 2024, the total value of FX deposits in the US amounted to $547,720,090, slipping by 0.01% from the $547,759,474 reported a month earlier.

Interactive Brokers Cites "Administrative Challenges" to Delay Prediction Exchange Launch

In other news, the launch of ForecastEx, a prediction exchange specializing in economic and climate events, was postponed until later in the summer due to administrative issues, according to Steve Sanders, EVP of Marketing and Product Development at Interactive Brokers.

ForecastEx, a wholly-owned subsidiary of Interactive Brokers Group, has received the required designations from the Commodity Futures Trading Commission (CFTC) to operate as a contract market and derivative clearing organization. The exchange was originally planned to begin operations on Monday, July 8, 2024.

Interactive Brokers and HSBC Launch Global Trading Platform

Still with Interactive Brokers, the global electronic brokerage firm collaborated with HSBC to enable HSBC's clients to access the global trading markets through a unified platform.

Accordingly, HSBC's customers in the UAE will be the first to benefit from this partnership. They will reportedly have access to equities, ETFs, and bonds in up to 25 markets and 77 exchanges worldwide. This is facilitated through WorldTrader, a digital investment platform powered by Interactive Brokers. The platform is accessible via mobile app or online, and plans to expand to more markets soon.

Myfxbook Co-Founder Alex Rekun Starts Marketlog, Expanding Into Stock Tracking

After three years of development, the creators of Myfxbook, one of the most popular FX/CFD online trading tools and social trading communities for retail traders, unveiled a new portfolio tracker for over 150,000 instruments called Marketlog this week.

Marketlog seeks to enable investors to track their stock portfolio and other instruments from a single location. According to Alex Rekun, one of Myfxbooks’s Founders, the application allows users to monitor dividends and stock splits, as well as track a range of other asset classes, including ETFs, indices, bonds, options, forex, and crypto.

Another Regulator Warns against Prop Firms, Calls Them Trading "Video Games"

Italy's securities regulator, Consob, issued a warning to investors about the risks associated with retail prop trading activities. It describes them as online trading simulations that promise profits but may lead to financial losses.

The Italian market watchdog describes the prop trading industry very interestingly, completely different from how the companies operating within it do. The regulator said these offerings, promoted on websites and social media platforms, "simulate an online trading activity in a type of finance video game aimed at passing skill tests and making a profit."

CFTC Commissioner Drama and My Forex Funds Case: "Government Lawyers Can't Afford to Slip"

In another significant development in the prop trading space, the Commodity Futures Trading Commission (CFTC) Commissioner Caroline D. Pham bravely shared her statement following the Sanctions Motion filed by My Forex Funds (MFF). She expressed her deep disappointment with the blatant misrepresentations of facts that CFTC staff members made in court.

Her comments highlighted the regulatory agency's actions in a specific case against MFF and its CEO, Murtuza Kazmi. The timing of the criticisms was also interesting. The court is about to rule on whether to impose sanctions against the CFTC, as requested by the prop trading firm.

Interesting but probably not significant development in CFTC vs #MyForexFunds today:

— MD Financial Skills (@MDiamondFinance) July 3, 2024

CFTC commissioner Pham rips her own agency. She made the remarks in August 2023 and May 2024, but they were released publicly today:https://t.co/RFuZLXGuVhhttps://t.co/RFuZLXGuVh

50 Forex and Crypto Firms on This Regulator's 2024 Warning List: Is Your Broker There?

Elsewhere, the French financial watchdogs added 50 new websites to their blacklist of unauthorized platforms offering forex and crypto-asset derivative investments this year as part of ongoing efforts to protect investors from potential scams.

The Autorité des Marchés Financiers (AMF) and the Autorité de Contrôle Prudentiel et de Résolution (ACPR) identified 24 unauthorized forex sites and 26 crypto-asset derivative platforms since the beginning of 2024. These additions bring the total number of blacklisted sites to several hundred.

Cyprus Targets Crypto and Non-Profit Organizations in Warning Against Terror Financing

Cyprus issued an alert to financial professionals, emphasizing their pivotal role in thwarting terror financing. This directive by the Institute of Certified Public Accountants of Cyprus (ICPAC) highlighted heightened scrutiny on cryptocurrency transactions and non-profit organizations (NPOs), which are increasingly susceptible to exploitation by terrorist entities.

The ICPAC's "terror financing alert" is calling on Cyprus' accounting and audit sectors. Acknowledging the evolving landscape of financial crime, the alert directs attention to five primary methods of fund transfer, prominently featuring cryptocurrencies. According to the institute, these digital assets, known for their pseudo-anonymous nature, present a growing challenge in tracking illicit financial flows.

NVIDIA CEO Jensen Huang Cashes in on Stock Surge

NVIDIA CEO Jensen Huang made headlines this week after selling a substantial portion of his company stock, amounting to $229 million. This move came on the heels of NVIDIA’s stock rally, which was driven by robust demand for its AI and data center chips and reflects broader trends in the sector.

The semiconductor sector has been on a tear recently, with stocks like NVIDIA leading the charge due to their critical role in powering next-generation technologies. As the demand for AI capabilities, data centers, and high-performance computing continues to skyrocket, companies in this space have seen their valuations soar. NVIDIA, in particular, has become a cornerstone of the AI revolution, with its GPUs serving as the backbone for countless AI applications.

Apple Hits $3.5 Trillion Market Cap, Steams Past Rivals

Lastly, Apple became the first-ever company to hit a staggering $3.5 trillion market cap. Just when Amazon was basking in the glory of its $2 trillion milestone and NVIDIA in its $3.33 trillion cap, Apple decided to casually drop this bombshell, reminding everyone who's really running the show.

Apple finished the day as the most valuable company in the world

— Morning Brew ☕️ (@MorningBrew) July 9, 2024

It's the first time a company's ever closed with a market cap over $3.5 trillion pic.twitter.com/RMovxSYGHb

Apple's journey to this unprecedented market cap has reportedly been fueled by a combination of innovation, strategic investments, and an almost cult-like consumer loyalty. From the groundbreaking iPhone to the burgeoning services sector, Apple has mastered the art of diversification.

Happy weekend!