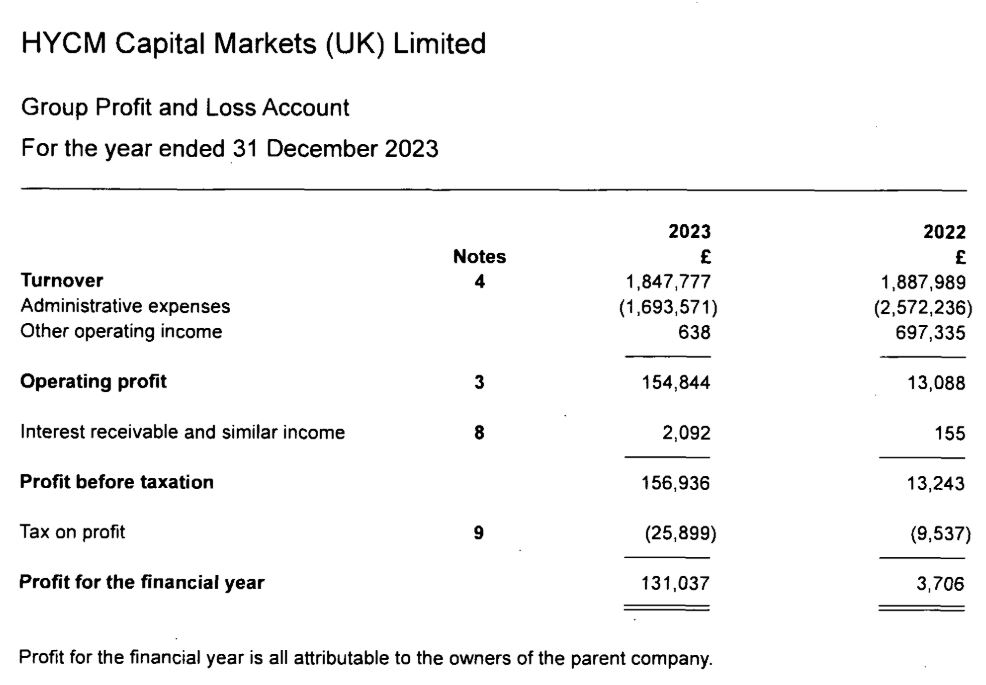

The UK unit of HYCM, a retail forex and contracts for differences (CFDs) broker, ended 2023 with a revenue of about £1.85 million and a pre-tax profit of £156,926. The company netted £131,037 in profits after taxes.

A Solid Year for HYCM UK

According to the latest Companies House filing, the annual revenue of HYCM Capital Markets (UK) Limited declined marginally by 2.1 percent from the previous year’s £1.89 million. However, when it comes to profits, the pre-tax figure jumped by more than 108 percent, while the net profit surged by 343.5 percent, as it only netted £3,706 in 2022.

The HYCM brand offers trading services with FX and CFDs to retail clients. The brand has a global presence and is operated by companies regulated in the United Kingdom, St Vincent and the Grenadines, the Cayman Islands, and Dubai. Earlier this year, the group stopped accepting European clients and renounced its Cypriot license.

The figures published through the Companies House filing only indicate the performance of the UK unit.

“The activity of the Group remains the provision of execution-only dealing services in financial derivative products relating to foreign currencies, commodities, and contracts for differences in London for retail clients, on behalf of a fellow group company,” the filing added.

Reduction in Administrative Expenses

Interestingly, despite stagnant revenue, the company significantly reduced administrative expenses to £1.69 million from £2.57 million. However, its other operating income became almost nil from the previous year’s £697,335.

“The Company and Group had a satisfactory year, with turnover remaining broadly in line with the previous year,” the filing added. “Administrative expenses were positively impacted by the effect of exchange rate differences, resulting in a significant increase in operating profit. The group’s balance sheet remains strong, with significant cash balances at the year end.”