Artificial intelligence (AI) is transforming industries across the board, and the trading world is no exception. Our latest Finance Magnates Quarterly Industry Report provides an in-depth look at how AI is revolutionizing the contract for difference (CFD) industry specifically.

Through interviews with leading industry experts, we explore a myriad of ways brokers can harness the power of AI to enhance their operations. As Kurt Mayell, the Head of CMC Markets Singapore explained: "The key advantage of integrating AI into a trading platform is that it opens a new market for people who want to trade but need some help in hatching their strategy."

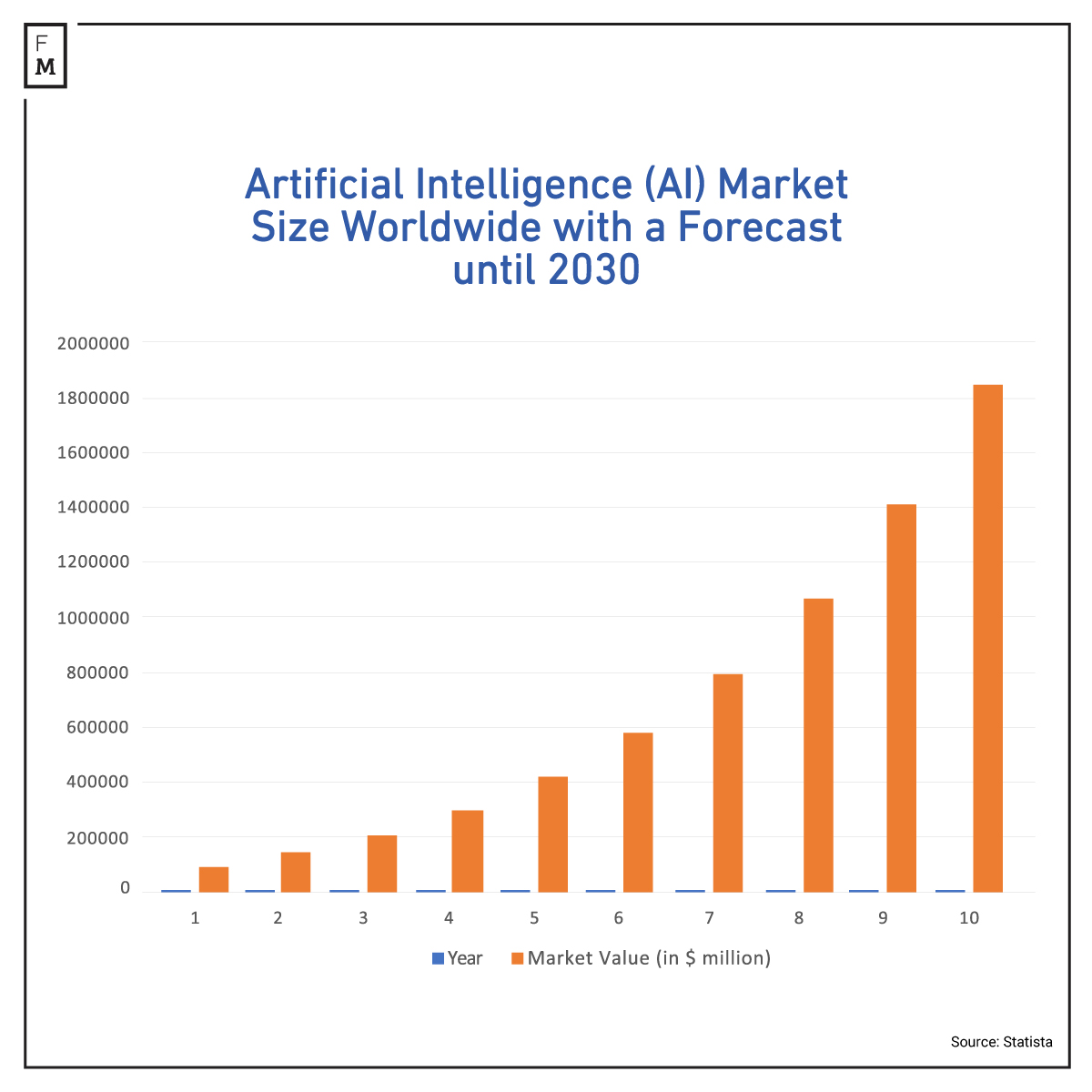

AI to Become a Trillion-Dollar Market

With AI already valued at over $200 billion, and expected to top $2 trillion by 2030, it's undoubtedly transforming finance. As Mayell predicted: "I think we are just at the tip of the iceberg in terms of AI capabilities at present."

In recent months, we have often heard that a particular broker has enhanced their offerings with AI solutions. Two names often come up: Acuity and Capitalise.ai. The former offers a range of AI-based solutions supporting the activities of CFD brokers. The latter, on the other hand, is an AI-based trading platform that allows the automation of trading strategies and simplifies the trading process for retail investors.

AI uncovers insights and patterns from vast datasets, enabling tailored recommendations and refined strategies. "One of the biggest advantages is automation. Traders can set up algorithms to make trades based on specific market conditions, so opportunities are never missed," David Lo, the Head of Financial Logics at Bybit, remarked.

In addition, AI bolsters efficiency, risk management, compliance and more. "Human intelligence simply can't compare to the speed, precision, pattern and trend recognition that AI is capable of," Maciej Wojciechowski of OnEquity pointed out.

The Dark Sides

However, this technological revolution is not without its challenges. The report candidly discusses the potential risks associated with AI integration in CFD trading. Issues like heightened market volatility , data privacy concerns, and the need for stringent regulatory compliance are critical considerations for any brokerage venturing into the AI domain.

According to Adam Dubiel, the Chief Product & Technology Officer at XTB, three main risks are access to talent and data and regulations. "It's necessary to acknowledge that AI is a rather new and unique skill set and as such, we need to build proper tools and data environments for them to be productive.”

Expert opinions in the report underscore the importance of a balanced approach to AI adoption. Industry leaders emphasize the need for brokers to harness AI's power and be mindful of its complexities and potential pitfalls.

Get the Full Article and Our Quarterly Magazine

The AI revolution has arrived. CFD brokerages that effectively ride this wave will reach new heights of success.

For those intrigued by the potential of AI in CFD trading, the full report offers an in-depth analysis of current trends, expert insights, and forward-looking perspectives. It's an invaluable resource for anyone looking to navigate the intricate landscape of AI-enhanced brokerage services.

Purchase the Quarterly Industry Report by Finance Magnates Intelligence today to equip your CFD brokerage for the AI revolution!