As some of the largest international brokerage firms release – or prepare to release – their 2023 results, we thought it might be interesting to look at their performance last year compared to their main rivals and what some of the key data tells us about their business and the wider broker market.

Since Interactive Brokers announced its 2023 financials relatively recently, we felt it would be appropriate to start with the Greenwich, Connecticut-based firm.

Revenue Soars: Interactive Brokers Leads with 42% Increase

Total revenue at Interactive Brokers was up 42% to $4.3 billion, which compares very favourably with the 5% increase recorded by IG for the financial year 2023 (which in the case of the UK-based trading provider ends in June 2023), Saxo’s 11% increase and the 12% managed by Fidelity over the same period.

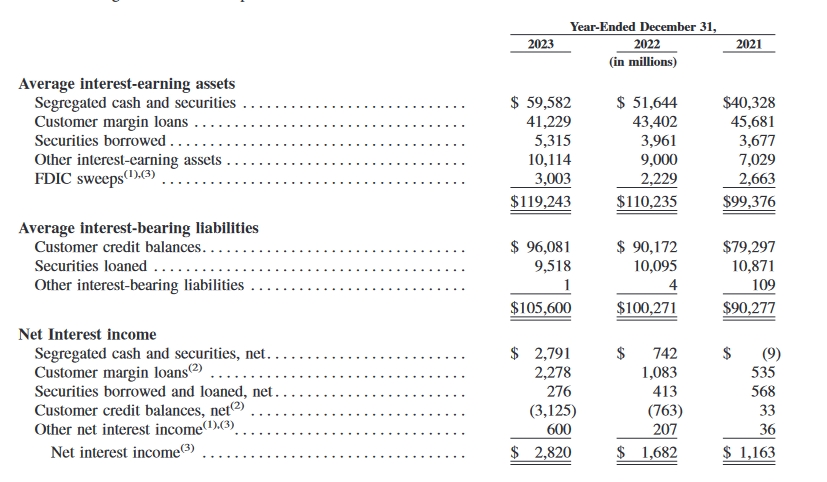

The company held $59.6 billion in segregated cash and securities at the end of 2023, an increase of almost 50% compared to 2021 and accounting for almost exactly half of total interest-earning assets.

While many of its peers have benefitted from higher interest rates - for example, IG saw its interest income increase from a negligible £800,000 in FY22 to more than £80 million in the last financial year - Interactive Brokers hit the jackpot with a 68% rise in net interest income to $2.8 billion.

In terms of revenue per client, 2.562 million Interactive Brokers clients generating $4.3 billion in revenues equates to revenue per client of approximately $1678. By comparison, Saxo’s 1.1 million clients generated revenues of DKK 4.481 billion (which at current exchange rates equates to $627 million or around $570 per client), while IG’s revenues of just over £1 billion from 358,300 active clients works out at £3576 per client based on current exchange rates.

Of course, the impact of interest rate movements in the US compared to the EU and UK have to be taken into account when making this comparison given that around two-thirds of Interactive Brokers’ 2023 revenues were generated by net interest income.

Commission Revenue Edges Upward

Interactive Brokers’ client accounts grew by 22.5% compared to 2022, down from 24.8% in the previous year but still favourable compared to Saxo’s 14% increase. Client equity rebounded after a sharp decline in 2022 to reach $426 billion, although daily average revenue trades fell again from 2.12 million to 1.94 million (2.57 million in 2021).

Commission revenue increased 3% from the prior year to $1.36 billion on higher options and futures volumes, although this was more than offset by higher execution , clearing and distribution fees and lower stock trading activity.

Average trades per US trading day were down 9% last year on the back of a 15% reduction in 2022. This was in line with many of the company’s international competitors – for example, Saxo’s total trades in 2023 were more than 20% lower than in 2022.

Stock Trading and International Presence

Interactive Brokers made a number of changes to its share trading offering during 2023 in a bid to increase stock trading activity, including the launch of fractional shares trading for Canadian stocks and the expansion of its overnight trading hours service, which lists more than 10,000 US stocks and ETFs.

The company’s international business accounted for just over 30% of total revenue, a slight decrease on the previous 12 month period. Over the same period, IG managed to reduce the proportion of revenue generated in its home market from 42% to 34%, while Saxo generated 60% of its revenues outside of the Netherlands.

During 2023, Interactive Brokers extended its international services by enabling clients to trade shares on Nasdaq Copenhagen and the Prague Stock Exchange and facilitating fractional trading of eligible Nasdaq Copenhagen shares.

Early last year the company was appointed as the primary international broker for Sinopac Securities, which meant institutional and retail clients of the Taiwanese securities firm were able to trade US stocks, ETFs and fixed income instruments and had access to over 90 stock markets worldwide. Interactive Brokers subsequently extended client access to the Taiwan Stock Exchange, enabling investment in the Taiwanese market without maintaining a relationship with a separate regional broker.

Industry Perspectives on Profit Margins

Investors have reacted positively to the 2023 results and also to the Q1 2024 data for which Interactive Brokers reported net revenues of just over $1.2 billion and commission revenue of $379 million. From just under $77 in late November 2023, shares were trading on the Nasdaq at more than $119 as of 9 May.

An increase of more than 55% in the value of Interactive Brokers stock over the last 12 months is impressive, albeit Schwab’s performance over that period has been even more eye-catching with an increase of more than 58%. IG’s share price is up 47.5% over the last 12 months.

Interactive Brokers’ Q1 2024 results showed a continuation of many of the trends highlighted above. Revenue of just over $1.2 billion was up 20% over the same period in 2023 while commission revenue was 6% higher as options activity remained strong

According to Interactive Brokers chairman Thomas Peterffy, a 71% adjusted pre-tax profit margin is unique in the industry. For context, Fitch Ratings described Schwab's adjusted pre-tax profit margin of more than 40% as ‘strong relative to retail brokerage and wealth management peers’.