Interactive Brokers (Nasdaq: IBKR) has ended the third quarter of 2023 with a reported net revenue of $1.145 billion, an increase of 45 percent year-over-year and 14.5 percent quarter-over-quarter. The adjusted figure came in very close to $1.139 billion.

A Jump in IBKR's Profit

In the official numbers published yesterday (Tuesday) post-market hours, the broker reported diluted earnings per share of $1.56 and $1.55 as adjusted. Both these figures improved significantly from $0.97 and $1.08, respectively, in the same period of the previous year.

The reported pre-tax income of the broker in the quarter came in at $840 million, with the adjusted figure at $834 million. The previous year's numbers were at $523 million and $580 million, respectively.

It had a profit margin of 73 percent, both reported and adjusted, improving from 66 percent and 68 percent in the previous year's third quarter.

Market Reacts

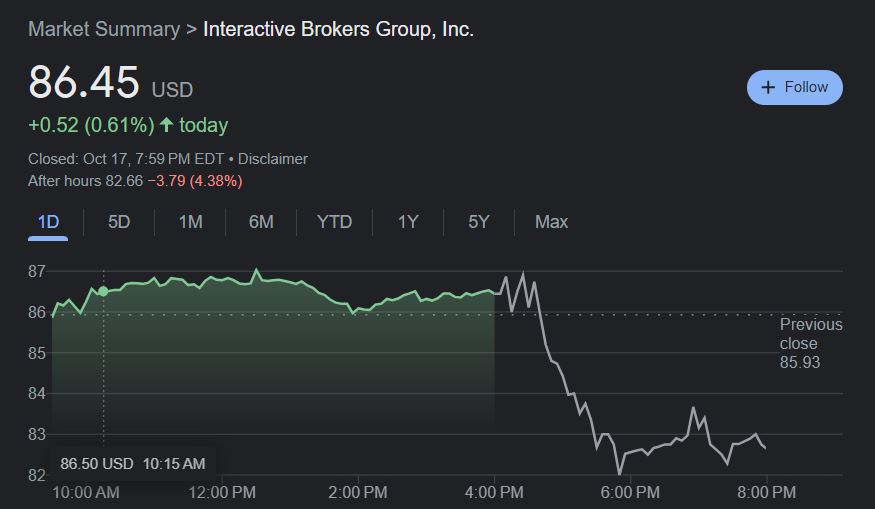

Despite the strong figures, the stocks of IBKR stocks shrank by almost 4.4 percent in the after-hours trading session. The unusual price drop came despite the reported revenue and earnings beat the street estimates significantly. According to analysts' consensus estimates, the per-share earnings would be at $1.51 on a revenue of $1.11 billion.

Diving Deep into the Figures

Interactive Brokers is one of the top electronic brokers in the US. It operates globally through various subsidiaries and has an extensive offering of trading services with stocks, forex, options, futures, CFDs, mutual funds, bonds, and even cryptocurrencies.

The broker's commission revenue leaped 4 percent to $333 million. It was backed by an 18 percent jump in options contracts trading volume, while the volume of futures and stocks decreased by 1 percent and 22 percent, respectively.

Its net interest income escalated 55 percent to $733 million, benefiting from higher interest rates and customer credit balances. Other income increased by $75 million, resulting in a gain of $27 million. It was driven by a gain of $37 million from its investment in Tiger Brokers.

The broker generated 98 million fees from execution , clearing , and distribution fees, an inverse of 14 percent.

The customer-related metrics of the broker also improved significantly last quarter. The number of accounts increased by 21 percent to 2.43 million, while customer equity improved 29 percent to $369.8 billion. However, the total DARTs dimmed 1 percent to 1.91 million.