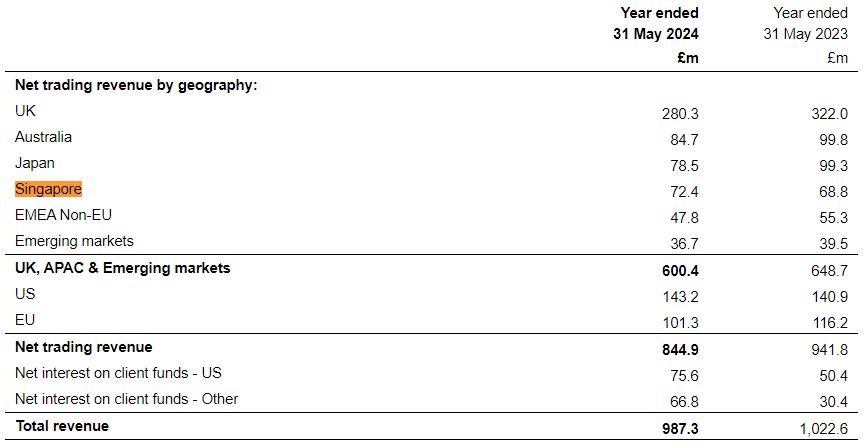

IG Group’s recognition that it needs to do more to get closer to its customers is reflected in a set of financial results for 2024. Those were massively boosted by interest income, which rose by more than three quarters from the previous year and without which the near 4% fall in overall revenue would have more than doubled. Across the UK, APAC and emerging markets, the only jurisdiction to record higher revenue last year was Singapore - where increased trading activity by larger clients produced a 6% increase in income. US revenue was also up from £140.9 million to £143.2 million.

In its financial results, IG pointed out that Singapore "delivered stronger trading revenue reflecting higher volumes from some of our largest traders."

A Tough Year for IG

IG delivers online trading platforms for retail and institutional clients. Headquartered in London, it provides clients with access to approximately 19,000 financial markets. Net trading revenue of £844.9 million for FY24 was down from £941.8 million in 2023, but higher interest rates saw net interest income rise from £80.8 million to £142.4 million.

Something was bound to give after a period of several years where costs grew faster than revenues, so in October 2023 IG implemented an operational improvement programme which – in common with CMC – included sizeable layoffs. Headcount at the end of the financial year (31 May) was 8% lower than when the measures were announced at the end of October 2023 - at a cost of just over £19 million – and the company is committed to further headcount reductions in the current financial year.

Total revenue of £987.3 million from 346,200 active clients equated to average revenue per customer of £2851 – approximately $3625 as of 31 May 2024 exchange rates. This figure was unchanged from 2023 and maintains the firm’s position towards the upper end of the scale of major brokers.

One of the Largest OTC Derivatives Providers

Within specific market segments, OTC revenue was down 9% and the number of clients actively trading OTC products fell by 6%. IG might be the largest provider of OTC derivatives by revenue globally but its share of primary accounts has fallen significantly in keys markets such as the UK and Singapore in recent years.

In an analyst briefing following the publication of the financial results, Breon Corcoran (who took over as CEO in January 2024) admitted that the company’s offering had become complex. “We have a very mature product that is well designed to target experienced users but in addressing the needs of these users we have obfuscated or complicated the product,” he said.

In the exchange-traded derivatives space, Spectrum (the group’s European multilateral trading facility) suffered a 12% drop in trading revenue. In this context, one of the most significant recent developments is the expansion of Tastytrade into the UK in a bid to tap into demand for derivatives trading from retail investors.

Corcoran confirmed that the company was applying for regulatory licences to launch the platform in a number of other markets without referring to any specific jurisdiction.

It is easy to see why IG is so keen to expand the platform given that it was the stand-out performer during FY24 with a 23% increase in revenue from £170.3 million to £200.6 million. Even then, most of that increase came from interest income which was 53% higher than in 2023.

Almost a third of new accounts are from outside the US, which suggests that international demand for US options and futures remains strong and is something the company can build on.

Eyes on Cash Equities

IG has been working on an upgrade to its cash equity product since the start of this year that it intended to roll out across all markets. However, Corcoran observed that momentum has stalled on that project and it was now taking a slightly different approach.

“We were working with a third party but we probably will do more of the work internally,” he said. “Some 20% of our CFD customers in the UK also trade cash equities so it is important that we continue to improve our cash offer, but the way that we positioned that back in January is probably not the way it is going to play out over the coming months.”

Despite filling 99% of OTC orders at clients’ desired price or better in the last financial year, IG acknowledges that there is a requirement for greater focus on customers, accelerated product velocity and increased efficiency. Steps already taken include decentralising product, engineering and marketing functions.

“Our priorities are to invest in product and user experience, deliver it quickly and improve customer acquisition and retention to accelerate revenue growth,” said Corcoran. “At the same time, we are seeking opportunities to deliver higher operating leverage through lowering our cost of serve.”

He also acknowledged that the focus on efficiency and consistency has led to IG underperforming in local markets where it has been late with payment options or slow in introducing best practise in terms of local conversion or KYC processes.

These improvements will not be achieved overnight. The initial focus has to be on building better product and getting closer to customers so the company can better understand what they want and adapt its offerings as their needs change.